INP-WealthPk

Hifsa Raja

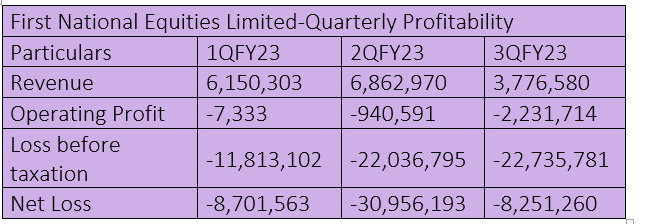

First National Equities Limited (FNEL) faced significant losses in the first three quarters of the ongoing financial year 2022-23. The company recorded the lowest revenue in the third quarter (January-March) as compared to the first two quarters of FY23. Furthermore, the operating profit and profit-before-taxation also exhibited negative trends, reflecting the financial difficulties faced by the company.

The net income was particularly affected, with substantial losses incurred in the second quarter. These figures underscore the need for FNEL to address the underlying issues and implement strategies to improve its financial performance. In the first quarter (July-September) of FY23, FNEL posted gross revenues of Rs6.15 million and loss-before-taxation of Rs11.81 million. The company posted a net loss of Rs8.70 million in this quarter.

In the second quarter (October-December), FNEL posted a gross revenue of Rs6.86 million and loss-before-taxation of Rs22 million. The company posted a huge net loss of Rs30 million during this quarter. In the third quarter (January-March), FNEL posted a gross revenue of Rs3.7 million and loss-before-taxation of Rs22 million. The company also posted a net loss of Rs8.2 million.

These variations indicate a lack of consistency in the company's profitability and highlight the challenges it faces in maintaining stable financial performance. It is crucial for the company to analyse the factors contributing to these fluctuations and devise strategies to ensure sustained growth and profitability in the future.

Performance in FY22

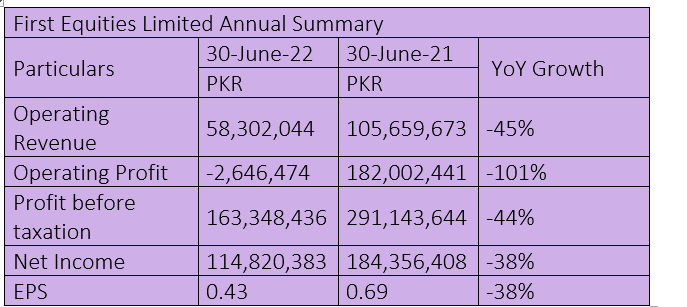

In the fiscal year 2021-22, the company’s operating revenue plunged 45% to Rs58 million from Rs105 million in the previous year. The company also sustained an operating loss of Rs2.6 million, down 101% from the previous year's operating profit of Rs182 million.

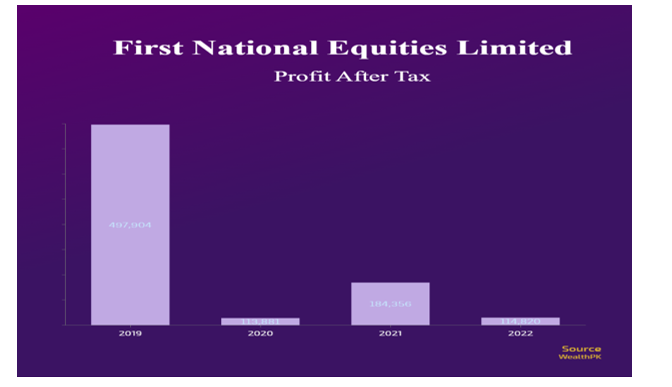

The company saw a decline of 44% in profit-before-taxation, which dropped to Rs163 million in FY22 from the previous year's profit of Rs291 million. The profit-after-tax for FY22 also witnessed a decline, going down to Rs114 million from Rs184 million in FY21, reflecting a decrease of 38%.

These figures, along with a decline in earnings per share (EPS) by 38% to 0.43, indicate the challenges faced by FNEL in boosting its financial performance. Despite these difficulties, the company remains committed to addressing the issues and implementing strategies to regain growth and profitability in the future.

Earnings Per Share

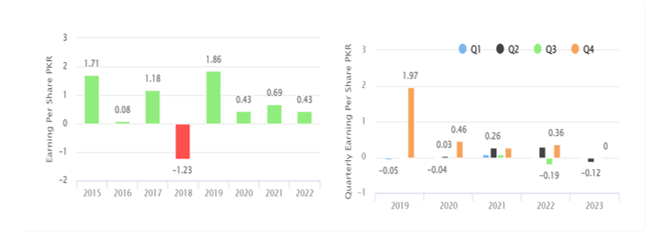

Over the past few years, the EPS of the company has shown varying trends. Notably, the company’s EPS saw a dramatic decline in 2018, which reached a value of Rs-1.23. The following year, however, saw a recovery, with EPS improving to Rs1.86 in 2019. The company's EPS did not perform well, as it stayed below Rs1 in the years to come.

These fluctuations in EPS reflect the company's inability to take advantage of growth possibilities in challenging circumstances. Stakeholders and investors will closely monitor these developments since they provide crucial information about the company's profitability and prospects.

In the latest financial update for the fiscal year 2022-23, the company's EPS also remained subdued across the quarters. During the first quarter, the company reported a negative EPS.

FNEL's net profit margins over the years show that it has been managing costs to some extent to benefit its stockholders. However, in order to continue attracting investors and shareholders, the company must put brakes to its falling net profit margins since 2019.

Company profile

First National Equities Limited is a Pakistan-based online stock trading and brokerage company. Its principal activities include shares brokerage, consultancy services and portfolio investment. The company's divisions include brokerage and trading of equities, investments, corporate finance and market intelligence. The brokerage and trading of equities division deals with over 625 stocks which are traded in approximately three stock exchanges in Pakistan.

The division dealing with stocks includes Pakistan investment bonds and national investment trust units. The investments division of the company makes investments/disinvestments on the company's behalf, as well as for its clients. The corporate finance division provides consultancy and advisory services to government-owned entities, corporate clients and private individuals. The corporate finance division specialises in the activities, such as syndication, privatisation, project advisory, credit rating advisory and mergers.

Credit : Independent News Pakistan-WealthPk