INP-WealthPk

Qudsia Bano

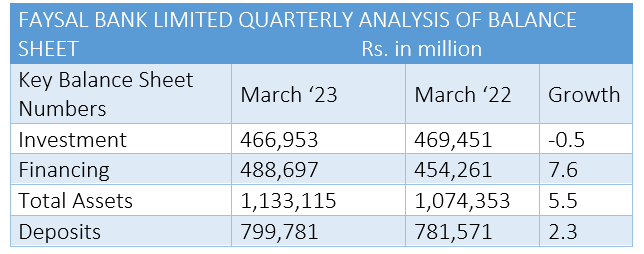

Faysal Bank Limited (FBL) demonstrated a steady growth in the first quarter of the ongoing calendar year 2023 (1QCY23) despite the challenging economic conditions. According to Asim Mustafa, the Regional Corporate Head at FBL, the bank underwent a significant transformation on January 1, 2023, transitioning into a fully-fledged Islamic bank. As a result, the quarter ending in March 2023 marked the bank's first quarter of complete Islamic operations. He said this transformation had led to a shift in the bank's liability mix, subsequently impacting the cost of deposits. The bank’s investment portfolio stood at Rs466 billion in 1QCY23, showing a marginal decline of 0.5% compared to the same period of the previous year. This slight decrease suggests the bank has been cautious in its investment strategy, possibly due to market uncertainties and a focus on risk management.

On the other hand, financing activities witnessed significant growth, with the bank's financing portfolio reaching Rs488 billion in 1QCY23. This represents a substantial increase of 7.6% compared to the same period last year. This robust growth indicates that FBL has been successful in extending credit facilities to individuals and businesses, supporting economic development and building customer trust.

The bank's total assets also experienced positive growth, reaching Rs1.13 trillion, a 5.5% increase from the previous year’s same months. This growth can be attributed to the bank's effective asset management strategies and prudent risk management practices. The bank's ability to expand its asset base indicates a healthy financial position and a strong foundation for future growth and profitability.

Deposits, a critical indicator of customer confidence, showed a steady rise. FBL recorded deposits of Rs799 billion in 1QCY23, marking a growth of 2.3% over the same months of the previous year. This increase reflects the trust and satisfaction of the bank's customers, who continue to choose it as their preferred banking partner.

Asim Mustafa stressed that Islamic banks have a peculiar way of managing their return on deposits, which is governed by a mechanism called pool management. Since Islamic banks are not required by regulators to pay minimum benchmark returns to depositors, there is a likelihood that the cost of the deposit is effectively managed by an Islamic bank, he explained.

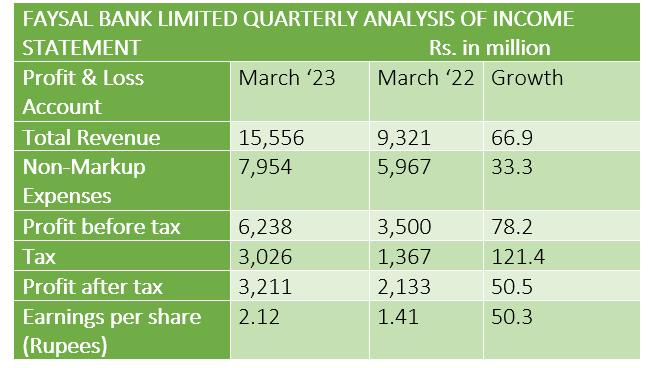

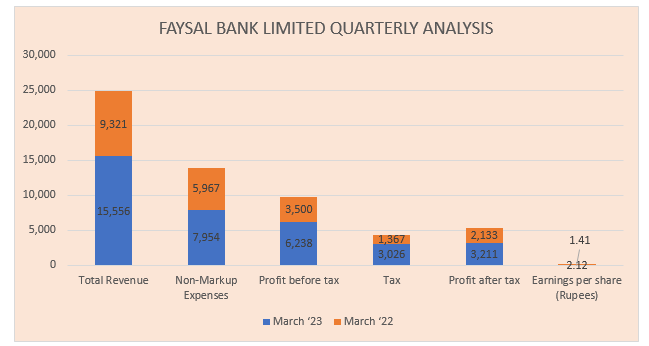

The bank’s income report also showcases an impressive performance, with substantial growth in key financial indicators, reflecting the bank's robust operational capabilities and effective management strategies. The total revenue of FBL witnessed a remarkable surge, reaching Rs15 billion in 1QCY23, compared to Rs9 billion over the same period last year. This substantial growth of 66.9% can be attributed to the bank's successful efforts in expanding its customer base, improving fee-based income, and optimising its revenue streams.

Non-markup expenses, which encompass operational and administrative costs, were recorded at Rs7.9 billion, reflecting a growth of 33.3% from the same period of the previous year. The increase can be attributed to investments in technology, infrastructure, and human capital to enhance the bank's operational efficiency and customer service. FBL’s commitment to improving its operational capabilities and providing an enhanced banking experience is evident in its focus on these areas.

The profit-before-tax, a crucial indicator of the bank's overall financial performance, experienced a substantial surge. The bank achieved a pre-tax profit of Rs6 billion in 1QCY23, compared to Rs3.5 billion in the same period last year, representing a remarkable growth of 78.2%. This impressive increase highlights the bank's ability to manage risks effectively, optimise its revenue streams, and deliver sustainable growth.

The tax expense also saw a significant rise, standing at Rs3 billion, indicating a growth of 121.4% compared to the previous year. This increase can be attributed to higher taxable profits resulting from the bank's improved financial performance. Despite the higher tax expense, FBL was able to maintain a strong profit-after-tax. The post-tax profit reached Rs3.2 billion in 1QCY23, reflecting a growth of 50.5% compared to the same period last year.

Commenting on the exceptional performance of the bank, Asim Mustafa said the topline increase was due to an extraordinary rise in the base rate (KIBOR). He said that the net margin hasn't increased, which shows the effect of rising market rates on both assets and liabilities side of business.

Furthermore, the earnings per share (EPS) witnessed a substantial increase, with the bank reporting an EPS of Rs2.12 in 1QCY23 compared to Rs1.41 over the same quarter last year, marking a growth of 50.3%. This increase highlights the bank's ability to generate higher earnings for its shareholders and indicates its commitment to creating sustainable value.

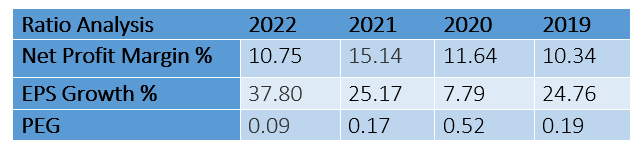

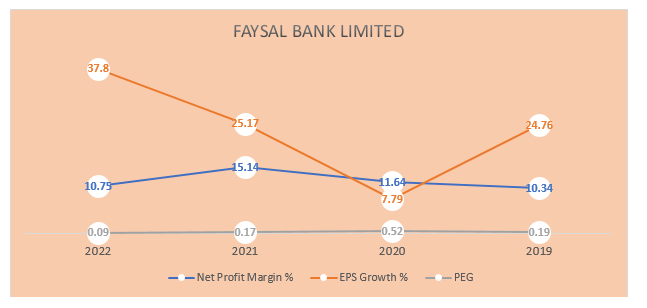

FBL’s ratio analysis for the past four years showcased its strong financial performance and highlighted key indicators of profitability and growth. The net profit margin percentage, which indicates the profitability of the bank, stood at 10.75% in 2022, compared to 15.14% in 2021, 11.64% in 2020, and 10.34% in 2019. Although there was a slight decline in the net profit margin in 2022, the bank maintained a healthy profit margin throughout the period, reflecting its ability to generate profits from its operations and effectively manage costs.

EPS growth percentage, a key measure of the bank's earnings per share, exhibited a positive trend. The bank achieved an EPS growth of 37.80% in 2022, compared to 25.17% in 2021, 7.79% in 2020, and 24.76% in 2019. This consistent growth in EPS indicates the bank's ability to generate higher earnings for its shareholders and reflects its successful management of profitability and shareholder value.

The price/earnings to growth ratio (PEG) provides insights into the bank's valuation in relation to its earnings growth. FBL recorded a PEG ratio of 0.09 in 2022, 0.17 in 2021, 0.52 in 2020, and 0.19 in 2019. The low PEG ratios suggest that the bank's stock price has been relatively undervalued in relation to its earnings growth, potentially presenting an attractive investment opportunity for investors.

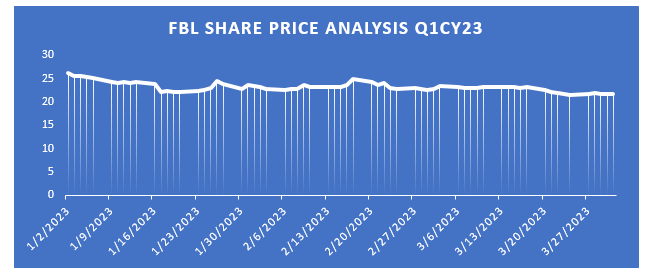

Share Price Analysis (1QCY23)

During the first quarter of 2023, FBL’s share price experienced fluctuations, reflecting the dynamics of the stock market and various factors influencing investor sentiment. On January 2, 2023, FBL’s share price opened at 26.3. Over the next few trading sessions, the price gradually declined, reaching a low of 22.07 on January 17, 2023. This downward trend can be attributed to overall market conditions, investor sentiment, and any negative news or market factors affecting the banking sector during that time.

However, from January 18, 2023, the bank's share price began to recover, experiencing intermittent ups and downs. By January 26, 2023, the price increased to 24.45, indicating a positive sentiment and potential investor confidence. This upward movement could be attributed to positive market sentiment, favourable industry news, or company-specific factors that instilled confidence among investors.

The share price continued to fluctuate throughout February and March 2023. It reached a high of 24.95 on February 17, 2023, before experiencing a downward correction. These fluctuations can be influenced by a range of factors, including economic indicators, interest rate changes, financial reports, market rumors, and investor sentiment. Despite the fluctuations, Faysal Bank's share price generally remained within a relatively narrow range during the quarter, hovering around the mid-20s. This stability could indicate a balanced market and investor confidence in the bank's performance and prospects.

Credit: Independent News Pakistan-INP