INP-WealthPk

Fakiha Tariq

Sales of the public-listed fertiliser companies collectively grew by 22% to Rs512 billion in the calendar 2022 from a revenue of Rs422 billion posted in 2021, WealthPK reports. Fauji Fertilizer Company Limited (FFC) is the largest firm in the sector with a market capitalisation of Rs125.6 billion, followed by Engro Fertilizers Limited (EFERT) with a market cap of Rs113.7 billion.

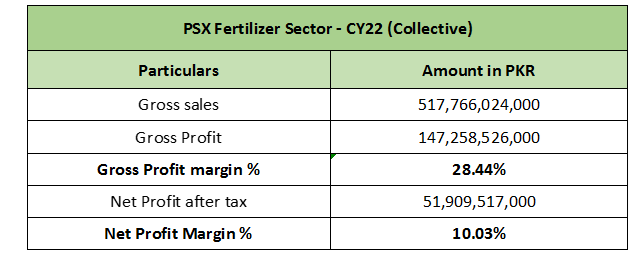

Fatima Fertilizer Company Limited (FATIMA) and Fauji Fertilizer bin Qasim Limited (FFBL) have market caps of Rs66.6 billion and Rs15.9 billion, respectively. The fertiliser sector ended 2022 with a gross profit of Rs147 billion and a net profit of Rs51 billion on sales of Rs517 billion. Thus, the gross profit and net profit ratios came out to be 28% and 10.03%, respectively.

Fertiliser sector – financial comparison – 2022

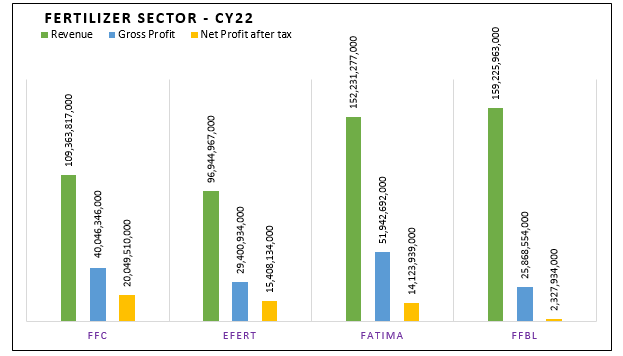

In 2022, FFBL topped the peer companies by grabbing the highest annual sales of Rs159 billion, trailed tightly by FATIMA with Rs152 billion in sales. FFC remained the third-highest revenue collector, posting sales of Rs109 billion. EFERT made the lowest sales of Rs96 billion in 2022.

In terms of gross profit, FATIMA posted the highest gross profit of Rs51 billion in 2022. FFC posted a gross profit of Rs40 billion and EFERT declared Rs29 billion gross profit. The lowest gross profit was reported by FFBL at Rs25 billion. In terms of net profit, FFC posted the highest net profit of Rs20 billion, followed by EFERT and FATIMA, with net profits of Rs15 billion and Rs14 billion, respectively. FFBL posted the lowest profit of Rs2.3 billion in 2022.

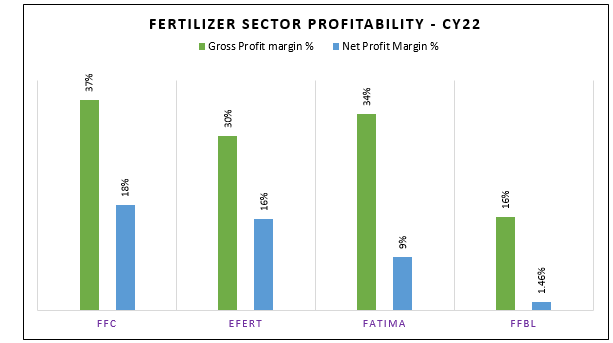

Fertiliser sector – profitability ratios – 2022

FFC posted the highest gross profit (GP) and net profit (NP) ratios of 37% and 18%, respectively, in 2022. FATIMA posted the second highest GP ratio of 34%, EFERT 30% and FFBL 16%.

In 2022, EFERT posted the second-highest NP ratio of 16%, followed by 9% and 1.46% posted, respectively, by FATIMA and FFBL.

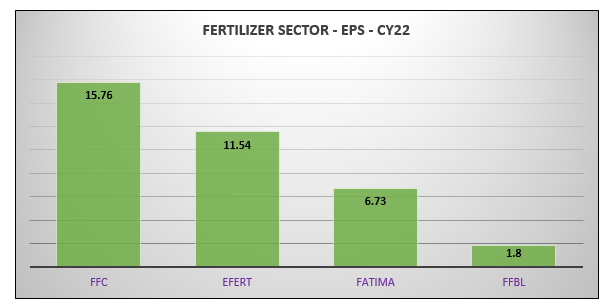

Fertiliser sector – EPS comparison – 2022

FFC posted the highest earnings per share of Rs15.76 in 2022, followed by EFERT’s Rs11.54.

By posting an EPS of Rs6.73, FATIMA stood third. FFBL posted the lowest EPS value of Rs1.80.

Credit: Independent News Pakistan-WealthPk