INP-WealthPk

Shams ul Nisa

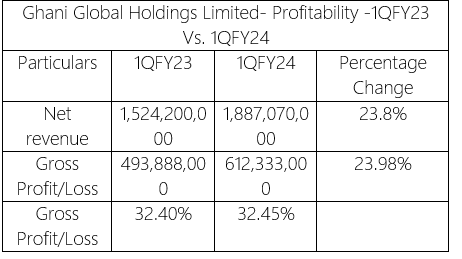

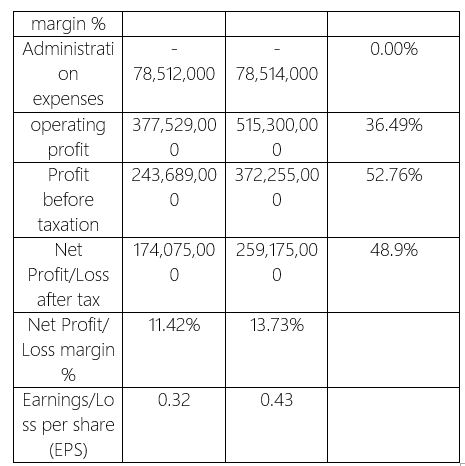

Ghani Global Holdings Limited reported a consolidated net profit of Rs259.17 million in the first quarter of Fiscal Year 2024, an increment of 48.9% from Rs174.07 million in the same period last year, reports WealthPK. This surge is driven by the higher net revenue generation during the period. The company posted a net revenue of Rs1.88 billion in 1QFY24, up 23.8% from Rs1.52 billion in 1QFY23. A growth of 23.98% was registered in gross profit reaching Rs612.3 million in 1QFY24 compared to Rs493.88 million recorded in 1QFY23. Gross margins during 1QFY24 clocked in at 32.45% versus 32.40% in the same period last year. Similarly, administrative expenses showed a marginal increment with Rs78.514 million in 1QFY24 and Rs78.512 million in 1QFY23.

Whereas, the operating profit went up by 36.49%, clocking in at Rs515.3 million in 1QFY24 compared to Rs377.5 million in 1QFY23. The company’s profit before tax climbed to Rs372.25 million in 1QFY24 from Rs243.68 million in 1QFY23, registering a significant growth of 52.76%. The net margin settled at 13.73% in 1QFY24 compared to 11.42% registered in the same period last year. The company posted earnings per share of Rs0.43 in 1QFY24 against Rs0.32 in 1QFY23.

Assets Analysis

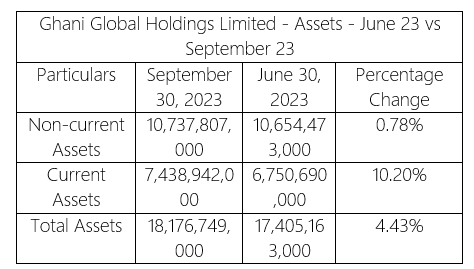

The rise in long-term asset investments, such as property, plant, and equipment, was partly due to the company's improved financial success. With a small rise of 0.78%, the non-current assets increased slightly from Rs10.65 billion in June 2023 to Rs10.73 billion in September 2023.

From Rs6.75 billion in June 2023 to Rs7.438 billion in September 2023, the current assets increased dramatically by 10.20%. This demonstrates that by investing more in short-term assets like cash, accounts receivable, and inventories, the company has enhanced its liquidity position. As a consequence of the increase in both current and non-current assets, the company's total assets increased from Rs17.405 billion in June 2023 to Rs18.176 billion in September 2023, representing a growth of 4.43%.

Equity and Liabilities Analysis

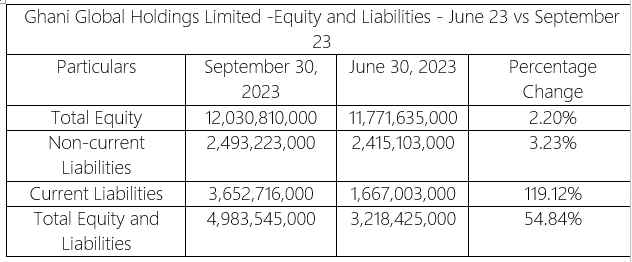

With an increase of 2.20%, the total equity as of September 2023 was Rs12.03 billion, up from Rs11.77 billion in June 2023. This suggests that the company has raised more money during this time. From Rs2.41 billion in June 2023 to Rs2.49 billion in September 2023, the non-current liabilities showed an incremental rise of 3.23%. This rise demonstrates the company's increased commitment over the long term to pay for other expenses as well as the capital investment.

The current liabilities surged by 119.12% from Rs1.667 billion in June 2023 to Rs3.65 billion in September 2023. The increased investment and operational activity over this time are most likely the source of this surge. The overall equity and liabilities increased by 54.84% during the period under consideration.

Company profile

Ghani Global Holdings Limited was established in Pakistan on November 19, 2007. The company's primary activity is to oversee its trading activities and investments in affiliated and subsidiary companies. The company’s authorized share capital is Rs4 billion, while its issued, subscribed, and paid-up share capital is Rs3.541 billion.

Credit: INP-WealthPk