INP-WealthPk

Ayesha Mudassar

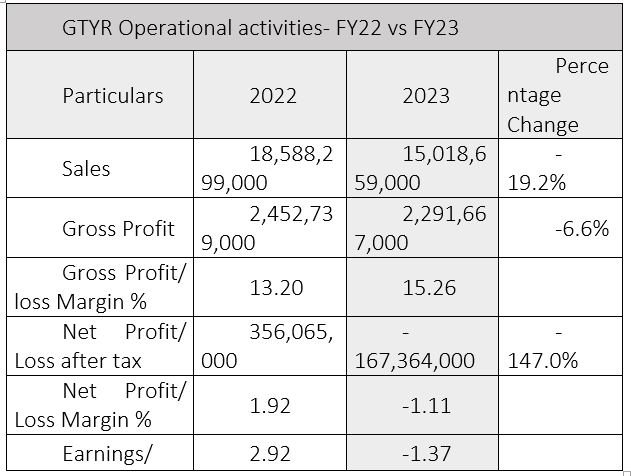

Ghandhara Tyre and Rubber Limited’s (GTYR) revenue and gross profit declined by 19.2% and 6.6%, respectively, in the last fiscal year 2022-23 as compared to FY22, WealthPK reports. In FY23, GTYR made net sales of Rs15.1 billion and earned a gross profit of Rs2.3 billion, thus coming up with a gross profit margin of 13.2%. However, the company posted a net loss of Rs167 million and a net loss ratio of 1.1% in FY23. Therefore, GTYR posted a loss per share of Rs1.37 in FY23.

![]()

In comparison to FY22, the auto parts maker’s revenues decreased by 19.2% from Rs18.5 billion to Rs15.1 billion in FY23. Likewise, the gross profit of Rs2.3 billion posted in FY22 dropped by 6.6%. Compared to a net profit of Rs356 million GTYR declared in FY22, it suffered a net loss of Rs167 million in FY23.

Company profile

Ghandhara Tyre and Rubber Company was incorporated in Pakistan on March 7, 1963, as a private limited company and was subsequently converted into a public limited company. The company is listed on the Pakistan Stock Exchange under the symbol “GTYR.” It is the fourth-largest firm in the automobile parts and accessories sector, with a market capitalisation of Rs2.8 billion. The firm is engaged in the manufacturing and trading of tyres and tubes for automobiles and motorcycles.

Performance over the last four years

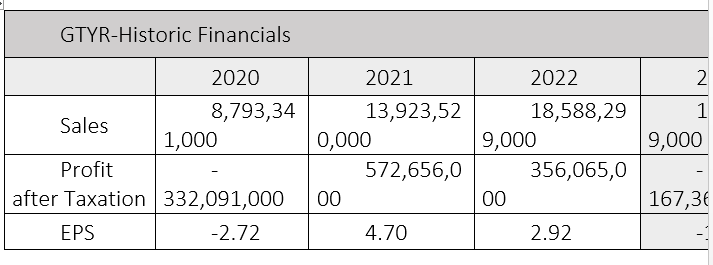

Historical analysis of GTYR sales shows that in the last four years, the company earned the highest revenues in 2022. The company had a single dip in sales in 2023. From sales of Rs18.5 billion in FY22, the company’s revenue declined to Rs15.1 billion in FY23. However, GTYR posted Rs8.7 billion in sales in FY20 and Rs13.9 billion in FY21.

Concerning net profit, the automaker’s historical performance fluctuated over the years.

In the last four years (2020-2023), the firm posted the highest net profit of Rs572 million in 2021. The company posted a net loss of Rs332 million in 2020. In 2022, the company posted a net profit of Rs356 million, which dropped to a net loss of Rs167 million in 2023 GTYR posted the highest four-year EPS of Rs4.7 in FY21. However, the company had a loss per share in FY20 and FY23.

Analysis of historical profit ratios

In the last four years, GTYR posted the highest gross profit ratio of 15.2% in 2022 and the lowest gross profit ratio of 11.9% in FY20. The company reported the highest net profit ratio of 4.1% in 2021, followed by 1.9% in 2022.

Credit: INP-WealthPk