INP-WealthPk

Qudsia Bano

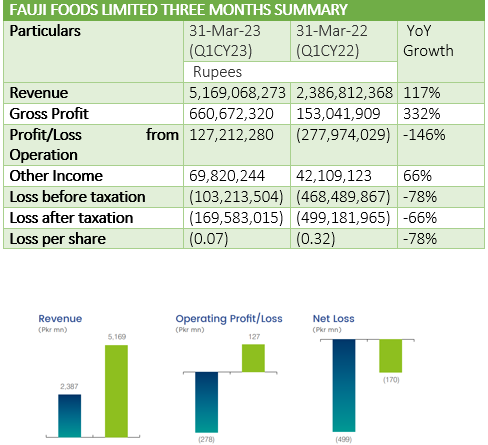

Fauji Foods Limited’s revenue in the first quarter of the ongoing calendar year 2023 (1QCY23) stood at Rs5.2 billion, which is up a staggering 117% from Rs2.4 billion posted over the same period last year, reports WealthPK. This increase in revenue was driven by continued volume growth in ultra-high temperature milk (54%), an expansion in distribution network as additional 13,000 outlets were set up, and yet another strong quarter of institutional sales of Rs2.03 billion.

Furthermore, Fauji Foods demonstrated a significant improvement in its gross profit, which soared to Rs660.6 million from Rs153 million in 1QCY22, registering a gigantic growth rate of 332%. The company's efforts to streamline its operations, optimise production processes, and enhance cost efficiency played a pivotal role in achieving such substantial growth in gross profit.

In terms of operating performance, Fauji Foods reported a profit from operations of Rs127 million in 1QCY23. This was a remarkable turnaround compared to the corresponding period of last year, when the company incurred a loss of Rs277.9 million. The company's relentless focus on improving operational efficiencies and reducing overhead costs has contributed significantly to this positive outcome.

The company also generated a substantial amount of other income, amounting to Rs69.8 million during the first quarter of CY23. This represents a 66% increase compared to the previous year's first quarter, when the other income stood at Rs42.1 million. This growth can be attributed to various factors such as improved financial management, effective investment strategies, and prudent utilisation of available resources.

Despite the overall positive financial performance, Fauji Foods reported a before-tax loss of Rs103.2 million in 1QCY23. However, this loss was significantly lower than the loss of Rs468.5 incurred during the same period of last year, indicating a notable improvement of 78%. The company's proactive measures to address challenges, restructure its operations, and enhance cost controls have substantially reduced pre-tax loss.

After accounting for taxation, Fauji Foods reported a loss of Rs169.6 million for 1QCY23. However, this loss represented a remarkable improvement compared to the loss of Rs499 million reported in 1QCY22. The company's focused efforts on managing costs, increasing operational efficiency, and strengthening its market position contributed to this significant reduction in post-tax loss.

Earnings per share (EPS) for 1QCY23 stood at Rs0.07, a substantial improvement compared to the loss per share of Rs0.32 in 1QCY22. This improvement in EPS reflects the company's dedication to enhancing shareholder value and optimising its financial performance. Fauji Foods delivered an impressive financial performance in 1QCY23, with substantial growth in revenue, gross profit and other income. Despite reporting a loss before and after taxation, the company has made significant progress in reducing losses compared to the previous year.

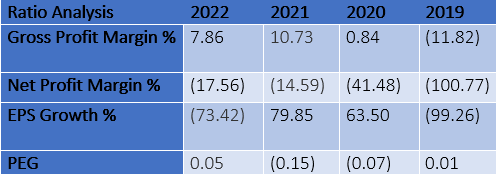

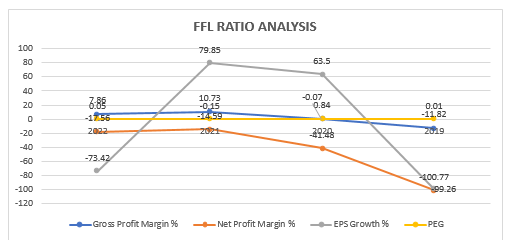

Fauji Foods ratio analysis provides insights into the company's financial performance over the past four years, highlighting both positive and negative trends. Fauji Foods witnessed a decline in gross profit margin from 10.73% in 2021 to 7.86% in 2022. This suggests a decrease in the company's ability to generate profits from its manufacturing and production processes. However, it is important to note that the 2022 figure is still an improvement compared to the significantly lower gross profit margin of 0.84% in 2020.

The net profit margin indicates the portion of revenue that translates into profit after all expenses, including taxes and interest. Fauji Foods reported negative net profit margins in all the years analysed. Although the net profit margin improved from -41.48% in 2020 to -14.59% in 2021, it worsened again to -17.56% in 2022. This signifies that the company's expenses continue to outweigh its revenue, resulting in losses. Further efforts are needed to enhance cost management and revenue generation.

The EPS growth rate showcases the change in earnings per share over time. Fauji Foods experienced significant fluctuations in EPS growth. While the company demonstrated positive growth of 79.85% in 2021, it suffered a substantial decline of -73.42% in 2022. It is an indication of a significant contraction in profitability and suggests challenges in sustaining earnings growth. Consistency and stability in earnings are essential for long-term investor confidence.

The price/earnings to growth (PEG) ratio evaluates the relationship between a company's earnings growth and its stock price. Fauji Foods PEG ratio has varied over the years, indicating mixed market perceptions. The negative PEG ratio in 2021 (-0.15) suggests undervaluation relative to the earnings growth rate. However, the positive PEG ratios in 2020 (0.07) and 2019 (0.01) indicate overvaluation concerns. The low PEG ratio of 0.05 in 2022 suggests an undervalued stock relative to the projected earnings growth rate.

About the company

Fauji Foods was incorporated in Pakistan on September 26, 1966, as a public company under the Companies Act, 1913 (now the Companies Act, 2017). It is a subsidiary of Fauji Fertilizer Bin Qasim Limited. The firm is principally engaged in the processing and sale of toned milk, milk powder, fruit juices, allied dairy and food products.

Credit: Independent News Pakistan-WealthPk