INP-WealthPk

Shams ul Nisa

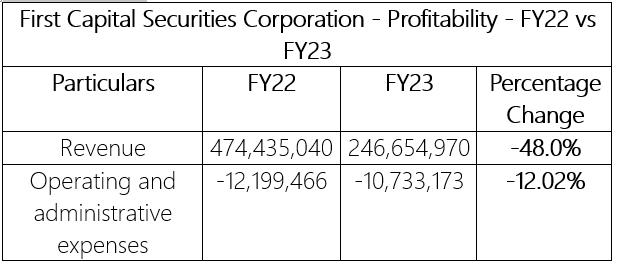

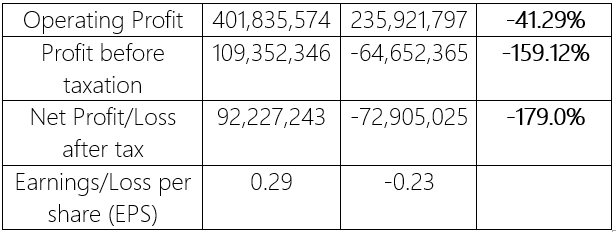

The First Capital Securities Corporation Limited reported a net loss of Rs72.9 million in the Fiscal Year 2023 against a net profit of Rs92.2 million in the same period last year, constituting a significant decline of 197.0%, reports WealthPK. During the Fiscal Year 2023, the company’s revenue flattened by 48.0% to Rs246.6 million from Rs474.4 million in FY22. However, the operating and administrative expenses reduced 12.02% to Rs10.7 million over the period from Rs12.19 million in FY22. This indicates that the company has narrowed down its operation amid economic uncertainties.

As a result, the investment and financial consultancy company’s operating profit fell substantially to Rs235.9 million in FY23, 41.29% lower than Rs401.8 million in the same period a year ago. In FY23, the company posted a loss before tax of Rs72.9 million compared to a profit before tax of Rs109.35 million in FY22, representing a significant decline of 159.12%. The financial report for FY23 indicated a loss per share of Rs0.23 against earnings per share of Rs0.29 in the same period a year ago.

Historical trend analysis

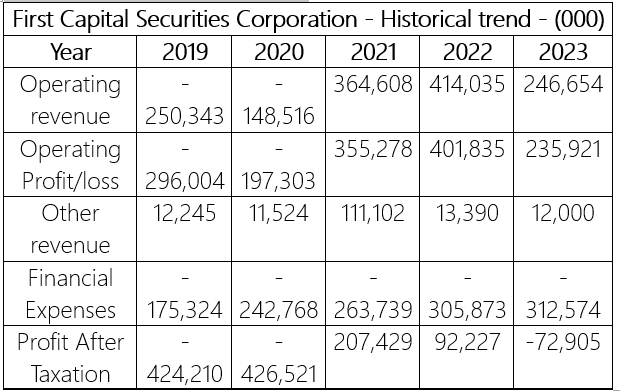

First Capital Securities Corporation Limited’s operating revenue observed concerning growth in 2019 and 2020, as the operating revenue remained negative with a value of Rs250.3 million and Rs148.5 million. However, 2021 and 2022 seem favorable years for the company, suggesting a significant boost in the operational activities during the years. This is because the company secured a positive revenue of Rs364.6 million in 2021 and Rs414.03 million in 2022. However, there is a decline to Rs246.6 million again in operational revenue in 2023.

The company witnessed an operating loss of Rs296.004 million in 2019 and Rs197.3 million in 2020, indicating its failure in managing generating significant profit from its operations. Nonetheless, in the subsequent years, the company registered an operating profit of Rs355.27 million, which rose to the highest of Rs401.8 million in 2022, showcasing a healthy financial activity of the company. In 2023, it reduced to Rs235.9 million. Over the five years, other revenue ranged between 12.00 million in 2023 and Rs111.1 million in 2021. However, the financial expenses grew continuously over the years, from the lowest of Rs175.3 million in 2019 to the highest of Rs312.5 million in 2023.

This shows that the company’s costs of financing and debt servicing surged over the years. During 2019, 2020, and 2023, the company registered net losses of Rs424.2 million, Rs426.5 million, and Rs72.9 million respectively, suggesting the company faced significant challenges regarding profit generation. The company observed a profit after tax of Rs207.4 million in 2021 and Rs92.2 million in 2022.

Credit: INP-WealthPk