INP-WealthPk

Shams ul Nisa

The government should invest more in the promotion of digitalization in order to ensure transparency in transactions and minimize tax evasion, said Rehana Kasi, Research Coordinate at the Board of Investment (BOI) Balochistan, while talking to WealthPK. Rehana underscored the need for establishing more research centers in the country to tackle the related issues. Enumerating the benefits of digitalization, she said this process would improve transparency in economic activities, incur low transaction fees, save the cost of printing and handling paper currency, enhance security and privacy of individuals, and provide instant notification of every transaction.

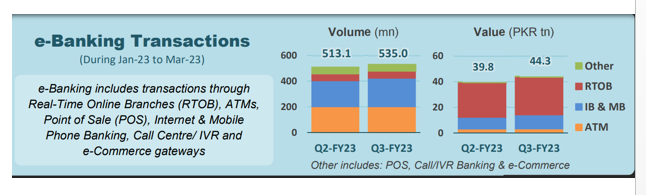

According to the State Bank of Pakistan, the e-banking transactions increased in volume and value in Q3-FY23 compared to the previous quarter Q2-FY23. The volume of e-banking transactions increased from 513.1 million in Q2FY23 to 535.0mn in Q3FY23, whereas the value of transactions increased from PKR39.8tn to PKR44.3tn.

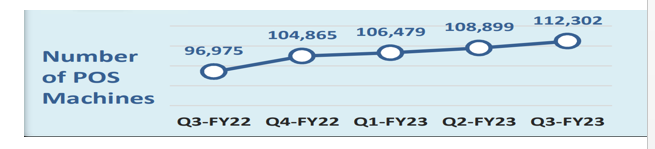

According to the State Bank of Pakistan, the number of points of sale (POS) machines increased to 112,302 in Q3-FY23 compared to 96,975 in Q3-FY22.

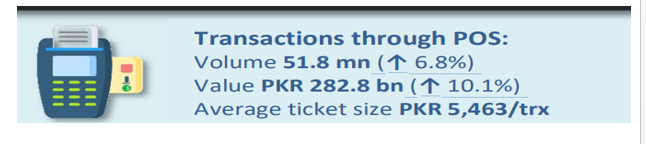

The transactions through the POS volume showed a growth of 6.8% and also growth in POS value by 10.1%. According to Rehana, digital economic activities facilitate financial auditing and faster analysis for policy making accordingly. “Businesses can easily tackle frauds, illegal activities and financial disputes through the digital record, as it can’t be removed or manipulated easily with the advancement in software. One of the major issues is money laundering or the informal sector. Promotion of digital transaction in Pakistan will discourage such activities by making every transaction trackable.

The rate of corruption will also decline, as this process will ensure accountability, reduce tax-evasion and help the government earn more revenue from taxes.” “Digitalization will remove the role of intermediaries in the transactions process and will ultimately lower the cost of transaction. It will also enable the consumers to tackle financial issues or the need for financing without personally visiting any financial institution. “It will foster real-time settlements and reduce delays in transactions. Overall, it will ensure transparency in both public and private sector spending or any economic activity.”

Credit: INP-WealthPk