INP-WealthPk

Fakiha Tariq

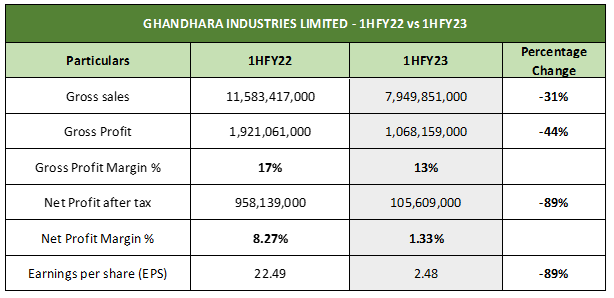

Ghandhara Industries Limited (GHNI) has had its yearly sales, gross and net profits decline by 31%, 44% and 89%, respectively, in the first six months (July-December) of the ongoing fiscal year 2022-23, WealthPK reports.It is to mention here that the firm is listed on the Pakistan Stock Exchange (PSX) with the symbol of GHNI in the automobile assembler sector. GHNI posted a gross profit of Rs1 billion and net profit of Rs105 million on the sales of Rs7.9 billion in 1HFY23. The company created gross profit and net profit ratios of 13% and 1.33%, respectively. It posted earnings per share value of Rs2.48 in the 1HFY23.

The company’s total sales had stood at Rs11 billion, gross profit at Rs1.9 billion and net profit at Rs958 million in 1HFY22. GHNI posted gross profit and net profit ratios of 17% and 8.27% in 1HFY22. It had reported an EPS value of Rs22.49 in 1HFY22. With a market capitalisation of Rs3.8 billion, GHNI is the eighth largest firm in the automobile assembler sector. Established under the tutelage of General Motors USA in 1963, GHNI is engaged in the production and selling of ISUZU pickups, trucks, buses and other heavy-duty vehicles.

GHNI – semi-annual financial analysis – 1HFY19 to 1HFY23

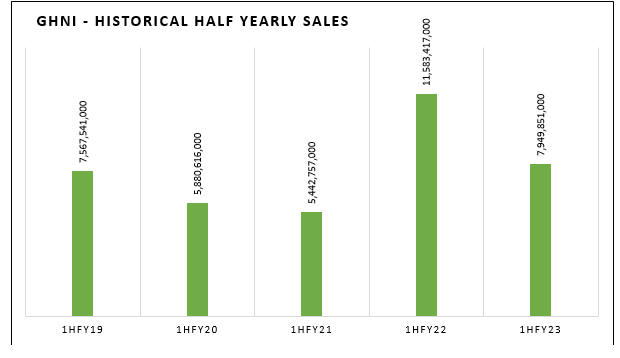

From 1HFY19 to 1HFY21, sales kept decreasing, but jumped to a maximum five-year value in 1HFY22. However, the sales failed to keep pace and dropped in 1HFY23. GHNI had posted sales of Rs7.5 billion, Rs5.8 billion and Rs5.4 billion in 1HFY19, 1HFY20 and 1HFY21, respectively. It posted the highest five-year semi-annual sales in 1HFY22 at Rs11 billion.

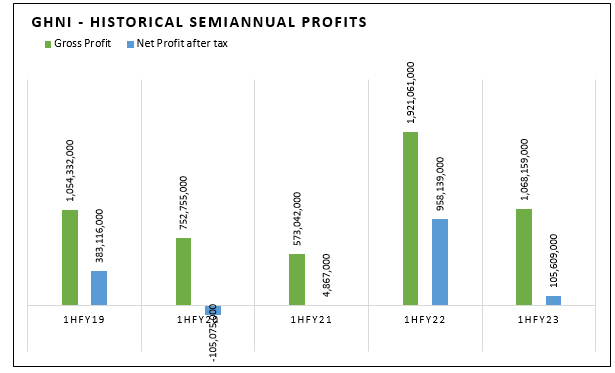

In terms of semi-annual profit making, GHNI did not produce a viable picture when graphed. The company posted the highest gross profit of Rs1.9 billion and a net profit of Rs958 million in 1HFY22. In the last five years, the company experienced the lowest gross and net profits in 1HFY21, and even posted net losses in 1HFY20.

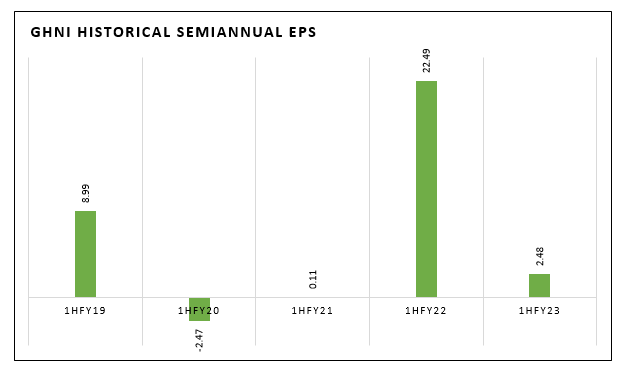

Half-yearly EPS analysis shows that GHNI posted the highest EPS of Rs22.49 in 1HFY22, followed by Rs8.99 in 1HFY19. The company also posted a loss per share of Rs2.47 in 1HFY20.

Credit: Independent News Pakistan-WealthPk