INP-WealthPk

Four largest banks show strong performance in CY22

April 12, 2023

Qudsia Bano

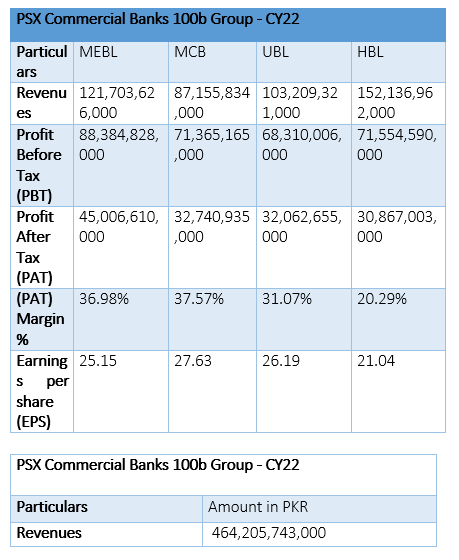

The Pakistan Stock Exchange’s so-called “Commercial Banks 100-billion Group,” consisting of Meezan Bank Limited (MEBL), Muslim Commercial Bank Limited (MCB), United Bank Limited (UBL) and Habib Bank Limited (HBL), has announced its financial results for the calendar year 2022.

According to the results, HBL stood out with the highest revenue of Rs152.1 billion, while MCB led with the highest earnings per share (EPS) of Rs27.63. MEBL led in the profit-after-tax (PAT) with Rs45 billion, and UBL maintained a strong position with Rs103.2 billion in revenue and a respectable PAT margin of 31.07%, reports WealthPK.

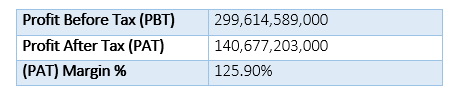

The group collectively recorded revenues of Rs464 billion, with HBL leading with Rs152 billion. MEBL followed with R121 billion, UBL with Rs103 billion and MCB with Rs87 billion. The group’s profit-before-tax (PBT) amounted to Rs299 billion, with MEBL securing the top spot with Rs88 billion, followed by MCB with R71 billion, UBL with Rs68 billion and HBL with Rs71 billion.

The group’s PAT amounted to Rs140 billion, with MEBL leading with Rs45 billion, followed by MCB with Rs32 billion, UBL with Rs32 billion, and HBL with Rs30 billion.The PAT margin ranged from 20.29% for HBL to 37.57% for MCB. The group’s EPS was highest for MCB at Rs27.63, followed by UBL at Rs26.19, MEBL at Rs25.15, and HBL at Rs21.04.

About the group

These banks are among the largest and most reputable financial institutions in the country, offering a wide range of banking and financial services to businesses and individuals. The group is committed to providing innovative solutions to meet the evolving needs of their clients and to drive growth and prosperity in the Pakistani economy.

Credit: Independent News Pakistan-WealthPk