INP-WealthPk

Ayesha Mudassar

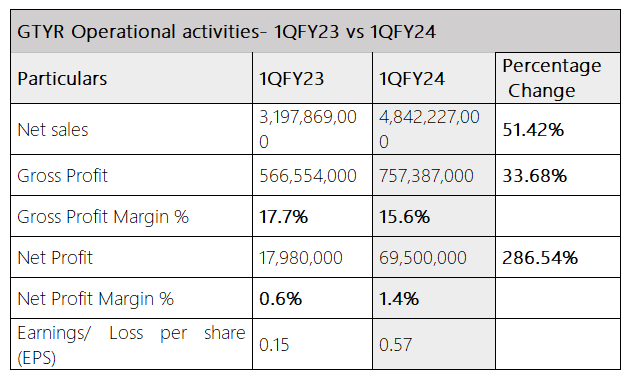

Ghandhara Tyre and Rubber Company Limited's (GTYR) revenue and gross profit increased by 51.4% and 33.6%, respectively, in the first quarter of the ongoing fiscal year (1QFY24) as compared to the 1QFY23, WealthPK reports. In 1QFY24, GTYR made net sales of Rs4.8 billion and earned a gross profit of Rs 757.3 million, resulting in a gross profit margin of 15.6%. The company posted a net profit of Rs 69.5 million and a net profit ratio of 1.4%. Therefore, GTYR posted an earnings per share of Rs0.57 during 1QFY24.

In comparison to 1QFY23, the auto parts maker’s revenue increased by 51.4% from Rs3.1 billion to Rs4.8 billion in 1QFY24. The improved sales were mainly due to enhanced focus on the replacement market. During the quarter, the company exported its first consignment to the African market and is now continuously exploring opportunities to expand its presence. Likewise, the gross profit of Rs566 million posted in 1QFY23 rose by 33.6%. Compared to a net profit of Rs17.9 million declared in 1QFY23, the company earned a net profit of Rs69.5 million in 1QFY24. However, the finance cost for the 1QFY24 was Rs414 million as compared to Rs286 million in the same period last year.

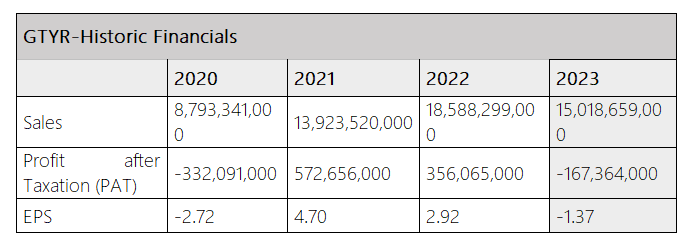

This rise in the cost is mainly attributable to increased discount rates and higher working capital requirements. Performance over the last four years Analysis of historical financials A historical analysis of GTYR sales shows that in the last four years, the company earned the highest revenues in 2022. The company had a single dip in sales in 2023. From sales of Rs18.5 billion in FY22, the company’s revenue declined to Rs15.1 billion in FY23. However, it posted Rs8.7 billion in sales in FY20 and Rs13.9 billion in FY21.

Concerning PAT, the automaker’s historical performance fluctuated over the years. In the last four years (2020-2023), the firm posted the highest net profit of Rs572 million in 2021 and a net loss of Rs332 million. The company went from a net profit of Rs356 million in 2022 to a net loss of Rs167 million in 2023. The company posted the highest four-year EPS of Rs 4.7 in FY21. However, a loss per share was reported in FY20 and FY23.

Analysis of historical profit ratios In the last four years, GTYR posted the highest gross profit ratio of 15.2% in 2023 and the lowest gross profit ratio of 11.9% in FY20. The company reported the highest net profit ratio of 4.1% in 2021 followed by 1.9% in 2022. The profitability ratios have improved in the recently ended fiscal year as compared to the previous year due to the low cost of sales.

Company Profile

Ghandhara Tyre and Rubber Company Limited was incorporated in Pakistan on March 7, 1963 as a private limited company and was subsequently converted into a public limited company. The company is listed on the Pakistan Stock Exchange under the symbol "GTYR". It is the fourth-largest firm in the automobile parts and accessories sector, with a market capitalization of Rs2.8 billion. The firm is engaged in the manufacturing and trading of tyres and tubes for automobiles and motorcycles.

Credit: INP-WealthPk