INP-WealthPk

Shams ul Nisa

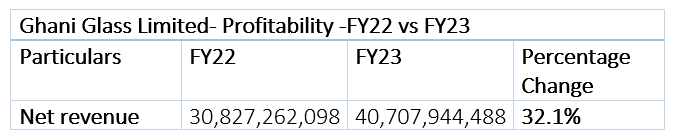

Ghani Glass Limited posted a 32.1% increase in revenue to Rs40.7 billion in the financial year ending on June 30, 2023, compared to Rs30.8 billion in FY22. This increase was thanks to the implementation of long-term solid growth strategies, which led to better operational performance. The company witnessed a 25.13% growth in gross profit, which climbed to Rs11.28 billion in FY23 from Rs9.015 billion in FY22. However, the gross margin reduced to 27.71% during the period under review from 29.25% in FY22.

The company attributed this decline to the hike in the cost of sales. The glass manufacturing company's general and administrative expenses increased by 21.98% to Rs1.16 billion in FY23 from Rs954.16 million in FY22. Meanwhile, the company's other income dropped 5.05% to Rs342.28 million in FY23. The operating profit clocked in at Rs8.08 billion in FY23, which was 27.41% greater than the Rs6.34 billion registered last year.

Similarly, the profit-before-tax stood at Rs8.53 billion in FY23 compared to Rs6.23 billion in FY22, posting a significant rise of 36.76%. The net profitability grew by 33.9% from Rs6.04 billion in FY22 to Rs8.09 billion in FY23. The net profit margin inched up to 19.89% in FY23 from 19.61% in FY22. The earnings per share stood at Rs8.10 in FY23 compared to Rs6.05 in FY22.

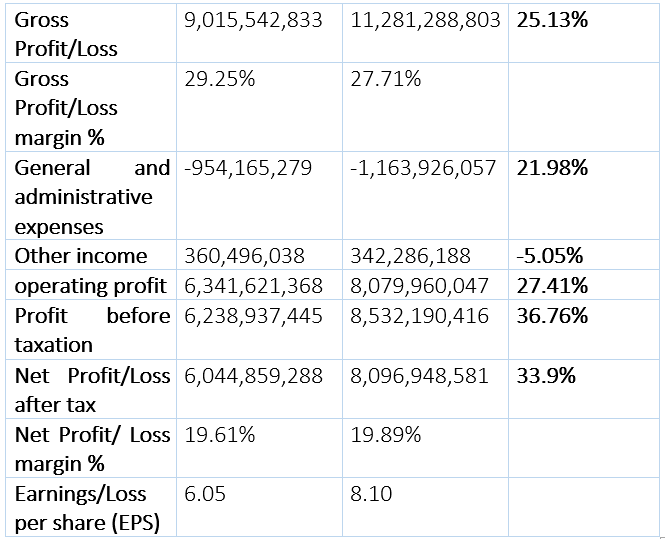

Profitability ratios analysis

Ghani Glass Limited's gross profit ratio stood at 28% in 2018 and 2023. However, it fluctuated in-between reaching the highest of 29% in 2022 and the lowest of 15% in 2020. The profit-before-tax ratio reached 21% in 2023 from 22% in 2018. The company witnessed a major dip in 2020, reaching the lowest of 9%, before recovering in the subsequent years. The inventory turnover ratio, which calculates the frequency of inventory replacement compared to the company's cost of sales, followed a decreasing trend from a maximum of 10.97 in 2018 to a minimum of 2.83 in 2020, before improving to 7.99 in 2021. However, the inventory turnover ratio followed a decreasing trend again in the following years.

Generally, a higher ratio value is considered better as it reflects higher sales of the company. The total assets turnover ratio assesses how well a company utilises its assets to generate revenue. A ratio greater than 1 is considered convenient as it means the company generates sufficient revenue from assets. The company's assets turnover ratio remained less than 1 over the years except in 2022, when it stood at 1. Earnings per share of the company registered the highest value of Rs8.10 in 2023 and the lowest of Rs1.63 in 2020. The company's price-earnings ratio ranged between 3.12 in 2023 and 20.37 in 2020.

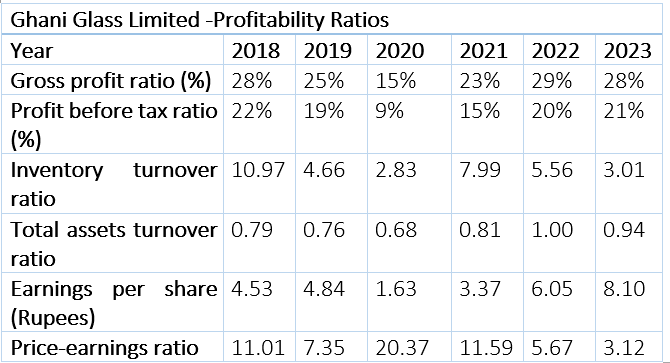

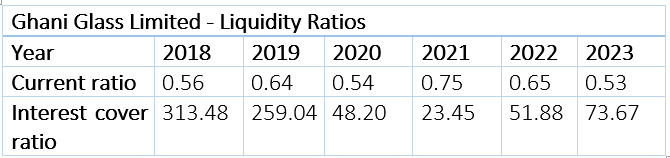

Liquidity ratios analysis

A company's current ratio evaluates how well it can use its current assets to pay off its short-term liabilities. A current ratio between 1.2 and 2 and above is considered safe, while one below 1.2 increases the likelihood that the business won't be able to pay its short-term debts. Over time, the company's current ratio has been below 1, which suggests an increasing risk regarding its ability to pay off its debts using its available assets. Similarly, a company's interest cover ratio assesses its ability to pay interest on outstanding debt. The company's interest cover ratio is above 1, reflecting a better position to pay its interest on the debt.

Credit: INP-WealthPk