INP-WealthPk

Qudsia Bano

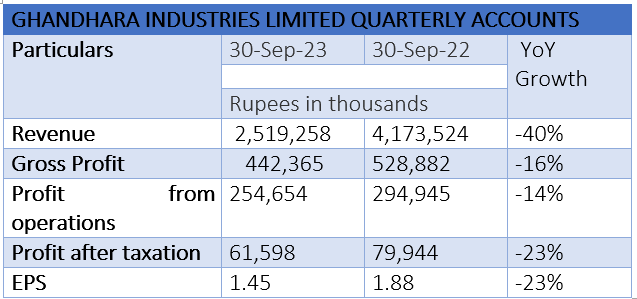

Ghandhara Industries Limited released its quarterly accounts for the period ending on September 30, 2023, indicating a significant downturn in the company's performance. This reflected the broader economic challenges during this timeframe. The total revenue of the company for the third quarter (July-September) of 2023 amounted to Rs2.5 billion, a stark contrast to Rs4.17 billion recorded in the corresponding period in 2022. This substantial decrease of 40% year-on-year was emblematic of the adverse economic environment, which saw a considerable impact on the company's top-line figures. The gross profit for the quarter stood at Rs442.3 million, showcasing a decline of 16% compared to Rs528.89 million in the same period last year. Similarly, the profit from operations also experienced a downturn, with figures dropping by 14% from Rs294.95 million in September 2022 to Rs254.6 million in the quarter under review.

The bottom line, as reflected in the profit-after-taxation, recorded a notable decline. Ghandhara Industries reported a net profit of Rs61.6 million, which was 23% lower than Rs79.9 million in the third quarter of 2022. Earnings per share (EPS) followed suit, standing at Rs1.45 as opposed to Rs1.88 in the same period last year, reflecting a similar 23% decrease. This downturn can be attributed to the prevailing economic challenges, including stringent economic conditions, heightened inflation rates, and an increased policy rate. These factors collectively contributed to a less favourable business environment for Ghandhara Industries Limited during the period under review.

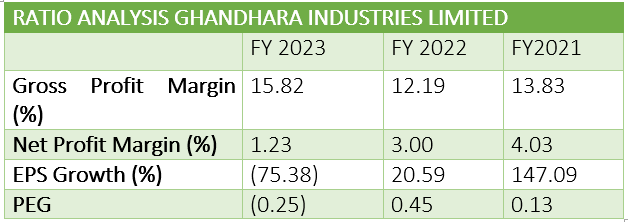

Ghandhara Industries Limited's ratio analysis for the fiscal year 2022-23 reveals important insights into the company's financial performance and growth trajectory. The gross profit margin, a key indicator of operational efficiency, has seen a positive trend. In FY23, the gross profit margin increased to 15.82%, up from 12.19% in FY22 and 13.83% in FY21. Contrastingly, the net profit margin, which reflects the company's profitability after all expenses, has shown a decline. In FY23, the net profit margin stood at 1.23%, down from 3% in FY22 and 4.03% in FY21. The EPS growth provides a glimpse into the company's ability to generate earnings for its shareholders. Unfortunately, FY23 witnessed a significant decrease in EPS growth, recording a negative 75.38%.

This contrasts sharply with the positive growth of 20.59% in FY22 and an impressive 147.09% in FY21. The negative growth in EPS implies a decline in the company's ability to generate earnings for each outstanding share, which could be attributed to various factors such as reduced net income or an increase in the number of outstanding shares. The price/earnings to growth (PEG) ratio, a valuation metric that considers both the P/E ratio and EPS growth, further supports the notion of challenging times for Ghandhara Industries. In FY23, the PEG ratio stood at -0.25, reflecting a negative outlook. This was in stark contrast to the positive PEG ratios of 0.45 in FY22 and 0.13 in FY21.

About the company

Ghandhara Industries was incorporated on February 23, 1963. The principal activity is the assembly, progressive manufacturing, and sale of Isuzu trucks, buses and pick-ups.

Credit: INP-WealthPk