INP-WealthPk

Ayesha Mudassar

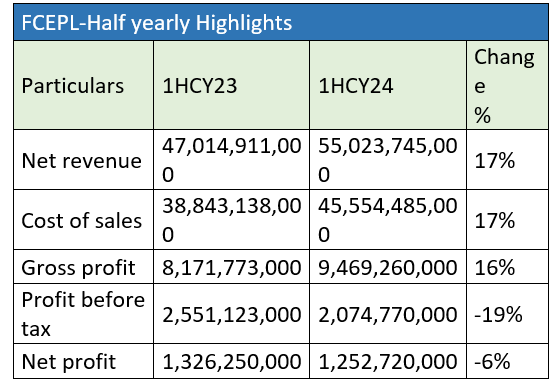

Friesland Campina Engro Pakistan Limited (FCEPL) reported a 6% decline in its profitability for the first half of the calendar year 2024 compared to the corresponding period of 2023, reports WealthPK.

The decline in profit can be primarily attributed to a significant rise in interest rates during the period.

![]()

The company’s profit-before-tax decreased 19% in the first half of 2024. Additionally, the earnings per share (EPS) for 1HCY24 declined 6% compared to the same period last year. This reduction in EPS indicates a decrease in the company’s earnings available to shareholders per share. On the positive side, the net sales posted a reasonable year-on-year (YoY) growth of 17% to clock in at Rs55.02 billion against Rs47.01 billion in 1HCY23. This robust performance was driven by a favourable portfolio mix, effective market investments, and the expansion of the distribution network.

Pattern of shareholding

As of December 31, 2023, the company had a total of 766.5 million outstanding shares held by 7,791 shareholders. Associated companies, undertakings, and related parties collectively owned 90.9% of the company’s shares followed by the local and general public with 6.06% of the shares. The remaining shares were held by other categories of shareholders, each holding less than 1%.

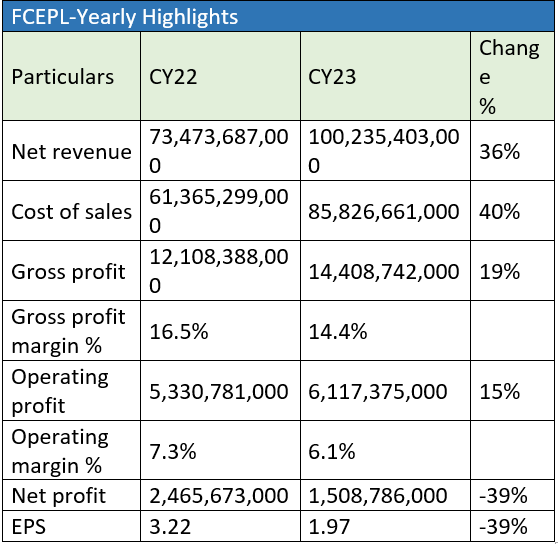

Financial performance in 2023

The company continued its growth trajectory and delivered a record year with the highest-ever top line and decent operating profit in 2023 despite facing a challenging macroeconomic environment and intense competition. Furthermore, the company achieved a remarkable milestone by surpassing the Rs100 billion revenue mark, reflecting a 36% increase compared to 2022.

The company recorded a 19% growth in gross profit in 2023; however, the gross margin decreased by 2.1% due to high inflation, global supply chain disruptions, foreign exchange constraints, and currency devaluation. In addition, the operating margin fell by 1.2% compared to the previous year due to cost rationalisation and efficiency improvement initiatives. The net profit declined from Rs2.4 billion in 2022 to Rs1.5 billion in 2023. This was on the heels of a substantial rise in finance costs with interest rates nearly doubling during the year.

The company and its operations

Friesland Campina Engro Pakistan Limited is a publicly listed company incorporated under the Companies Ordinance, 1984 (now the Companies Act, 2017). The company is a subsidiary of Friesland Campina Pakistan Holdings BV (the holding company), which is a subsidiary of Zuivelcoöperatie Friesland Campina UA (the ultimate parent company). The principal activity of the company is to manufacture, process and sell dairy-based products and frozen desserts.

Future outlook

The company is dedicated to sustaining its market position while ensuring the highest quality of products for consumers. The organisation will continue to adapt to consumer needs through targeted initiatives and relevant product offerings. Additionally, the company will continue to enhance efficiencies across value chains and optimise investments to improve the overall financial health of the business, thereby generating greater value for shareholders. Leveraging its global expertise and 150 years of heritage, FCEPL remains committed to upholding the highest standards of hygiene, food safety and sustainability.

Credit: INP-WealthPk