INP-WealthPk

Hifsa Raja

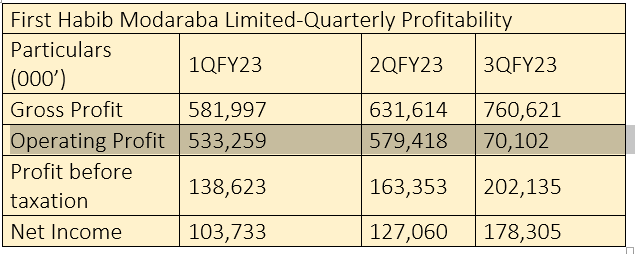

First Habib Modaraba Limited, a non-banking Islamic financial institution, has released its profitability report for the first three quarters of the last fiscal year 2022-23, posting a gradual increase in both the gross and net profits. In the first quarter (July-Sept) of FY23, the company posted gross profit of Rs581 million and net income of Rs103 million.

In the second quarter (Oct-Dec), gross profit stood at Rs631 million and the net income at Rs127 million, respectively. In the third quarter (Jan-March), the company posted gross profit of Rs760 million and net income of Rs178 million. First Habib Modaraba’s quarterly profitability demonstrates a consistent upward trajectory, reflecting a robust financial performance. The substantial growth in gross profit and net income across the three quarters is indicative of the company’s effective operational strategies.

The impressive net income figures further highlight its sustainable profitability. This consistent pattern suggests a well-managed enterprise with a strong potential for continued growth and enhanced shareholder value in the foreseeable future. First Habib Modaraba’s track record positions it favourably within the industry and underscores its commitment to delivering consistent financial excellence.

Performance in FY22

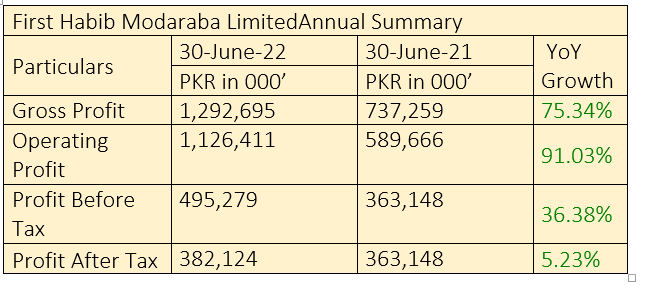

In the fiscal year 2021-22, the company reported a strong increase in gross profit, which jumped to Rs1.2 billion from Rs737 million in FY21, registering a growth of 75%. The operating profit also increased to Rs1.1 billion, up 91%, from the previous year’s Rs589 million.

The profit-before-tax increased by 36% to Rs495 million in FY22 from Rs363 million in FY21. However, the profit-after-tax rose moderately by 5% to Rs382 million in FY22 from Rs363 million in FY21. First Habib Modaraba Limited’s annual summary underscores its exceptional financial performance, with remarkable year-on-year growth in key metrics. The increases in gross profit, operating profit, and profit before and after tax reflect the company’s effective strategies and operational efficiency.

Notably, while the after-after profit experienced a comparatively modest growth of 5.23%, the overall consistency is commendable. This consistent performance speaks volumes about the company’s prudent management and its ability to navigate challenges. First Habib Modaraba’s robust growth trajectory positions it as a key player in the industry, instilling confidence in its potential for sustained success and value creation.

Performance over past four years

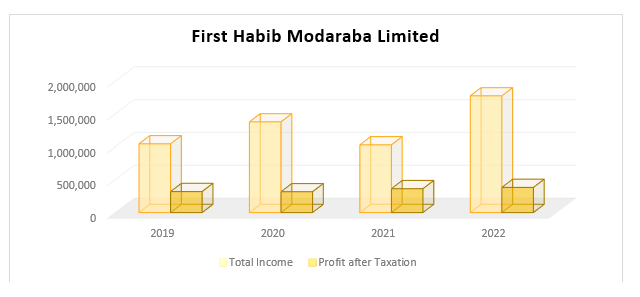

First Habib Modaraba Limited’s financial performance over the past four years reveals a consistent growth trajectory.

Starting from 2019 with a total income of Rs1.04 billion, the company experienced incremental growth in subsequent years. In 2020, the total income rose to Rs1.37 billion, reflecting a significant increase. This upward trend, however, reversed in 2021, with the total income dropping to Rs1.02 billion, but still quite healthy. In the most recent year, 2022, the total income reached an impressive Rs1.77 billion, showcasing a substantial and consistent growth trajectory over the four years.

Likewise, the after-tax profit also follows a positive trajectory. Starting from 2019 with a profit of Rs319 million, there was a slight decrease in 2020 to Rs316 million. The subsequent years, however, marked notable growth. In 2021, the profit reached Rs363 million, demonstrating a significant rise. The trend continued in 2022, with the profit amounting to Rs382 million, reflecting a steady increase over the four-year span.

Earnings per share

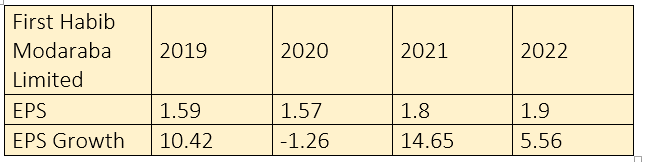

First Habib Modaraba has demonstrated a consistent trend in its earnings per share (EPS) over the past four years, reflecting its resilient financial performance. Starting 2019 with an EPS of Rs1.59, the company’s EPS experienced a downturn of -1.26% in 2020. However, it swiftly rebounded with a strong growth of 14.65% in 2021, reaching an EPS of Rs1.8. In the subsequent year, 2022, the EPS continued its upward trajectory, marking a growth of 5.56% and reaching Rs1.9.

This consistent growth trajectory indicates First Habib Modaraba’s ability to navigate various market challenges effectively, showcasing its resilience and prudent financial management.The positive EPS growth percentages reflect a company that has created sustainable value for its shareholders over the years. While the growth rate might have fluctuated, the overall trend suggests a steady and positive trajectory. It’s noteworthy that despite economic uncertainties and global disruptions, First Habib Modaraba has managed to maintain an upward movement in its EPS, signifying a strong foundation for future growth and stability.

Investors and stakeholders can find assurance in the company’s ability to generate consistent returns, making it a noteworthy player in the financial sector. This trend serves as an encouraging indicator of the company’s potential to continue creating value for its shareholders in the years to come.

Company profile

First Habib Modaraba’s principal business activities are to provide Shariah-complaint mode of financing and invest in Shariah-compliant instruments. Its financial services include lease financing, diminishing Musharaka, Sirat-auto consumer and Murabaha. The company’s financial products include Salam, Istisna, Musharaka and certificate of investments.

Diminishing Musharaka is a Musharaka with an additional feature of decreasing ownership of approximately one party. It also offers a car lease-financing scheme for corporate employees and self-employed persons. Murabaha is a non-participatory mode of Islamic financing. Istisna is a sale contract between the company as the seller and the customer as the purchaser.

Credit: INP-WealthPk