INP-WealthPk

Hifsa Raja

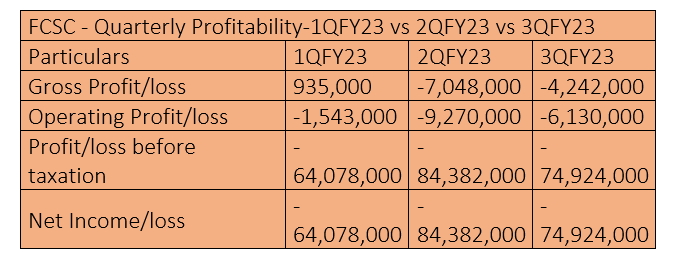

First Capital Securities Corporation (FCSC) suffered net losses in the first three quarters of the current fiscal year 2022-23, though it posted gross profit in the first quarter. FCSC posted a gross profit of Rs935,000, but a net loss of Rs64 million in the first quarter (July-September) of FY23.

In the second quarter (October-December), the FCSC posted a gross loss of Rs7.04 million. The company also posted a net loss of Rs84 million during this period. In the most recent quarter (January-March) of FY23, the company posted a gross loss of Rs4.24 million and a net loss of Rs74.9 million.

FCSC- nine-month performance

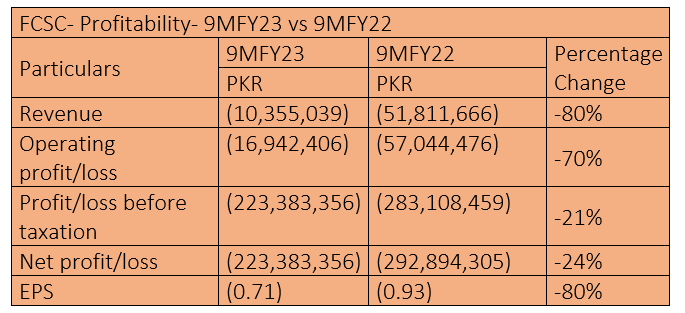

FCSC managed to bring down its revenue losses by 80% to Rs10 million in the first nine months of the fiscal year 2022-23 (9MFY23) from Rs51 million in the corresponding period of FY22. Similarly, its operating loss registered a decrease of 70% to reach Rs16 million in 9MFY23 from Rs57 million loss over the corresponding period of FY22.

The loss-before-tax decreased 21% to Rs233 million in 9MFY23 from Rs283 million in 9MFY22. The net loss decreased 24% to Rs223 million in 9MFY23 from Rs292 million over the corresponding period of FY22. The loss per share decreased 80% to Rs0.71 in 9MFY23 from Rs0.93 in 9MFY22, reports WealthPK.

Performance in 2021-22

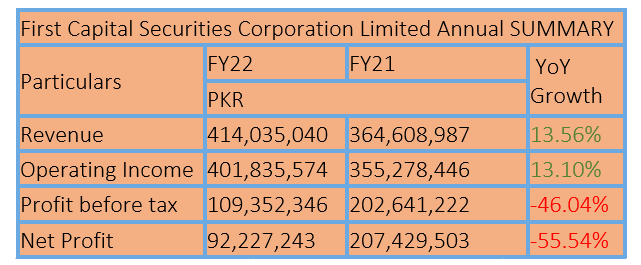

FCSCL’s revenue increased 13% to Rs414 million in the fiscal year 2021-22 from Rs364 million in FY21. The company’s operating income increased by 13% to Rs401 million in FY22 from Rs355 million in FY21. However, the profit-before-taxation dipped 46% to Rs109 million in FY22 from a pre-tax profit of Rs202 million in FY21. The profit-after-taxation also decreased 55% to Rs92 million in FY22 from a post-tax profit of Rs207 million in FY21.

Earnings Per Share

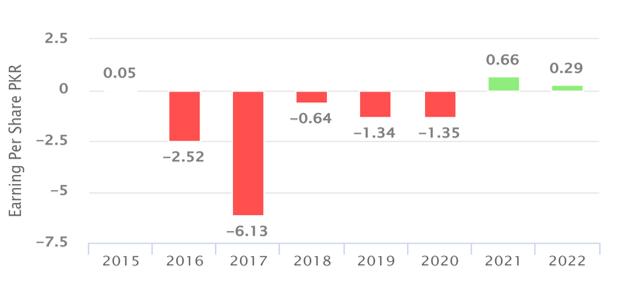

The company witnessed a loss per share from 2016 to 2020. However, in 2021 the company’s earnings per share stood at Rs0.66. In 2022, the EPS decreased to Rs0.29.

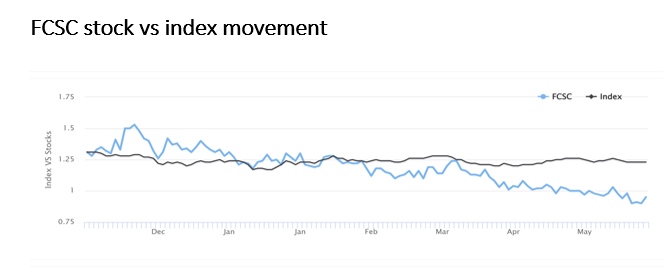

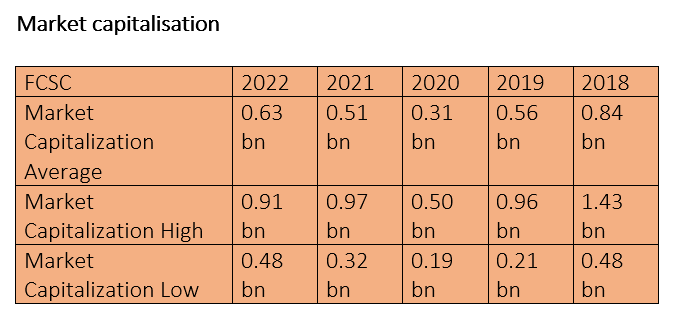

In 2022, FCSC had market capitalisation of Rs0.63 billion, the highest since 2018, when the market cap stood at Rs0.84 billion. The company had the lowest market cap of Rs0.31 billion in 2020.

Industry comparison

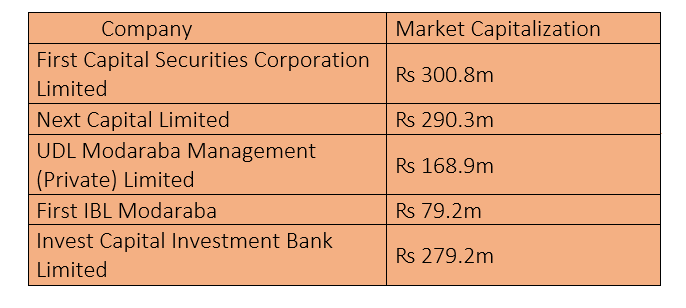

FCSC competitors include Next Capital Limited, UDL Modaraba Management (Private) Limited, First IBL Modaraba and Invest Capital Investment Bank Limited.

FCSC has the highest market capitalisation of ₨300 million among its competitors. Next Capital Limited has the second highest market cap of ₨290 million. First IBL Modaraba has the lowest market cap of Rs79.2 million.

About the company

First Capital Securities Corporation was incorporated in Pakistan on April 11, 1994, as a public limited company under the repealed Companies Ordinance, 1984 (now Companies Act 2017) and is listed on the Pakistan Stock Exchange. The company engages in long and short-term investments, money market operations and financial consultancy services.

Credit: Independent News Pakistan-WealthPk