INP-WealthPk

Qudsia Bano

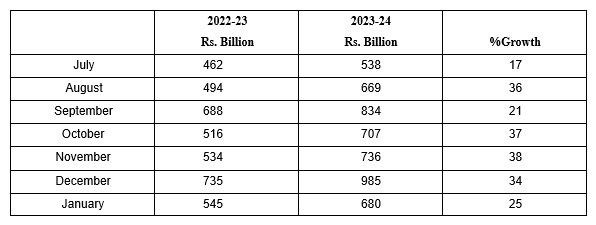

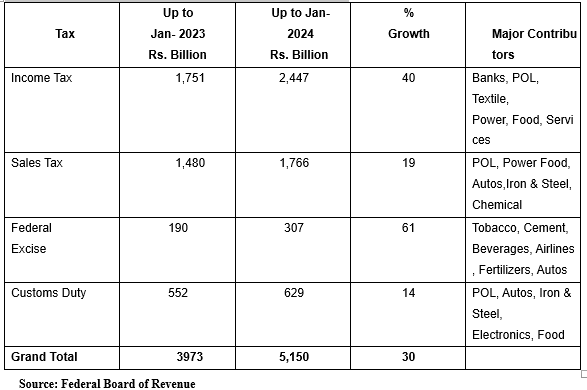

In a remarkable fiscal achievement, the Federal Board of Revenue (FBR) has recorded a substantial revenue collection of Rs 5,150 trillion from July 2023 to mid-February 2024. This reflects an impressive 30% growth compared to the same period last fiscal year when collections stood at Rs.3,973 trillion. The surge in tax revenue, fueled by a robust 40% growth in domestic taxes, signifies a buoyant economy as GDP experiences a revival. The month-wise revenue collection for July 2023 to January 2024 is as under:

Notably, tax refunds witnessed a commendable 28% increase during this period, underlining the efficiency and responsiveness of the revenue system. The overall growth in domestic taxes has been a significant driver, now constituting over 64% of the total revenues for the current financial year. This represents a positive shift, with import taxes contributing 36%, down from more than 50% just three years ago. However, the growth in import duty and related taxes has been tempered, increasing by 16% over the July 2023 to January 2024 period. This slowdown is attributed to downward adjustments in import tariffs over the years and recent restrictions on import licenses imposed by the State Bank of Pakistan to address balance of payments concerns amid foreign exchange constraints.

Despite challenges in import tax growth, the FBR's focus on enhancing anti-smuggling efforts has yielded noteworthy results. The anti-smuggling drive experienced a substantial 69% growth in the current fiscal year compared to FY 22-23, contributing significantly to revenue. Importantly, revenue collection from imports incorporates improvements in import valuation, generating Rs 151 billion. The tax-wise collection reveals the following trends:

Recognizing the potential for further anti-smuggling efforts, there is a call to augment the customs force in Baluchistan. Currently, with only 378 anti-smuggling staff in the province, it is suggested that enforcement efforts should be strengthened by increasing personnel, especially compared to the substantial 20,000 personnel in other provinces. This strategic move could fortify the nation's revenue collection and safeguard against illicit trade practices.

INP: Credit: INP-WealthPk