INP-WealthPk

Qudsia Bano

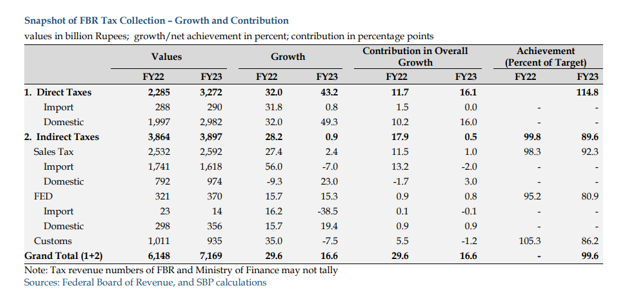

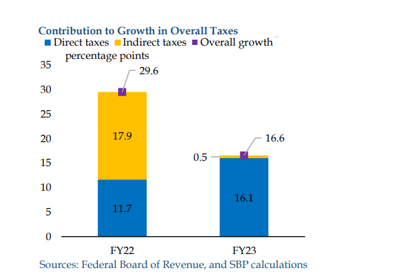

The Federal Board of Revenue (FBR) witnessed a growth of 16.6% in tax revenue in the fiscal year ending on June 30, 2023, marking a notable deceleration from the preceding year's robust expansion of 29.6%, according to the latest data. Despite introducing measures in the Finance (Supplementary) Act in February 2023, the FBR tax-to-GDP ratio experienced a dip, falling to 8.5% in FY23 from 9.2% in FY22.

Several factors converged to contribute to this decelerated growth in FBR taxes. Import compression, a considerable moderation in domestic demand, a contraction in Large Scale Manufacturing (LSM) output, devastating floods, zero Goods and Services Tax (GST) on petroleum oil and lubricant (POL) products and crude, and ad-hoc exemptions on duties, particularly on imports, and the supply of relief goods, played significant roles in shaping the fiscal landscape in the wake of floods. The Finance (Supplementary) Act in February 2023 aimed to bolster revenue through additional measures. However, despite these efforts, the FBR tax-to-GDP ratio saw a decrease. Notably, the additional tax measures, including an increase in super tax, GST, and Federal Excise Duty (FED), played a crucial role in helping the FBR get closer to the FY23 target. A breakdown of the figures shows that the collection of direct taxes surpassed the target, nearly compensating for the shortfall in indirect taxes. Withholding taxes and voluntary payments emerged as major contributors to the growth in direct taxes.

On the flip side, indirect tax collection experienced only marginal growth due to import curtailment, especially in dutiable imports, impacting sales tax, FED, and customs duties related to imports. Talking to WealthPK, Shahid Javed, a senior economist at the State Bank of Pakistan, said several factors contributed to the growth in FBR taxes in FY23. "Firstly, high inflation played a role in boosting indirect taxes despite a decline in sales. Secondly, an increase in interest income stemming from investments in government securities, saving certificates, saving deposits, bank profits, and income taxes paid thereof contributed to the positive trend. Thirdly, the increase in tax rates implemented through the Finance Act, 2022 and the Finance Act, 2023 played a role. For instance, there were increases in income tax rates on salaries, a surge in super tax from 4% to 10% on high-earning individuals, and hikes in GST from 17% to 18%, as well as on locally manufactured cars and luxury imports to 25%."

Javed added that administrative efforts by FBR to enhance tax compliance and improve the ease of doing business constituted the fourth factor that contributed to the growth in FBR taxes. "These efforts aimed at streamlining processes and encouraging businesses to meet their tax obligations more efficiently." "While the FBR experienced a commendable growth of 16.6% in tax revenue in FY23, various challenges and a slower pace compared to the previous fiscal year indicate the complexity of the economic landscape. The interplay of domestic and global factors, coupled with the FBR's efforts to adapt and innovate, will likely continue to shape the fiscal narrative in the coming years," said the economic expert.

Credit: INP-WealthPk