INP-WealthPk

Fauji Fertilizer posts record Rs109bn revenue in CY22

February 03, 2023

Fakiha Tariq

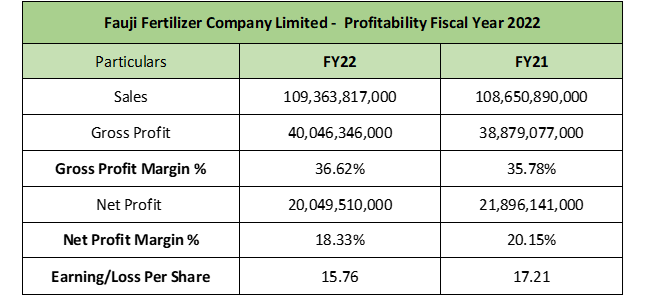

Fauji Fertilizer Company Limited (FFC) revenue from sales clocked in at Rs109 billion in calendar year 2022, the highest during the last five years, reports WealthPK. In CY21, FFC reported a sales revenue of Rs108 billion. The company’s gross profit value increased to Rs40 billion in CY22 from Rs38 billion in CY21. FFC reported a gross profit ratio of 36.62% and a net profit ratio of 18.33%, respectively, in CY22. The earning per share value in CY22 stood at Rs15.76.

FFC Profitability – Horizontal Analysis

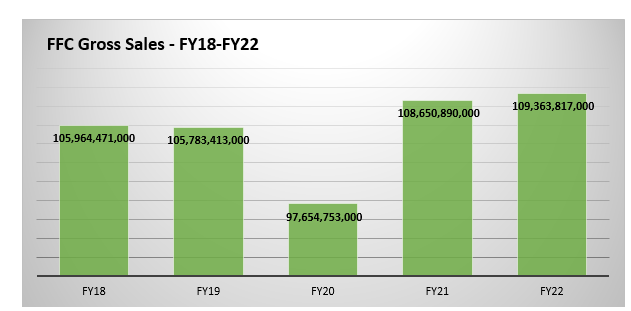

The gross sales value reported by FFC in CY22 was the highest of last five years.

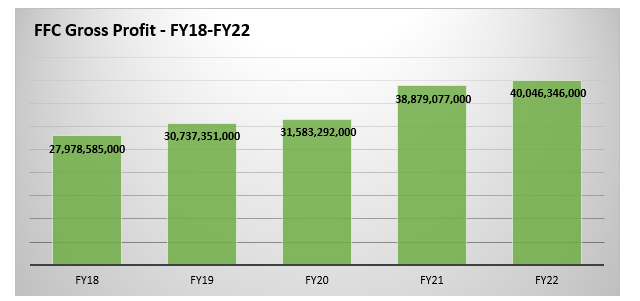

From CY18 to CY22, FFC showed a 3.2% growth in revenue as its revenue stood at Rs105 billion in FY18, but witnessed a decrease in CY19 and CY20. The company’s revenue jumped in CY21 to Rs108 billion. A continuous increasing trend has been observed when the company’s gross profit value from CY18 to CY22 are graphed. Over the last five years, FFC sustained a gross profit increase of 43% from Rs27 billion in CY18 to Rs40 billion in CY22.

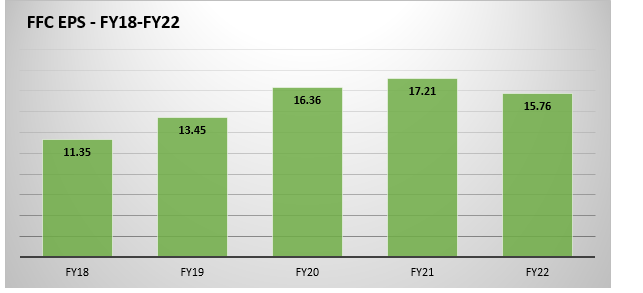

The company reported a gross profit of Rs27 billion in CY18, which went up to Rs30 billion and then Rs31 billion in CY19 and CY20, respectively. The company reported a gross profit of Rs38 billion in CY 21, which increased to Rs40 billion in CY22. FFC’s earning per share (EPS) value remained at Rs14.83 on average during the last five years. However, the highest of all time EPS value was reported in CY21 at Rs17.21.

The EPS, however, dropped to Rs15.76 in CY22.

Credit: Independent News Pakistan-WealthPk