INP-WealthPk

Fakiha Tariq

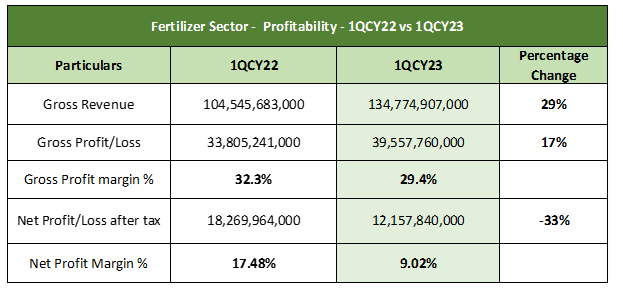

Pakistan’s fertilizer makers jointly posted 29% increase in sales and 17% growth in gross profit in the first quarter (January-March) of calendar year 2023 compared to the corresponding period of 2022, WealthPK reports. In the 1QCY23, listed fertilizer firms collectively made gross revenue of Rs134 billion and gross profit of Rs39 billion, thus coming up with the gross profit ratio of 29.4%. However, the sector’s net profit dipped 33% to Rs12 billion, with net profit ratio standing at 9.02%.

The fertiliser sector’s revenue increased to Rs134 billion in 1QCY23 from Rs104 billion in the same period of CY22. Likewise, the gross profit grew from Rs33 billion in 1QCY22 to Rs39 billion in 1QCY23. However, the fertilizer makers declared a net profit of Rs12 billion in 1QCY23 compared to Rs18 billion in 1QCY22, showing a decrease of 33%. The fertilizer sector is represented on Pakistan Stock Exchange (PSX) by four companies with collective market capitalisation of Rs319 billion.

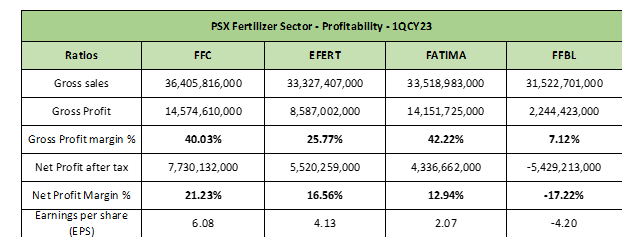

Fauji Fertilizer Company Limited (FFC) with market cap of Rs130.2 billion leads its peers followed by Engro Fertilizers Limited (EFERT) with market cap of Rs114.2 billion. Fatima Fertilizer Company Limited (FATIMA) and Fauji Fertilizer Bin Qasim Limited (FFBL) are the third and fourth with market caps of Rs59.6 billion and Rs15 billion, respectively.

Fertilizer Sector– Quarterly Review – 1QCY23

In 1QCY23, FFC beat its peers by marking highest sales and declaring highest gross profit, net profit and earnings per share (EPS). In terms of profitability ratios, FATIMA posted highest gross profit ratio followed by FFC, EFERT and FFBL. On net level profitability, the sequence changed from FFC to EFERT and FATIMA. FFBL is the only firm that experienced net loss in 1QCY23.

FFC posted gross revenues of Rs36.4 billion and gross profit of Rs14.5 billion. The company posted net profit of Rs7.7 billion. Therefore, the gross profit and net profit ratios were calculated at 40.03% and 21.237%, respectively. In 1QCY23, FFC reported the earnings per share of Rs6.08.

EFERT posted gross profit of Rs8.58 billion and net profit of Rs5.52 billion on the gross revenue of Rs33.3 billion. Therefore, the gross profit and net profit ratios were reported to be 25.77% and 16.56%, respectively. In 1QCY23, the company reported the earnings per share of Rs4.13. In 1QCY23, FATIMA posted gross profit of Rs14.1 billion and net profit of Rs4.33 billion on the gross revenue of Rs33.5 billion. Therefore, the gross profit and net profit ratios turned out to be 42.22% and 12.94%, respectively.

In 1QCY23, FATIMA reported the earnings per share of Rs2.07. FFBL posted the gross revenue of Rs31.5 billion in 1QCY23. The company declared the gross profit of Rs2.24 billion and net loss of Rs5.4 billion. In 1QCY23, FFBL reported loss per share of Rs4.20.

Credit: Independent News Pakistan-WealthPk