INP-WealthPk

Shams ul Nisa

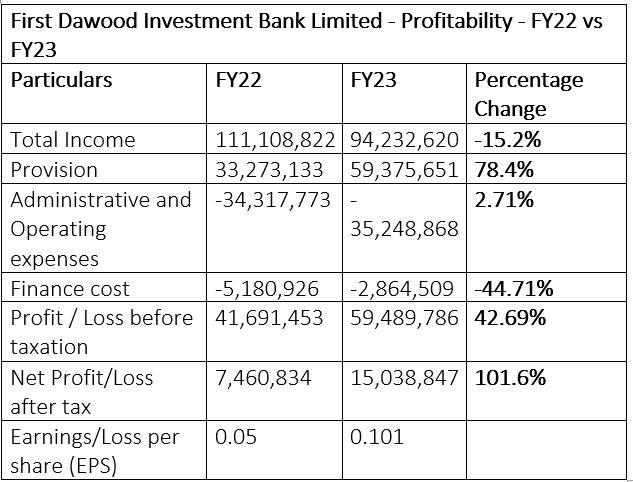

First Dawood Investment Bank Limited’s (FDIBL) net profit for the fiscal year ending on June 30, 2023 jumped 101.6% to Rs15 million from Rs7.46 million in FY22. The bank attributed this increase to improvement in the recovery of non-performing loans and its continued focus on strategic and operational priorities.

However, the bank’s total income fell 15.2% year-on-year to Rs94.23 million in FY23 because of a slowdown in economic activity due to high interest rates and inflationary pressures. Meanwhile, the bank's provisions surged to Rs59.37 million in FY23, posting 78.4% increase over Rs33.27 million in FY22. The bank's administrative and operating expenses increased marginally by 2.71% to Rs35.2 million year-on-year, but finance costs reduced by 44.71% because of the bank’s restrictive policy to ensure that the costs didn’t exceed the expected benefits. FDIBL also witnessed a major increase in profit-before-tax as it grew by 42.69% to Rs59.48 million in FY23 from Rs41.69 million the previous year. Similarly, the earnings per share went up to Rs0.101 in FY23 From Rs0.05 in FY22.

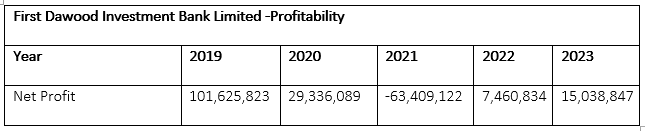

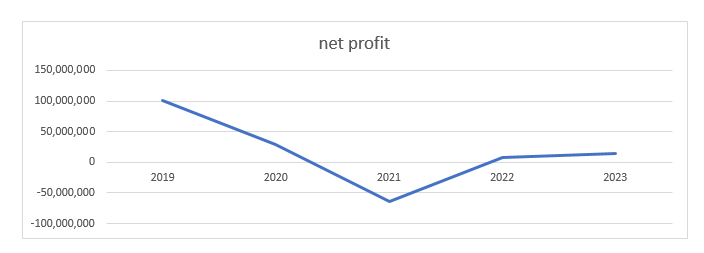

Profitability analysis

The bank's profitability fluctuated from 2019 to 2023, with the bank registering its highest net profit of Rs101.6 million in 2019. However, the net profit fell in 2020 and 2021. The bank witnessed a significant dip in 2021 as it registered a net loss of Rs63.4 million. However, the bank posted a profit of Rs7.46 million in 2022 and Rs15 million 2023. The loss in 2021 was a result of Covid-19 pandemic-induced impact on economy.

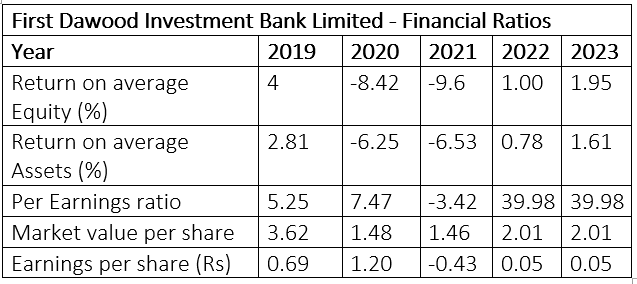

Financial ratios analysis

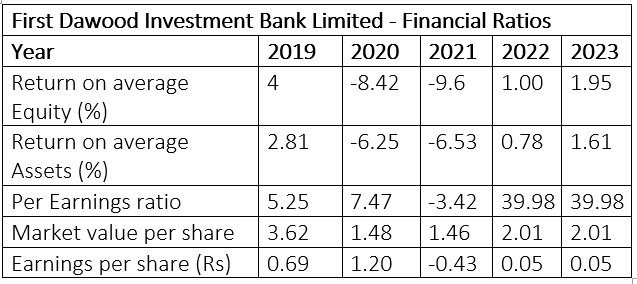

The bank's financial ratio exhibited a fluctuating trend over the period from 2019 to 2023. The return on average equity measures the ability of a company to generate profit using its equity. The bank observed the highest return on equity of 4% in 2019, but it declined to negative -8.42% and -9.6% in 2020 and 2021. The bank earned a positive return on equity of 1% in 2022 and 1.95% in 2023.

Similarly, the return on assets followed the same pattern, registering the highest of 2.81 in 2019. The per-earnings ratio, on the other hand, gradually improved over the years, reaching its highest of 39.98 in 2022 and 2023 from 5.25 in 2019. However, the bank observed a dip of -3.42 per-share earnings in 2021. The market value of per share ranged between 1.46 and 3.62 over the years. In 2022 and 2023 it stood at 2.01. The earnings per share remained positive in 2019, 2020, 2022, and 2023, but registered a dip of -0.43 in 2021.

Current ratio analysis

The current ratio evaluates how well a business can use its current assets to pay for its short-term liabilities. The bank recorded the highest current ratio of 1.14 in 2023 and the lowest of 0.86 in 2018, showcasing the improved management and liquidity position of the bank over the period.

Credit: INP-WealthPk