INP-WealthPk

Shams ul Nisa

First National Equities Limited unveiled its financial report for the first quarter (July-Sept) of FY2024, with the loss after tax clocking in at Rs8.6 million, 0.8% lower than the loss of Rs8.7 million in the same period last year, reports WealthPK. The company attributed this loss to the low trading volumes and capital losses in trading as a result of the nation's high inflation and political unpredictability during the period under review. The company’s core activities include share brokerage, consultancy services, and portfolio investments.

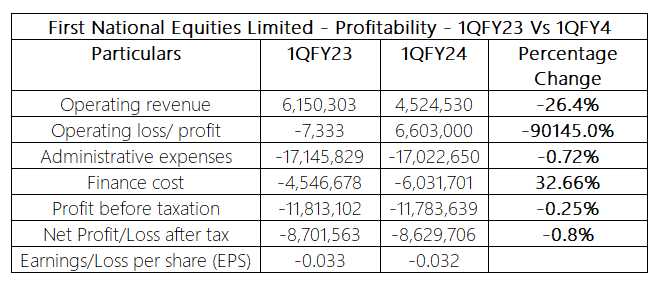

Similarly, the operating revenue dropped by 26.4% to Rs4.5 million in 1QFY24 from Rs6.15 million in 1QFY23. However, the company managed to earn an operating profit of Rs6.6 million during the period under review compared to the operating loss of Rs7,333 in 1QFY23, indicating a massive growth of 90145.0%.

On the expenses front, the company observed an increase in administrative expenses and finance costs by 0.72% and 32.66% during the 1QFY24. The company registered an administrative expense of Rs17.02 million and finance costs of Rs6.03 million during 1QFY24. In 1QFY24, the company incurred a loss before tax of Rs11.78 million, 0.25% lower than Rs11.81 million in the same period last year. Similarly, the loss per share stood at Rs0.032 in 1QFY24 compared to Rs0.033 in 1QFY23.

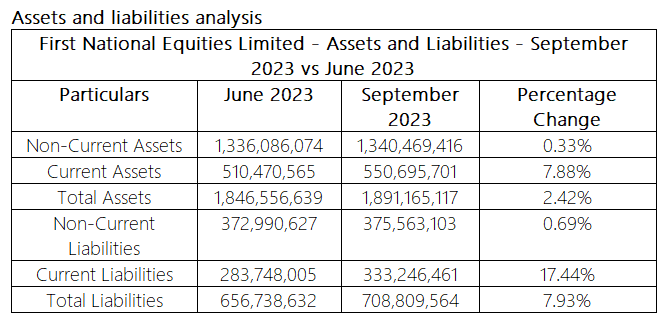

On September 30, 2023, First National Equities Limited reported a marginal increase of 0.33% in non-current assets and 7.88% in current assets compared to June 30, 2023. As a result, the total assets grew by 2.42% from Rs1.84 billion in June 2023 to Rs1.89 billion in September 2023. With a marginal increase of 0.69%, the company's non-current liabilities were Rs375.56 million at the end of September 2023 against Rs372.99 million at the end of June 2023. On the other hand, the current liabilities saw a notable increase of 17.44% in September 2023, amounting to Rs333.2 million. The total liabilities surged by 7.93% from Rs656.7 million in June 2023 to Rs708.8 million in September 2023.

Historical trend

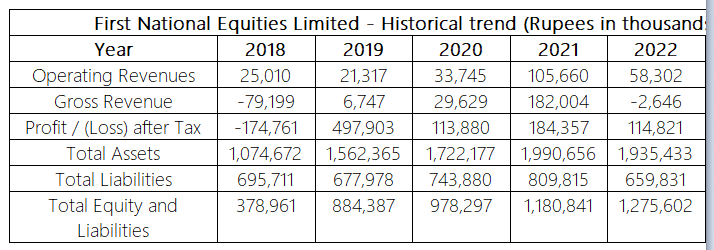

The operating revenue of First National Equities Limited has experienced fluctuations over the years. It began at R25.01 million in 2018 and reached its highest point of Rs105.66 million in 2021, before declining to Rs58.3 million in 2022 and hitting Rs20.65 billion in 2023. The gross revenue remained negative in 2018, 2022, and 2023 with the value of Rs79.19 million, Rs2.64 million, and Rs56 thousand respectively.

This negative gross revenue value indicates that during these years, the company faced challenges in generating enough revenue to cover its production costs as a result of a decrease in sales volume, higher costs, and inefficient production strategies. However, the gross revenue kept increasing over the period from Rs6.7 million in 2019 to the highest of Rs182.004 million in 2021.

In terms of profit after taxes, the company's results from 2018 to 2023 were inconsistent, showing a loss after tax of Rs174.7 million in 2018 and Rs87.49 million in 2023. The company registered the highest profit after tax of Rs497.9 million in 2019. The total assets kept on increasing from Rs1.07 billion 2018 to a peaked value of Rs1.99 billion in 2021 before declining in the subsequent years. A similar pattern was followed by the total liabilities of the company accounting for a total liability of Rs656.7 million in 2023. The total equity and liabilities followed an upward trajectory from Rs378.9 million in 2018 to Rs1.27 billion in 2022 and a dip to Rs1.189 billion in 2023.

Credit: INP-WealthPk