آئی این پی ویلتھ پی کے

Ayesha Mudassar

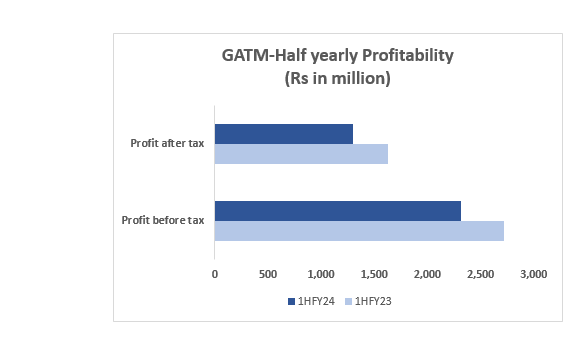

Gul Ahmed Textile Mills Limited (GATM) witnessed a decline of 15% and 20% in before and after-tax profits, respectively, during the first half of the Fiscal Year 2023-24 compared to the corresponding period of the earlier fiscal year, WealthPK reports. The company posted a pre-tax profit of Rs2.3 billion and a post-tax profit of Rs1.3 billion in the first half of FY24. The lower profit was mainly due to the challenging and adverse economic conditions caused by higher raw materials costs, depreciation of local currency, rapid increase in the interest rate, and high inflation.

GATM posted an earnings per share (EPS) of Rs1.76 during the period under review. Furthermore, the company's sales stood at Rs69.1 billion in 1HFY24 compared to Rs51 billion in 1HFY23, representing 35% growth. This notable increase is attributed to the favourable impact of currency fluctuations and an increase in exports. The cost of sales has experienced a significant upswing of 37%, primarily driven by increased material costs, higher energy costs, and an increase in minimum wages. In the presence of challenges, the company has managed to maintain its operating cash flows at a robust Rs5.9 billion, up by 78% when compared with the corresponding period of last year. This achievement can be attributed to the effective and diligent management of the working capital.

Pattern of shareholding

As of June 30, 2023, the company had a total of 740 million shares outstanding which are held by 7,394 shareholders. Around 69 percent of the shares are held by associated parties, undertakings, and related parties. Within this category, Gul Ahmed Holdings (Private) Limited leads with a stake of 80 percent in GATM’s outstanding share volume. In addition, the individuals and directors own 11.5% and 7.4% of the entire share shareholding.

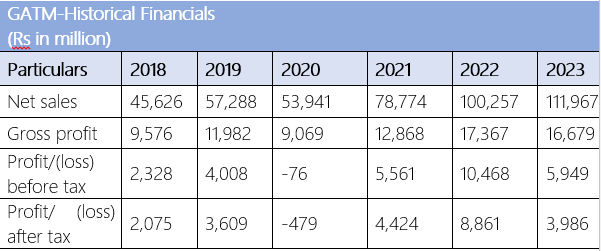

Financial performance (2018-23)

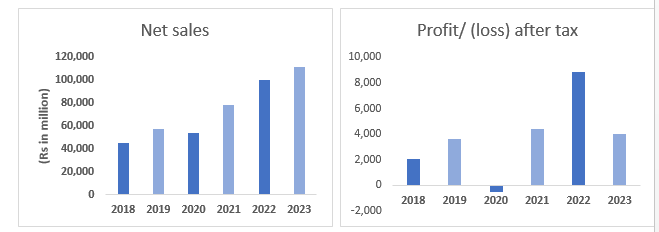

GATM’s mills topline showed a growth trend over all the years except 2020. Conversely, its bottom line slid twice during 2020 and 2023. In 2019, the company’s topline grew by 26% year-on-year (YoY) on account of a satisfactory demand in the local and export markets. The company closed the year with a 25% and 74% rise in gross and net profit, which clocked in at Rs11.9 billion and Rs3.6 billion, respectively. The profit-before-tax also progressed from Rs2.3 billion in 2018 to Rs4 billion in 2019. Owing to Covid-19, the company registered a drop in sales by around 6% YoY in 2020.

The weak demand and pandemic-related restrictions have resulted in a 24% decline in the company’s gross profit. In addition, the company registered a net loss of Rs479 million during the year. 2021 was a recovery year, as the company's sales posted a YoY growth of 46%. The growth came on the heels of a rebound in both local and export sales. The gross profit and net profit also grew to Rs12.8 and Rs4.4 billion, respectively.

The year 2022 was characterized by grave macroeconomic challenges and persistent political uncertainty. However, the massive rupee devaluation enabled the company to boost its export sales, which resulted in a topline growth of 27% in 2022. Furthermore, the company registered a 100% enhancement in its net profit, which clocked in at Rs8.8 billion. In 2023, the company’s topline registered a nominal 10% surge. The hike in the prices of raw materials, local currency depreciation, and higher utility charges resulted in a 4% decline in the gross profit. In addition, the net profit slipped by 55% to Rs3.9 billion.

Company profile

Gul Ahmed Textile Mills Limited was incorporated on April 01, 1953 as a private limited company. Subsequently, it was converted into a public limited company on January 07, 1955. It is a composite textile mill engaged in the manufacture and sale of textile products.

Pakistan’s textile sector

Global economic uncertainty and rising production costs have posed substantial challenges to Pakistan’s textile industry. Additionally, frequent energy shortages and power outages have disrupted the production schedules, affected delivery timelines, and undermined customer confidence. Moreover, Pakistan faces a tough competition from regional counterparts such as India, Bangladesh, and Vietnam, who are offering competitive pricing and high-quality products.

Future outlook

Despite formidable headwinds and the adverse impact on profitability, the company remains resolute in its commitment to achieve operational excellence and financial resilience.

Credit: INP-WealthPk