INP-WealthPk

Fakiha Tariq

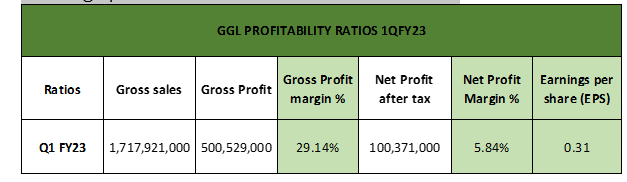

Ghani Global Holdings Limited (GGL) earned over Rs500 million (29.14%) in gross profit from its total sales of over Rs1.7 billion in the first quarter of fiscal year 2022-23 (1QFY23).

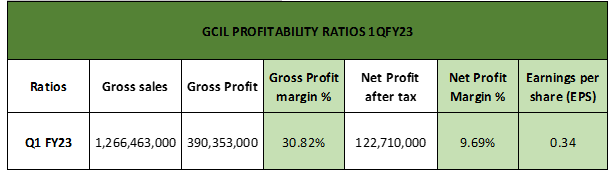

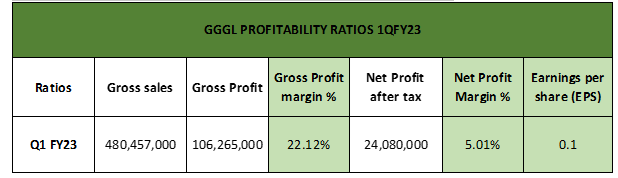

This gross profit was the result of consolidated gross profit values of 30.82% and 22.12%, contributed, respectively, by GGL’s subsidiaries – Ghani Chemicals Industries Limited (GCIL) and Ghani Global Glass Limited (GGGL), WealthPK research shows.

GGL is the manufacturer and distributor of liquid industrial and medical gases.

The company started its operations as a private firm under the name of Ghani Gases Private Limited. It got listed with the Pakistan Stock Exchange in 2010 with the name and symbol of Ghani Global Holdings Limited and GGL.

On October 14, G3 Technologies Limited (GTECH) was merged into GCIL, thus expanding the Ghani Global Group.

GGL is mainly involved in managing operations of its subsidiaries – GCIL listed on PSX in chemical sector and GGGL in glass and ceramics sectors.

GGL profitability in 1QFY23

A major contribution was made by GCIL in the consolidated interim financial results of GGL during 1QFY23 as the subsidiary earned higher profits.

Consolidated gross sales of GGL stood at Rs1 billion during the period, and the gross profit was 29.14% of the overall sales. However, the company’s net profit margin declined 5.84%. Earnings per share stood at Rs0.31 1QFY23.

In consolidated results, GCIL contribution in gross profits stood at 30.82% and net profit at 9.69%. GCIL earned EPS value of Rs0.34 in 1QFY23.

GGGL, which is primarily engaged in manufacturing and selling of glass, is a leading Pakistani glass tubing company. During the first quarter of FY23, GGGL earned a gross profit margin of 22.12% over Rs481 million in sales. The net profit margin remained 5.01%, giving EPS value of Rs0.10.

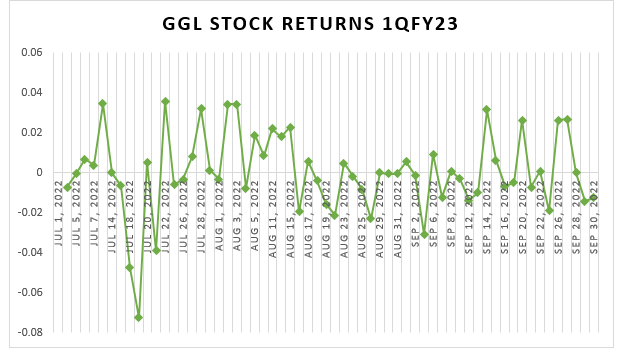

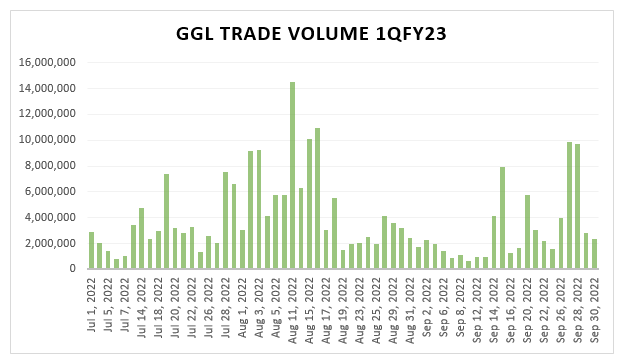

GGL stock returns analysis – 1QFY23

The average stock returns for the 1QFY23 remained positive and made money to the investors. Maximum top spikes can be seen in the graph below after a single dip in returns during the start of the quarter i.e., the mid of July 22.

However, during 1QFY23, GGL experienced the highest trade volume of 14,508,403 shares on Aug 11, 2022 as shown in the graph below.

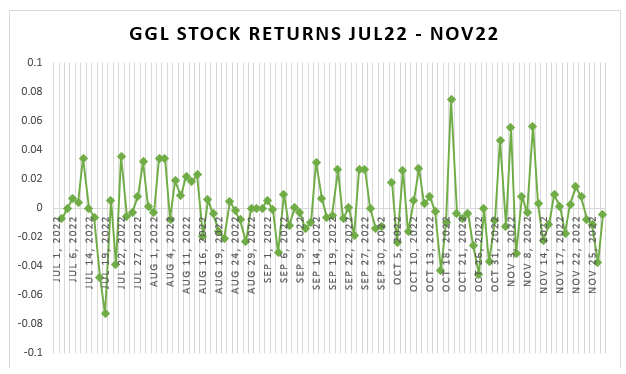

GGL stock returns analysis – July 22-Nov 22

The WealthPK study also calculated and analysed the stock returns pattern of GGL for the last five months from July 2022 to Nov 2022. Of the five-month period, the average stock returns remained positive during August and November. Whereas, the average returns for the months of July, September and October 2022 reflected a negative trend.

The comprehensive picture of GGL market returns for the last five month is also compelling. During the period under review, the months of October and November produced high returns for the investors.

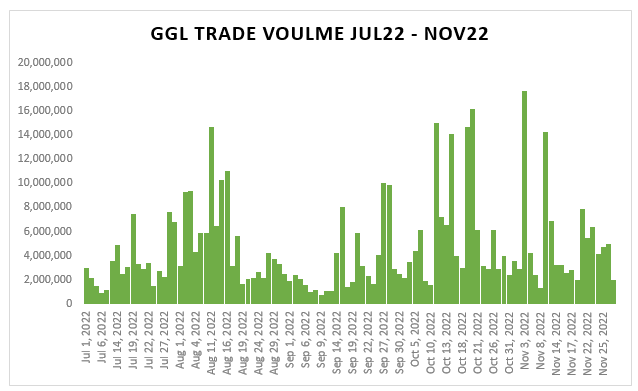

Of the last five months in FY23, GGL experienced the highest traded volume in November.

GGL also ranked in the PSX top 10 symbols chart in terms of trade volume in the months of October 22 and November 22.

Credit : Independent News Pakistan-WealthPk