INP-WealthPk

Shams ul Nisa

First National Equities Limited (FNEL) reported a net loss of Rs87.49 million amid a significant drop in operating revenue and high cost of finance in the fiscal year 2022-23 compared to a profit of Rs114.8 million in FY22, the company’s financial results for the period show. As a result, loss per share clocked in at Rs0.33 in the period under review compared to earnings per share of Rs0.43 in FY22. This decline is because of currency devaluation and the surge in fuel prices, utility and commodity prices due to inflationary pressures.

![]()

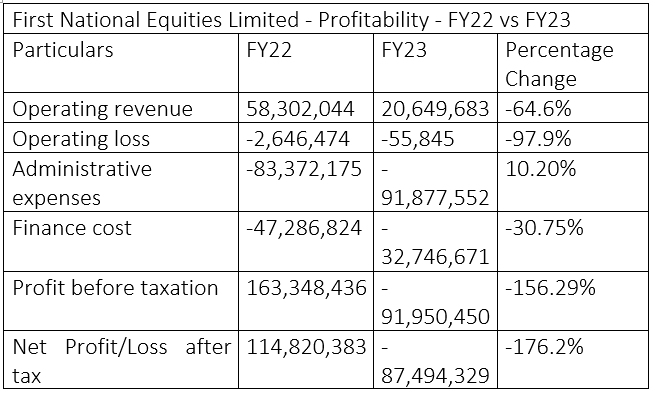

FNEL’s operating revenue fell 64.6% to Rs20.6 million in FY23 from Rs58.3 million recorded in FY22. This decline was driven by rising economic risks due to increased inflation, slowing growth, and current account deficit. During the period, the company’s operating loss dropped significantly to only Rs55,000 from Rs2.64 million in FY22. However, the company’s administrative expenses rose by 10.20% to Rs91.877 million in FY23 from Rs83.37 million in FY22. The finance cost dropped 30.75% to Rs32.7 million during FY23 from Rs47.28 million in the previous year. Meanwhile, the company reported Rs91.95 million in loss-before-tax in FY23 as compared to profit-before-tax of Rs163.34 million in FY22, registering a significant decrease of 156.29%.

Analysis of cash flow

FNEL generated net cash of Rs48.4 million from operations in June 2023 compared to Rs64.2 million used in June 2022. In June 2023 and June 2022, the company generated cash of Rs11.5 million and Rs76.37 million, respectively, from investing activities. This means that during this period the company invested in purchasing assets. For financing activities, the company invested Rs19.77 million in June 2022 and Rs4.028 million in June 2023. The company’s cash and cash equivalent at the end of the period stood at Rs279.09 million in June 2023, which was greater than Rs223.17 million in June 2022.

Analysis of income statement

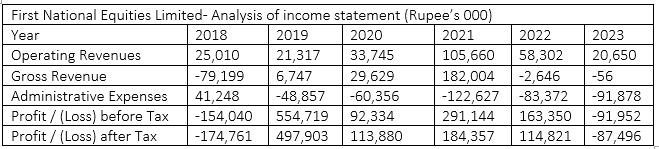

FNEL reported moderate operating revenue growth over the years with a significant hike of Rs105.6 million in 2021. The company recorded the lowest operating revenue of Rs20.6 million in 2023.

FNEL’s gross revenue remained negative in 2018, 2022, and 2023 with values of Rs79.19 million, Rs2.64 million, and Rs56,000, respectively. However, in 2019, 2020, and 2021 it remained positive with values of Rs6.7 million, Rs29.6 million, and Rs182 million, respectively. The company's administrative expenses grew over the years, with the highest Rs122.6 million recorded in 2021. In 2018 and 2023, the company recorded a loss-before-tax of Rs154.04 million and Rs91.9 million, respectively.

The company earned the highest profit-before-tax of Rs554.7 million in 2019. Similarly, loss-after-tax was witnessed in 2018 and 2023 with the values of Rs174.7 million and Rs87.49 million, respectively. However, in 2019, the company posted the highest post-tax profit of Rs497.9 million.

Analysis of current ratio

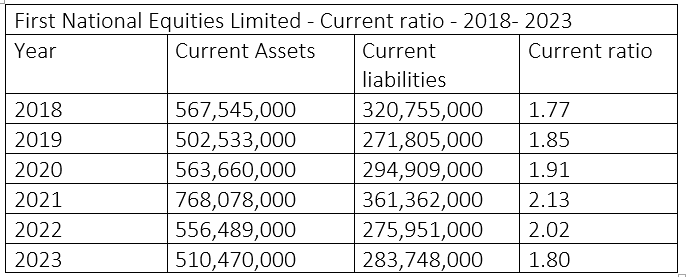

The current ratio measures a company's ability to cover its short-term obligations using its current assets. The company's risk of covering its short-term obligations increases if the ratio lies below 1.2, and the current ratio is considered safe if it lies between 1.2 and 2 and above.

Over the years, FNEL’s current ratio remained above 1.2, and in 2021 and 2022 it remained above 2, which indicates the company was able to easily cover its short-term obligations using its current assets.

Credit: INP-WealthPk