INP-WealthPk

Qudsia Bano

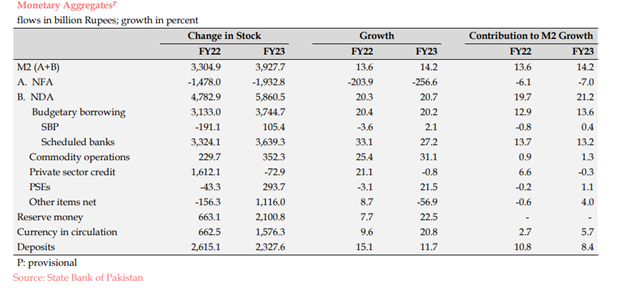

In a financial landscape marked by intricate dynamics, Pakistan experienced a significant surge in broad money (M2), growing by 14.2% during the fiscal year 2022-23 (FY23). This uptick, slightly higher than the 13.6% recorded in the previous year, was primarily driven by the expansion of Net Domestic Assets (NDA) within the banking system, amounting to a notable Rs5,860.5 billion in FY23 compared to Rs4,782.9 billion in FY22. The surge in NDA can be attributed to a substantial increase in government budgetary borrowing from the banking system. The government's heightened reliance on domestic financing, exacerbated by the unavailability of external financing, played a pivotal role in this expansion. Additionally, borrowings by Public Sector Enterprises (PSEs), particularly in the energy sector, increased as they turned to the domestic banking system to settle circular debt-related payments. The financing under commodity operations also saw a rise, driven by an increase in the wheat support price, which heightened the borrowing needs of procurement agencies.

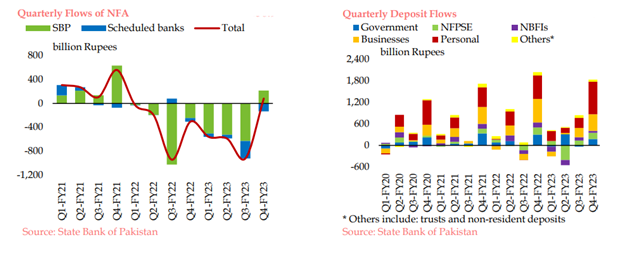

However, while government borrowing fueled the growth in NDA, credit to the private sector remained lackluster throughout FY23. This subdued performance was a consequence of deteriorating economic conditions and the rising cost of borrowing, driven by persistently high-interest rates. On the flip side, the Net Foreign Assets (NFA) of the banking system contracted by Rs1,932.8 billion in FY23, reflecting increased stress on external accounts. Reduced financial inflows, uncertainty surrounding the resumption of the IMF programme, and concerns about the domestic economic environment collectively impacted the NFA. The State Bank of Pakistan's NFA bore the brunt of this decline, though the disbursement of some multilateral and commercial loans in the last quarter of FY23 provided marginal relief.

A nuanced analysis of the liability side reveals a notable acceleration in currency in circulation, soaring to 20.8% in FY23 from 9.6% in the previous year. This acceleration, particularly concentrated in Q4-FY23 during the fasting month and two Eid festivals, was driven by factors such as rising macroeconomic uncertainty, high inflation, and increased spending during festive periods. Conversely, the growth in deposits decelerated from 15.1% in FY22 to 11.7% in FY23, with the slowdown attributed to an overall economic downturn and a decline in workers' remittances.

Segment-wise, the deposit landscape shifted, with private businesses and Non-Financial Public Sector Enterprises (NFPSEs) experiencing a slowdown. Private businesses, choosing to utilise their own funds in a high-interest rate environment, contributed to the deposit deceleration. In the case of NFPSEs, the reclassification of some entities as federal government institutions from December 2022 onward explained the slowdown. Non-bank Financial Institutions (NBFIs) saw a decline in deposits, as they strategically shifted funds to government securities to seek higher returns.Meanwhile, personal deposits grew by 15.9% in FY23, buoyed by favourable returns offered by banks amid elevated interest rates.

Talking to WealthPK, Hamid Haroon, a former World Bank economist, said that the acceleration in currency in circulation, notably in Q4-FY23 during festive periods, coupled with the deceleration in deposit growth, underscores the impact of macroeconomic factors on consumer behaviour. "Rising macroeconomic uncertainty, high inflation, and reduced workers' remittances have collectively influenced the deposit landscape. Policymakers must carefully consider these factors in crafting strategies to stabilise currency circulation and promote deposit growth."

He said that the segment-wise variations in deposits, with private businesses opting for self-funding in a high-interest rate environment and NBFIs strategically reallocating funds, highlight the adaptive strategies of different sectors. "Policymakers should recognise these nuances to tailor interventions that support sectors facing challenges and capitalise on those that show resilience."

"As Pakistan grapples with this complex financial landscape, policymakers and industry stakeholders must carefully navigate the implications of the surge in money supply, addressing both the drivers of growth and the challenges posed by varying sectoral performances," Haroon stressed.

Credit: INP-WealthPk