INP-WealthPk

Shams ul Nisa

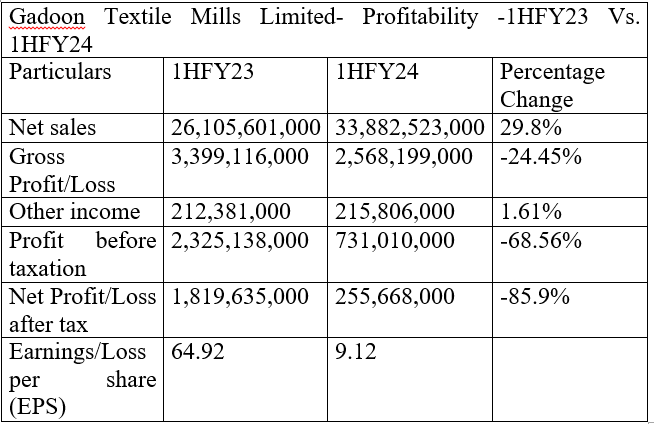

Gadoon Textile Mills Limited witnessed a substantial surge of 29.8% in sales, but its net profit plunged by 85.9% in the first half of the ongoing fiscal year (1HFY24) compared to the corresponding period of the last fiscal, according to WealthPK. The company’s gross profit declined to Rs2.56 billion in 1HFY24 from Rs3.39 billion in 1HFY23, indicating a decrease of 24.45%. However, the other income expanded by 1.61% to Rs215.8 million in 1HFY24.

The company’s pre-tax profit plunged 68.56% to Rs731.01 million in 1HFY24 from Rs2.32 billion in the same period last year. The earnings per share contracted significantly to Rs9.12 in 1HFY24 from Rs64.92 in 1HFY23.

Quarterly analysis

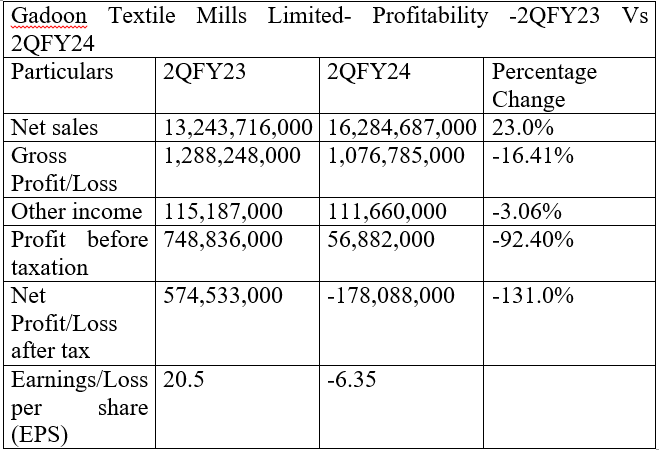

In 2QFY24, net sales increased 23.0% to Rs16.28 billion from Rs13.24 billion in 2QFY23. However, gross profit and other income shrank by 16.41% and 3.06%, respectively, in this quarter.

The pre-tax profit also nosedived to Rs56.88 million in 2QFY24 from Rs748.8 million in 2QFY23, posting a decline of 92.40%. The company witnessed a net loss of Rs178.08 million in 2QFY24, representing a hefty decline of 131.0% compared to a net profit of Rs574.5 million in the same quarter of the previous year. Resultantly, the company suffered a loss per share of Rs6.35 in 2QFY24 against earnings per share of Rs20.5 in 2QFY23.

Profitability ratios

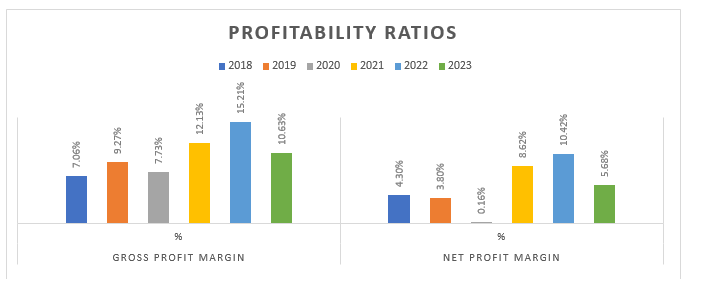

The historical profitability ratios provide useful insights into the company's ability to generate profit relative to sales. The gross profit ratio widened from 7.06% in 2018 to 9.27% in 2019. However, in 2020 it declined to 7.73%, but kept on growing in subsequent years reaching 15.21% in 2022. The company observed another dip of 10.63% in 2023. This decline indicated that the company failed to manage its costs and pricing strategies effectively.

The net profit margin varied over the past six years. It grew slightly from 4.30% in 2018 to 5.68% in 2023. The company recorded the highest net profit margin of 10.42% in 2022 and the lowest of 0.16% in 2020.

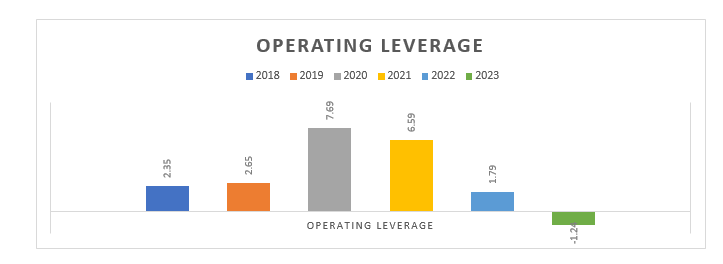

The operating leverage asses the ability of the company to generate revenues by increasing sales. The operating leverage followed a rising trend from 2.35 in 2018 to the highest of 7.69 in 2020. However, it gradually dropped over the next years reaching a negative value of 1.24 in 2023. This reflects the company produced less revenue as compared to its costs.

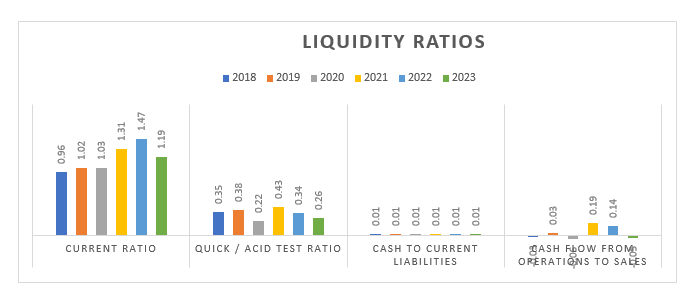

Liquidity ratios analysis

The current ratio evaluates how well a company can pay its short-term debts with its current assets. A current ratio between and above 1.2 and 2 is regarded as safe, and below 1.2 increases the danger. The current ratio of Gadoon Textile Mills in 2018, 2019, 2020 and 2023 was 0.96, 1.02, 1.03 and 1.19, respectively, showing the risk of not being able to cover its debt. Nonetheless, the company improved its current ratio in 2021 and 2022 with values of 1.31 and 1.47, respectively.

The quick ratio assesses how well a company can use its current assets to pay for short-term obligations. Over the years, the company's quick ratio stayed below 1, indicating the risk associated with meeting its obligations.

From 2018 to 2023, the company's cash to current liabilities was constant at 0.01, indicating that the company's cash position was below its current liabilities. The company’s cash flow from operations to sales increased from -0.03 in 2018 to -0.05 in 2023. The company witnessed the highest cash flow from operations to sales ratio of 0.19 in 2021.

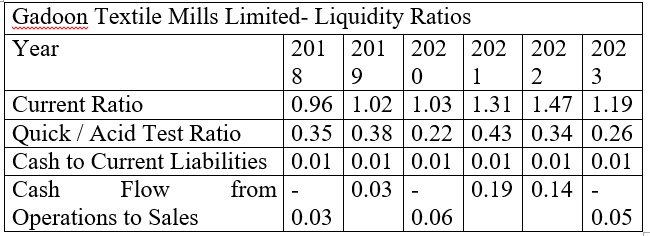

Analysis of textile spinning sector

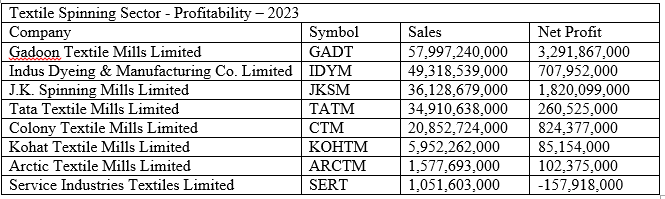

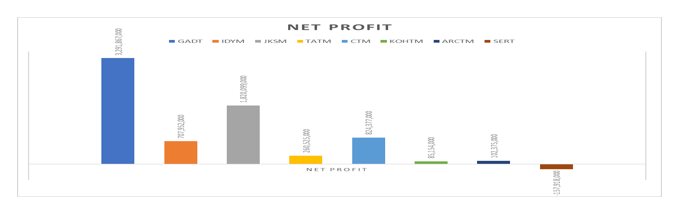

The analysis of the textile spinning sector provides a detailed comparison of the companies within this sector. For that, we have taken the sales and net profit patterns of the companies as proxies for comparison for the year 2023.

According to sales volumes for 2023, Gadoon Textile Mills Limited leads the sector accounting for 28% of the total sales of the sector, followed by Indus Dyeing & Manufacturing Co. Limited with 24%, and 17% each by JK Spinning Mills Limited and Tata Textile Mills Limited.

Similarly, Gadoon Textile Mills remained at the forefront in terms of net profit generation in the textile spinning sector, with a net profit of Rs3.29 billion, followed by JK Spinning Mills with a net profit of Rs1.82 billion. In 2023, Service Industries Textiles Limited faced a net loss of Rs157.9 million.

Company profile

Gadoon Textile Mills was established as a public limited company in Pakistan on February 23, 1988. The company's main operations include the manufacturing and selling of yarn and knitted bedding products. The company's holding company is YB Holdings (Private) Limited.

INPCredit: INP-WealthPk