INP-WealthPk

Qudsia Bano

Pakistan finds itself in the midst of a daunting economic challenge as it grapples with its ever-mounting debt crisis. With an economy strained by decades of borrowing, the country faces pressing questions about its ability to service its debt and foster sustainable growth. Pakistan's debt situation has been a cause for concern for several years, but recent figures have highlighted the gravity of the situation. The central bank reported a substantial 29% increase in its total debt and liabilities, reaching Rs56.21 trillion by the end of the fiscal year 2022-23.

This surge in debt comes as the government heavily relies on borrowing to finance its spending requirements. Data released by the State Bank of Pakistan (SBP) reveals that in FY23, the total debt and liabilities as a percentage of GDP rose to 91.1% from 89.7% in the previous fiscal year. Pakistan's national debt saw a notable increase of 28.4% to Rs72.991 trillion, while liabilities surged by 34.6% to Rs4.587 trillion in FY23. This escalation is primarily attributed to the government's need to finance its expanding budget deficit and cover the costs of repaying domestic debt.

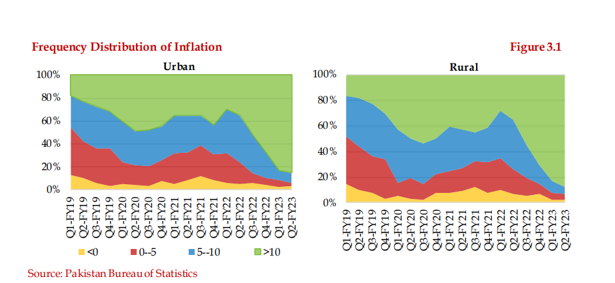

Given the debt situation, the National Consumer Price Index (NCPI) inflation also soared to 25% in the first half of FY23, nearly three times greater than 9.8% over the same period of FY22. Maintaining the steep uptrend of the fourth quarter of FY22, inflationary pressures continued to widen, as more than three-fourths of the entire NCPI items witnessed double-digit inflation across rural and urban areas in 1HFY23. In addition, the disaggregated data suggests that inflation momentum also remained elevated almost throughout 1HFY23 as indicated by the monthly inflation outcomes.

Dr Hassan Daud Butt, a senior adviser at the Sustainable Development Policy Institute, told WealthPK that the recent 29% surge in Pakistan's debt and liabilities was deeply concerning and underscored the urgency of implementing comprehensive fiscal reforms. “It's imperative that Pakistan focuses on widening its tax base, reducing budget deficits and enhancing transparency in its financial management to mitigate this crisis.” He said that Pakistan's escalating debt levels had implications not only for the government but also for the wider economy.

“The increase in debt servicing costs leaves fewer resources for vital public services and economic development. The government should explore avenues for economic diversification to boost revenue generation, ultimately reducing the burden of debt on future generations.” Azfar Ahsan, former chairman of Board of Investment (BOI), while talking to WealthPK, said that Pakistan's mounting debt and liabilities had raised serious questions about its ability to manage its fiscal challenges effectively.

“The government now faces the formidable task of stabilising the country's financial situation and finding sustainable solutions to address its debt crisis.” He emphasised the urgent need for fiscal discipline, enhanced tax reforms and diversification of the economy to reduce reliance on external borrowing. “Transparency and accountability in debt management and exploring debt restructuring options with international creditors also feature prominently in the path toward economic recovery.”

The road ahead for Pakistan's economy is undoubtedly challenging, but concerted efforts and prudent fiscal policies are vital for securing the nation's financial stability and promoting long-term prosperity. The government must navigate these challenges wisely to ensure a brighter economic future for Pakistan.

Credit: INP-WealthPk