INP-WealthPk

Ayesha Saba

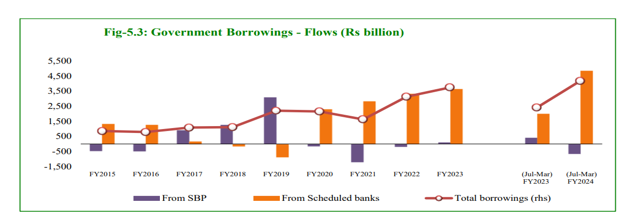

The government’s heavy reliance on borrowing from the money market to address the budget deficit has significant implications for private sector growth, caution economic experts, who advocate for a more balanced approach. They emphasize the need to support fiscal requirements without stifling the private sector, ensuring sustainable economic development. According to the Economic Survey 2023-24, during the period from July to March FY24, government borrowing for budgetary support expanded by Rs4,187 billion, compared to Rs2,419 billion in the same period the previous year. The budget deficit during this period amounted to Rs3,902 billion, with approximately 87% financed through the domestic banking system. Discussing the government's borrowing practices with WealthPK, Dr. Eatzaz Ahmed, former Memorial Chairperson at the State Bank of Pakistan, highlighted the steady rise in

Pakistan’s debt burden, with both domestic and external debts reaching alarming levels. “As the country grapples with repayments and servicing costs, the government must prioritize capital formation and development projects,” he stated. Dr. Ahmed advocated for a balanced borrowing strategy that supports essential public sector initiatives without compromising private sector growth. He stressed the importance of strategic fiscal management, noting, “It's crucial for the government to prioritize borrowing for projects that yield high economic returns and create a conducive environment for private sector investment.” He suggested that the government should explore alternative financing mechanisms, such as public-private partnerships (PPPs), to alleviate the direct borrowing burden. “Government borrowing should be directed towards projects with high economic returns, such as infrastructure, education, and technology.

These investments can generate long-term economic benefits and help repay the debt over time,” he elaborated. “By leveraging private capital for public projects, the government can also reduce the crowding-out effect and foster a more collaborative economic environment,” he added. In a conversation with WealthPK, Dr. Sajid Amin, an esteemed economist and Deputy Executive Director of the Sustainable Development Policy Institute (SDPI), emphasized that the government's inability to effectively manage the gap between revenue and expenditure could significantly impede private sector growth. Dr. Amin pointed out that a major challenge for Pakistan has been the persistent mismanagement of resources by successive governments.

He suggested that addressing this issue requires creating ample opportunities for private businesses to access financial resources and ensuring robust credit availability. He further remarked that Pakistan’s debt becomes problematic or unsustainable when it is used to cover current expenditures, or short-term recurrent spending. “The development sector accounts for only 10% of the government’s budget, indicating that most of the borrowed funds are used for current expenditures. This makes the debt problematic,” he explained. On the domestic front, he advocated for prudent fiscal management, emphasizing the need to align government spending with revenue generation. “Structural reforms aimed at improving the business environment, enhancing tax collection mechanisms, and curbing unnecessary expenditures could contribute to a more sustainable economic model,” he suggested.

Credit: INP-WealthPk