INP-WealthPk

Shams ul Nisa

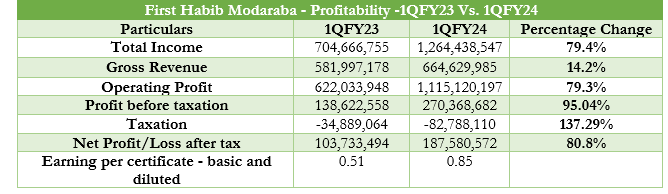

The First Habib Modarabas achieved a total income of Rs1.26 billion in the first quarter of the fiscal year 2024, showcasing a considerable increase of 79.4% from Rs704.6 million in the first quarter of FY23. The factors propelling the trend include slightly better economic circumstances such as the current account position, increased domestic remittances, strengthening of the Pakistani rupee versus the US dollar, and rising Pakistan Stock Exchange index.

The company’s gross profit grew by 14.2% to Rs664.6 million in 1QFY24 from Rs581.99 million in the same period of the previous year. This is because of the hike in income from diminishing musharaka financing by the company during the review period. The operating profit for the first quarter of 2024 reached Rs1.115 billion, an increase of 70.3% from Rs622.03 million in the same quarter FY23.

The company’s profit before tax stood at Rs270.36 million for 1QFY24, a surge of 95.04% over Rs138.6 million in the same period last year. On the taxation side, the company bore a tax of Rs82.78 million in 1QFY24, against Rs34.88 million in 1QFY23, representing a massive growth of 137.29%. At the end of 1QFY24, the company reported a net profit after tax of Rs187.5 million, up 80.8% from Rs103.7 million in 1QFY23. The earnings per share improved marginally from Rs0.51 in 1QFY23 to Rs0.85 in 1QFY24.

Historical Trend Analysis

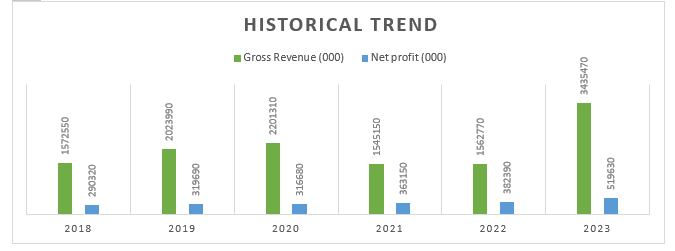

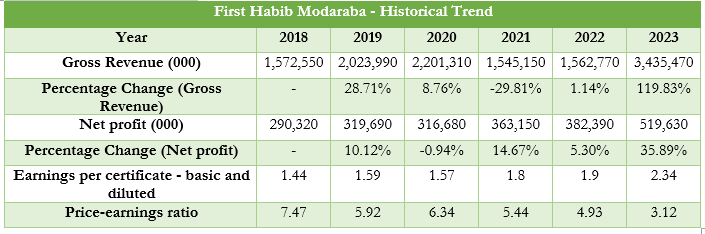

The historical trend analysis of the company portrays an overall improvement in the gross revenue and net profit but with mixed results in between. The company registered gross revenue of Rs1.57 billion and net profit of Rs290.3 million in 2018. In 2019, the gross revenue grew by over 28.71% and net profit by 10.12% compared to 2018. However, the company observed a decline in growth percentage in 2020, as its gross revenue rose by 8.76%. However, its net profit declined by 0.94% to Rs316.6 million in 2020 compared to the previous year.

In contrast, the modaraba’s gross revenue slipped by 29.81% to Rs1.54 billion in 2021, but its net profit climbed to Rs362.15 million, 14.67% higher than in 2020. In the subsequent years, the company’s gross revenue witnessed an upward swing of 1.14% in 2022 and the highest of 119.83% in 2023 to register Rs3.45 billion. Similarly, the net profit stood at Rs519.6 million in 2023, 35.89% higher than Rs382.3 million in 2022.

The company earnings per share witnessed an overall expansion from Rs1.44 in 2018 to Rs2.34 in 2023, with a dip of Rs1.57 in 2020. However, the price-earnings ratio reduced to 3.12 in 2023 from 7.47 in 2018.

Profitability Ratios Analysis

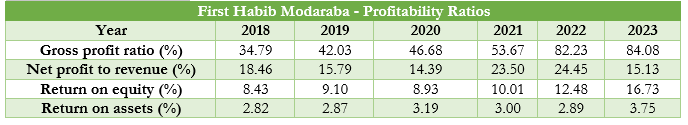

The profitability ratios analysis provides useful insights into how well a company generates profit from its core operations. During the period 2018 to 2023, the company’s gross profit ratio moved on an increasing track from 34.79% to 84.08%. However, the net profit to revenue ratio remained volatile, ranging between the lowest of 14.39% in 2020 and the highest of 24.45% in 2022. Starting from 18.46% in 2018, the company’s net profit declined till 2020 and improved in 2021 and 2022, before declining to 15.13% in 2023.

The return on equity grew twice to 16.73% in 2023 compared to 8.43% in 2018. The company witnessed only one dip to 8.93% in 2020. The return on assets remained stagnant during the period as it ranged between 2.82% in 2018 and 3.75% in 2023.

Liquidity Ratios Analysis

![]()

The liquidity ratio analysis of the company provides a detailed insight into the company’s ability to pay back debt. The current ratio remained below 1 over the year, ranging between 0.52 in 2023 and 0.64 in 202. This showed that the company’s current ratio is below 1.2, indicating a higher risk because there aren't enough current assets to cover all of the company's short-term obligations.

Future Outlook

Going ahead, the company is optimistic that its business activity will improve this year. During the first quarter, the company’s performance fell short of meeting the company’s objectives by a small amount. As per its year-long business plan, the company will proceed with caution, strengthen its domestic footprint, keep providing its clients with unrivaled services, and expand its financing portfolio with reliable companies.

Company profile

First Habib Modaraba is a multipurpose modaraba working under the management of Habib Metropolitan Modaraba Management Company (Private) Limited. The company’s core operations include the leasing and financing of murabaha and musharaka industries, among other related businesses.

INP: Credit: INP-WealthPk