INP-WealthPk

Shams ul Nisa

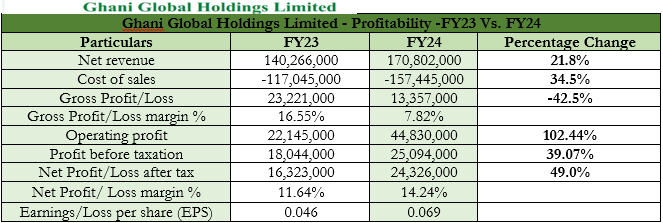

Ghani Global Holdings Limited's net revenue has increased by 21.8%, indicating strong demand and successful market penetration strategies, reports WealthPK.During the year under review, the Company engaged in trading and sales activities. However, the cost of sales rose by 34.5%. As a result, the gross profit dropped sharply by 42.5% to Rs13.3 million, with the gross profit margin falling from 16.55% in FY23 to 7.82% in FY24. Despite these pressures, the operating profit grew significantly by 102.44% to Rs44.83 million.

The company’s profit before tax increased by 39.07%, reflecting effective cost management. Notably, the net profit after tax rose by 49%, improving the net profit margin from 11.64% in FY23 to 14.24% in FY24. Other income for FY24 included commissions from corporate guarantees issued by the company and profit from Islamic bank savings accounts. Additionally, the earnings per share increased from Rs0.046 to Rs0.069, signaling enhanced value for shareholders.

Assets, Equity and Liabilities

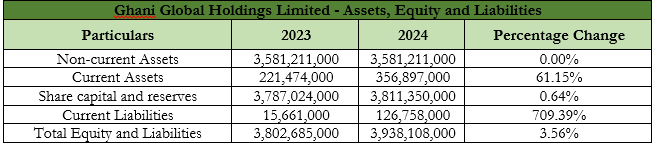

The financial and operational analysis of Ghani Global Holdings Limited for 2023 and 2024 shows stable non-current assets at Rs3.58 billion, reflecting a cautious approach to capital expenditures. The current assets grew by 61.15%, indicating improved liquidity and a stronger capacity to handle short-term obligations. However, the substantial 709.39% increase in current liabilities raises concerns about the company’s short-term financial stability and operational risk.

Ghani Global Holdings Limited's share capital and reserves experienced a modest growth of 0.64%, signifying steady equity financing but minimal growth in retained earnings. Its total equity and liabilities rose by 3.56%, reflecting slower expansion compared to the significant rise in current liabilities.

Chemical Sector

Sales

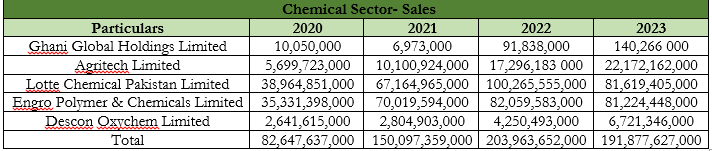

The sales performance of the chemical sector from 2020 to 2023 displayed notable growth and variation among key companies. Ghani Global Holdings Limited experienced a major increase in sales, which grew from Rs10.05 million in 2020 to Rs140.27 million in 2023.

Agritech Limited also saw its sales quadruple to Rs22.1 billion in 2023, reflecting a strong market presence and effective strategies. Lotte Chemical Pakistan Limited and Engro Polymer & Chemicals Limited reported high sales but faced fluctuations. Lotte Chemical’s sales grew from Rs38.96 billion in 2020 to Rs100.27 billion in 2022, then declined to Rs81.62 billion in 2023. Similarly, Engro Polymer’s sales rose from Rs35.33 billion in 2020 to Rs82.06 billion in 2022, with a slight dip to Rs81.22 billion in 2023. Descon Oxychem Limited’s sales showed consistent growth, increasing from Rs2.64 billion in 2020 to Rs6.72 billion in 2023.

Net Profit

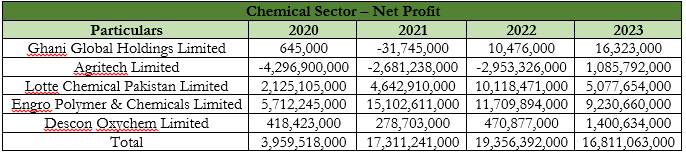

The chemical sector's net profits from 2020 to 2023 exhibited considerable volatility and varied performances among major companies. Ghani Global Holdings Limited achieved a notable turnaround, shifting from a loss of Rs31.75 million in 2021 to a net profit of Rs16.32 million in 2023. Agritech Limited, despite significant prior losses, recorded a strong profit of Rs1.08 billion in 2023, reflecting challenges in market navigation and cost control. Lotte Chemical Pakistan Limited performed well, with net profits climbing from Rs2.13 billion in 2020 to Rs10.12 billion in 2022, before declining to Rs5.08 billion in 2023. Engro Polymer & Chemicals Limited reported solid profits but saw a decrease from Rs11.7 billion in 2022 to Rs9.2 billion in 2023. Descon Oxychem Limited posted steady growth of net profit, which reached Rs1.4 billion in 2023, indicating effective operations and market positioning. Overall, the sector's total net profit declined from Rs19.36 billion in 2022 to Rs16.81 billion in 2023.

Company profile

Ghani Global Holdings Limited was established in Pakistan on November 19, 2007. The company's primary activity is to oversee its trading activities and investments in affiliated and subsidiary companies.

Credit: INP-WealthPk