INP-WealthPk

Fakiha Tariq

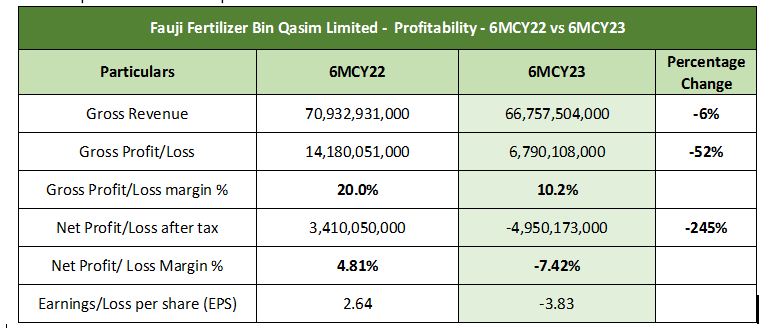

Fauji Fertilizer Bin Qasim Limited (FFBL) experienced 6%decline in revenues and a massive 52% and 245% drop ingross and net profits, respectively, in the first six months (January-June) of 2023 as compared to the corresponding period of 2022, WealthPK reports. FFBL posted agross profit of Rs6.7 billion and net loss of Rs4.9 billion on sales of Rs66 billion in the first half of CY23. The company came up with gross profit and net loss ratios of 10.2% and 7.42%, respectively.

FFBL posted loss per shareof Rs3.83 in 1HCY23.

The company’s sales stood at Rs70 billion in 1HCY22. Compared to 1HCY22, gross and net profits dropped by 52% and 245%, respectively, in 1HCY23.

The firmposted gross profit and net profit ratios of 20% and 4.81%, respectively,in 1HCY22. The company reported the EPS of Rs2.64in 1HCY22.

The firm is listed on the Pakistan Stock Exchange in the fertilizer sector under the symbol of FFBL. With the market capitalisation of Rs17.8 billion, FFBL is the smallest firm of its sector.

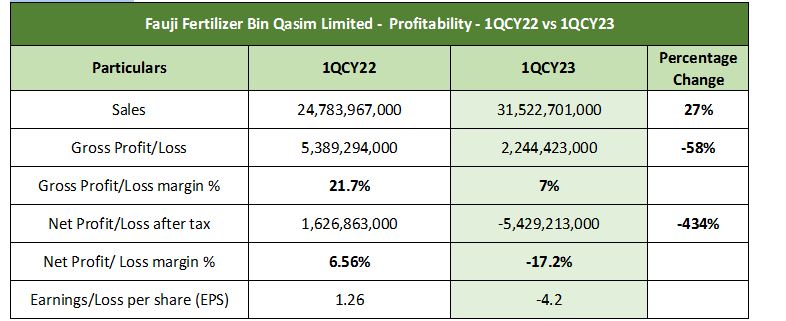

FFBL – 1QCY23 vs 1QCY22

In the first quarter (January-March) of 2023, FFBL sales increased 27% compared to the same period of CY22. However, the company bore net loss during this quarter. FFBL posted a gross profit of Rs2.2 billion and net loss of Rs5.4 billion on sales of Rs31 billion in the first quarter of 2023. The company came up with gross profit and net loss ratios of 7% and 17.2%, respectively.

The company also posted loss per share of Rs4.20 in the 1QCY23.

The company’s sales had stood at Rs24 billion in 1QCY22. Compared to 1QCY22, gross profit dropped 58% and net profit plunged 434% in 1QCY23. The firm had posted gross and net profit ratios of 21.7% and 6.56%, respectively,over the same period of 2022. The company reported EPS of Rs1.26 in 1QCY22.

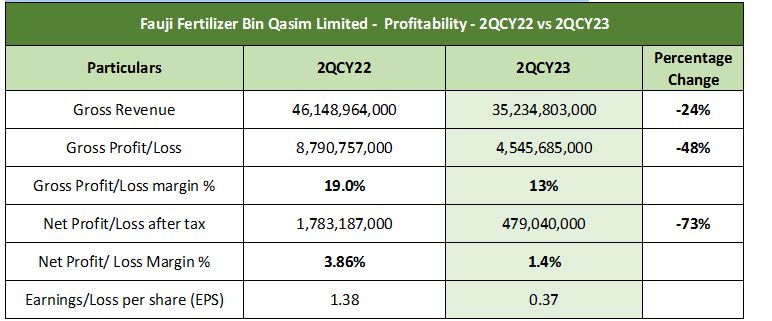

FFBL – 2QCY23 vs 2QCY22

In comparison to 1QCY23, FFBL’s financial performance stabilised in the second quarter. However, the company performed poorly in comparison to the same period of 2022. FFBL posted a gross profit of Rs4.5 billion and net profit of Rs479million on sales of Rs35 billion in the second quarter of calendar year 2023. The company came up with gross profit and net profit ratios of 13% and 1.4%, respectively. FFBL posted earnings per share of Rs0.37 in 2QCY23.

In comparison to 2QCY22, the company’s sales dropped 24% in 2QCY23. Gross and net profits dropped by 48% and 73% in 2QCY23. The firmposted gross profit and net profit ratios of 19% and 3.86%, respectively, in2QCY22.FFBL reported EPS of Rs1.38 in 2QCY22.

Credit: INP-WealthPk