INP-WealthPk

Qudsia Bano

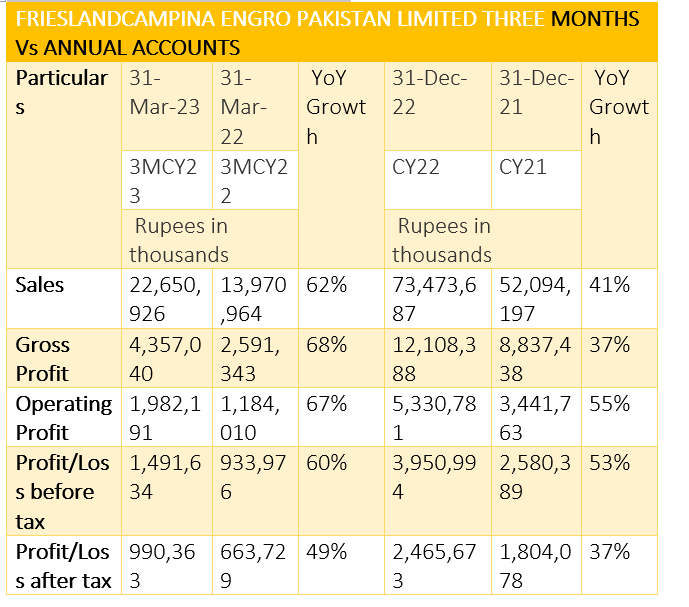

FrieslandCampina Engro Pakistan Limited has released its financial results for the three-month period ending on March 31, 2023, showcasing impressive growth in various financial metrics. The company reported sales of Rs22.65 billion during this quarter, marking a significant 62% year-on-year increase compared to the same period last year. This surge in sales can be attributed to robust consumer demand and effective market strategies. The company's gross profit for the three months amounted to Rs4.36 billion, reflecting a substantial growth rate of 68% compared to the corresponding period of the previous year.

This growth underscores the company's efficient cost management and operational optimisation. FrieslandCampina Engro Pakistan’s operating profit during the three months reached Rs1.98 billion, showcasing remarkable year-on-year growth of 67%. This growth in operating profit reflects the company's ability to generate strong profits from its core operations. The profit-before-tax for the three months amounted to Rs1.49 billion, demonstrating a robust year-on-year growth of 60%. The increase in pre-tax profit indicates the company's successful financial management strategies. The profit-after-tax for the three months stood at Rs990.36 million, representing a solid year-on-year growth of 49%.

The increase in after-tax profit reflects the company's ability to sustain profitability and generate positive results on its bottom line. The earnings per share (EPS) for the three months stood at Rs1.29, reflecting a 48% growth compared to the same period last year. This growth in EPS indicates that the company's earnings available to shareholders have increased on a per-share basis.

Annual analysis

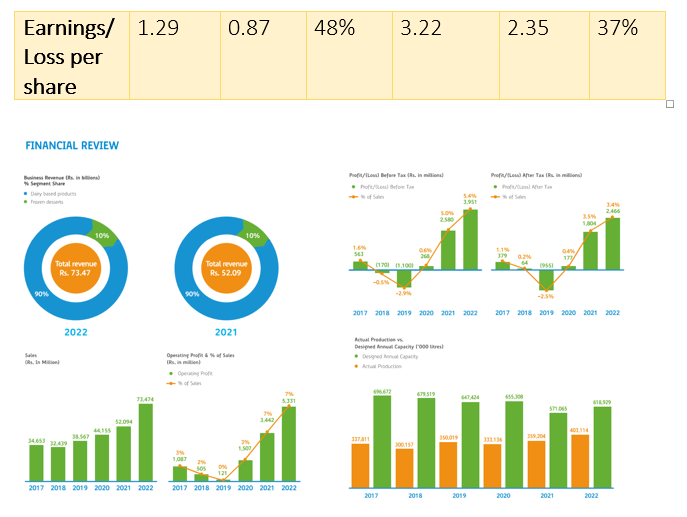

FrieslandCampina Engro Pakistan has reported significant growth in key financial metrics for the year ended December 31, 2022. The company's annual sales reached Rs73.47 billion, marking a robust year-on-year growth of 41%. This growth can be attributed to sustained consumer demand, effective marketing strategies, and successful product offerings. The company's gross profit for the year amounted to Rs12.11 billion, reflecting a solid growth rate of 37% compared to the previous year. The increase in gross profit underscores the company's ability to manage production costs effectively. FrieslandCampina Engro Pakistan’s operating profit for the year stood at Rs5.33 billion, representing a notable year-on-year growth of 55%.

This growth in operating profit highlights the company's strong operational efficiency. The profit-before-tax for the year amounted to Rs3.95 billion, demonstrating a substantial year-on-year growth of 53%. The increase in pre-tax profit reflects the company's effective financial management and ability to capitalise on market opportunities. The profit-after-tax for the year reached Rs2.47 billion, representing a commendable year-on-year growth of 37%. The growth in after-tax profit highlights the company's consistent profitability and financial stability. The EPS for the year stood at Rs3.22, reflecting a 37% growth compared to the previous year. This growth in EPS indicates the company's ability to generate higher earnings available to shareholders on a per-share basis.

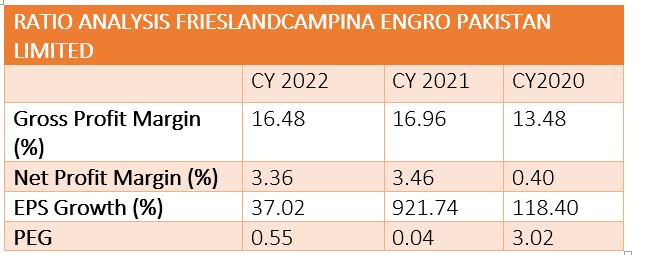

FrieslandCampina Engro’s gross profit margin, which indicates the percentage of revenue retained as gross profit, has shown a slightly declining trend. In CY22, the gross profit margin was 16.48%, down from 16.96% in CY21 and 13.48% in CY20. This suggests that the company has maintained a reasonable portion of its revenue as gross profit, even though there has been a slight decrease in recent years.

Similarly, the net profit margin, which reflects the percentage of revenue retained as net profit after all expenses, has also exhibited a minor decline. In CY22, the net profit margin was 3.36%, slightly lower than 3.46% in CY21 and significantly higher than 0.40% in CY20. This indicates that the company has managed its costs effectively, resulting in a consistent net profit margin despite slight fluctuations.

The EPS growth, which measures the percentage change in EPS from one fiscal year to another, has shown substantial fluctuations. In CY22, the EPS growth was 37.02%, reflecting a healthy growth rate. However, in CY21, the EPS growth was an impressive 921.74%, driven by extraordinary circumstances. In contrast, in CY20, the EPS growth was 118.40%, showing a strong performance in that year as well.

The PEG (price/earnings to growth) ratio compares a company's P/E ratio to its EPS growth rate, indicating its valuation relative to its earnings growth potential. In CY22, FrieslandCampina Engro's PEG ratio was 0.55, suggesting that the stock's price might have been fairly aligned with its earnings growth. In CY21, the PEG ratio was remarkably low at 0.04, implying potential undervaluation compared to the exceptional EPS growth. However, in CY20, the PEG ratio increased to 3.02, possibly indicating that the stock's price was not in sync with the EPS growth rate during that year.

About the company

FrieslandCampina Engro Pakistan is a public listed company incorporated in Pakistan under the repealed Companies Ordinance, 1984 (now the Companies Act, 2017). The company is a subsidiary of FrieslandCampina Pakistan Holdings B.V. (the holding company), which is a subsidiary of Zuivelcoöperatie FrieslandCampina UA (the ultimate parent company). The principal activity of the company is to manufacture, process and sell dairy products and frozen desserts. The company also owns and operates a dairy farm.

Credit: INP-WealthPk