INP-WealthPk

Shams ul Nisa

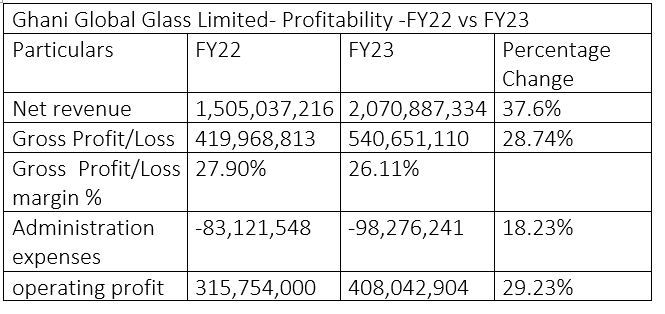

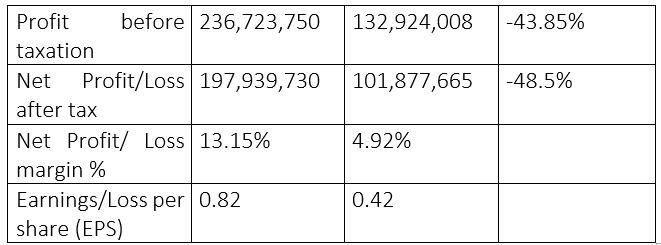

Ghani Global Glass Limited announced its financial results for the fiscal year ending on June 30, 2023, posting a 37.6% year-on-year growth in net revenue. The revenue clocked in at Rs2.07 billion in FY23 compared to the previous year’s Rs1.5 billion. Despite the increase in sales, the company’s net profit declined 48.5% to Rs101.87 million in FY23 from Rs197.9 million in FY22. The net profit margin thus reduced from 13.15% in FY22 to 4.92% in FY23. The company recorded a gross profit of Rs540.6 million during the period under review, posting an increase of 28.74% over Rs419.96 million in FY22. The gross profit margin fell slightly to 26.11% in FY23 from 27.90% the previous fiscal year.

The company bore a total administrative expense of Rs98.27 million during FY23, 18.23% higher than Rs83.12 million registered in FY22. The company is principally engaged in the manufacturing and sale of glass tubes, glassware, vials and ampules, and chemicals. During FY23, the operating profit of the company climbed by 29.23% to Rs408.04 million from Rs315.7 million last year. The glass manufacturing company’s profit-before-tax narrowed by 43.85% to Rs132.9 million from Rs236.7 million in FY22. The company’s earnings per share (EPS) stood at Rs0.42 in FY23 compared to Rs0.82 in FY22. The company attributed this reduction in net profitability to the delay in opening of the letters of credit for import of raw material for production of tubes and ampoules. Additionally, the Drugs Regulatory Authority of Pakistan took a long time to announce an increase in pharma products.

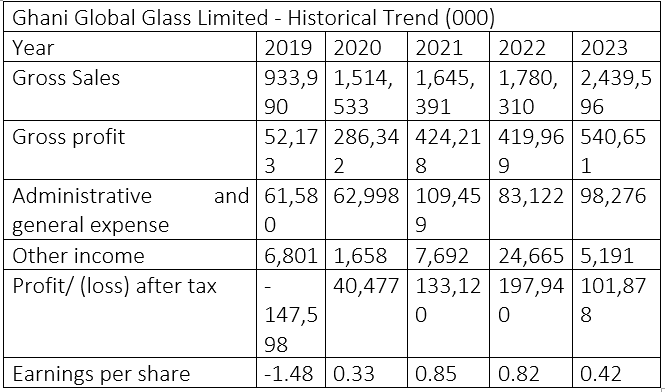

Historical trend analysis

The glass manufacturing company saw an increase in gross sales from Rs933.9 million in 2019 to Rs2.439 billion in 2023. The gross profit of the company kept increasing, rising to Rs540.6 million in 2023 from Rs52.17 million in 2019, except a single decline of Rs419.9 million occurred in 2022 compared to the previous year. Administrative and general costs for the company were the highest in 2021 at Rs109.45 million and the lowest in 2019 at Rs61.58 million. The other income dropped from Rs6.8 million in 2019 to Rs1.6 million in 2020, before rising to Rs7.6 million in 2021 and soaring to Rs24.6 million in 2022. However, this income dropped steeply to Rs5.19 million in 2023.

The company suffered a net loss of Rs147.5 million in 2019, but the negative trend snapped in the subsequent years with net profit reaching its highest of Rs197.9 million in 2022. However, the net profit fell in 2023 to Rs101.87 million. Similarly, the EPS remained positive over the years except in 2019 when the company posted loss per share of Rs1.48.

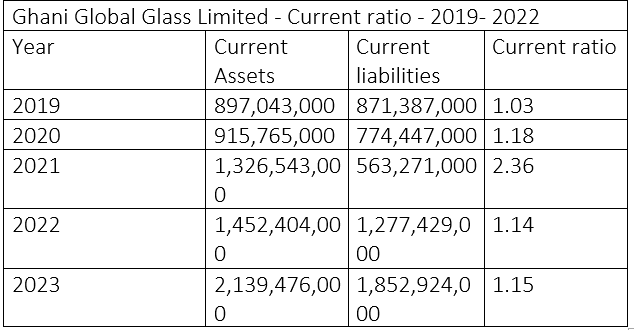

Current ratio analysis

The current ratio shows how much of a company's current assets can be used to pay off its short-term liabilities. As demonstrated in the table, the company's current ratio remained above 1, meaning that it was able to sustain a steady liquidity position over time. Ghani Global Glass recorded the highest current ratio of 2.36 in 2021 and the lowest ratio of 1.03 in 2019.

Credit: INP-WealthPk