INP-WealthPk

Ayesha Mudassar

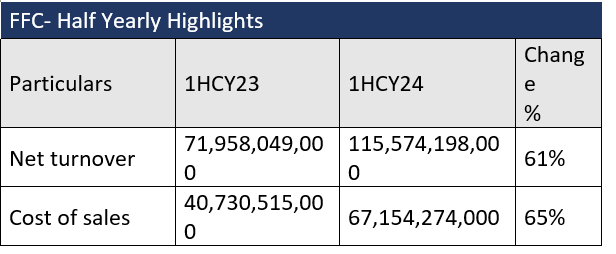

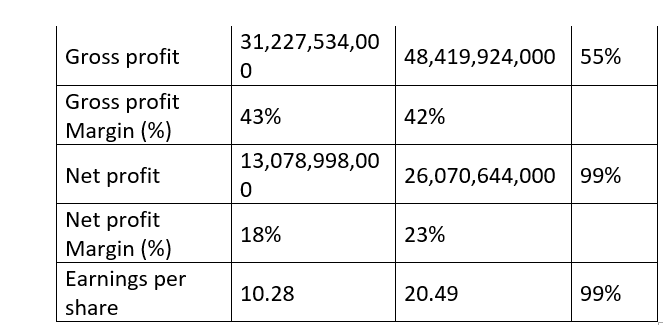

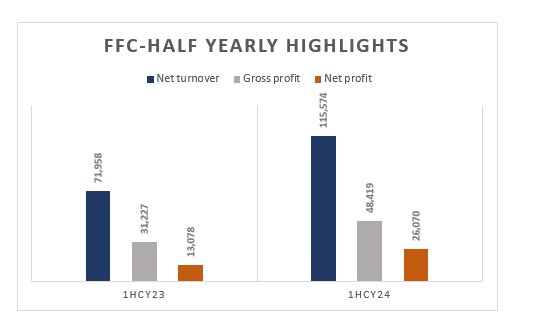

Fauji Fertilizer Company Limited (FFC) achieved a 61% increase in revenues, a 55% rise in gross profit and a 99% surge in net profit during the first half of the ongoing calendar year 2024 compared to the same period of last year, according to WealthPK.

The company recorded sales of Rs115.5 billion, a gross profit of Rs48.4 billion, and a net profit of Rs26.07 billion in 1HCY24. Additionally, FFC posted gross and net profit ratios of 42% and 23%, respectively, during the period under review.

The earnings per share (EPS) for the first half of 2024 were reported at Rs20.49, reflecting a substantial 99% increase compared to Rs10.28 in the corresponding period of 2023. This notable growth underscores the company’s effective utilisation of profits to benefit shareholders.

Pattern of shareholding

As of December 31, 2023, FFC had 1,272.2 million shares outstanding, which were held by 15,478 shareholders. The largest shareholding (44.3%) was owned by associated companies, undertakings, and related parties. Public sector companies and corporations owned 11.6% of the shares, while banks, development finance institutions (DFIs), non-banking financial institutions (NBFIs), insurance companies, takaful, modarabas, and pension funds collectively held 7.3% of the shares.

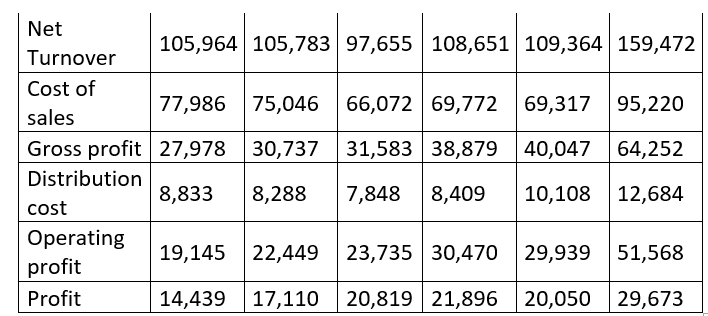

Past six years at a glance

The company achieved a significant milestone by surpassing the Rs150 billion mark in turnover for the first time in the past six years, reaching a record-high turnover of Rs159.4 billion in 2023. This represents an annual average growth of 10% since 2018, primarily driven by increased sales and higher selling prices. Correspondingly, the cost of sales rose at an average annual rate of 5% since 2018 due to elevated raw material prices and inflationary pressures. Effective resource management, cost optimisation and favourable fertilizer prices have contributed to substantial gross profit growth over the past six years. The gross profit increased from Rs27.9 billion in 2018 to an impressive Rs64.2 billion in 2023, reflecting an annual average growth rate of 22%.

Prudent cost control measures had effectively contained distribution costs until 2021. However, the adverse economic conditions and geopolitical uncertainties led to a substantial increase in these costs in subsequent years. Consequently, distribution costs rose by 20% in 2022 and 25% in 2023 compared to the respective preceding years. Nevertheless, the operating profit grew from Rs19.1 billion in 2018 to Rs51.5 billion in 2023. The company has also demonstrated robust growth in net profitability, maintaining an impressive average annual growth of 17% since 2018. In 2023, the net profit reached Rs29.6 billion, largely attributable to the record turnover and exceptional investment income.

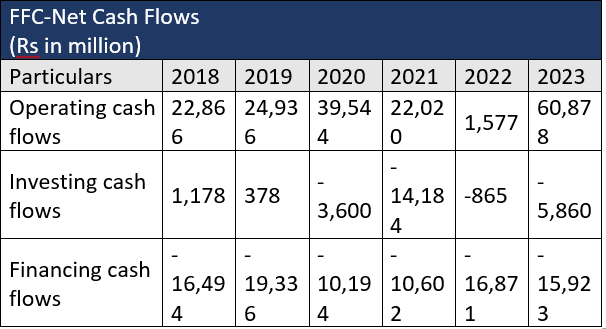

Cashflow highlights

The net cash generated from operations reached Rs60.8 billion in 2023, reflecting an increase of Rs38.01 billion from 2018, primarily due to higher profitability and inventory liquidation. To support ongoing operations and ensure business continuity, the company continued its strategic investment in capital projects, and hence, net cash used in investing activities was Rs5.8 billion in 2023 compared to a cash inflow of Rs1.1 billion in 2018.

Furthermore, the net cash utilised in financing activities amounted to Rs15.9 billion in 2023, slightly lower than the Rs16.4 billion reported in 2018.

About the company

FFC is a public company incorporated in Pakistan under the Companies Act, 1913, (now the Companies Act, 2017). The company is engaged in the manufacturing, purchasing and marketing of fertilizers and chemicals. Besides, FFC also undertakes investments across various sectors, including chemicals, cement, food processing, energy generation, and banking operations.

Future outlook

The company is committed to collaborating with the industry and the government to ensure continuous urea production. In response to declining gas pressures, FFC and other fertilizer producers have signed an agreement with Mari Petroleum Company Limited (MPCL) to invest in pressure enhancement facilities (PEFs) at MPCL's delivery node. The project is expected to require substantial capital outlay and aims to secure sustained gas supplies for fertilizer manufacturers.

Credit: INP-WealthPk