INP-WealthPk

Qudsia Bano

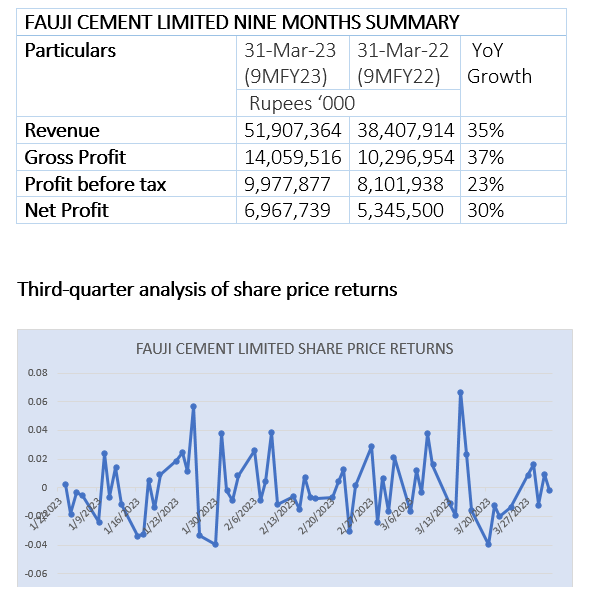

Fauji Cement Limited showed impressive growth in sales and profitability year-on-year in the first three quarters of the ongoing fiscal year 2022-23. During the period ending on March 31, 2023, Fauji Cement recorded a significant increase in revenue, reaching an impressive Rs51.9 billion compared to Rs38.4 billion in the corresponding period of the previous fiscal. This represents a remarkable YoY growth of 35%, reflecting the company’s strong market position and effective business strategies, reports WealthPK.

Gross profit in 9MFY23 stood at Rs14.1 billion, reflecting a substantial increase of 37% over Rs10.3 billion in 9MFY22. This growth can be attributed to improved operational efficiencies, optimised cost management and favourable market conditions.

The company’s profit-before-tax also witnessed a notable surge, reaching Rs9.98 billion at a 23% growth rate year-on-year. This increase indicates Fauji Cement’s ability to effectively capitalise on market opportunities and deliver sustainable profitability. Furthermore, the net profit in 9MFY23 stood at Rs6.96 billion, exhibiting a strong YoY growth of 30%. This underscores the company’s ability to generate consistent returns for its shareholders while maintaining a solid financial standing.

Fauji Cement Limited’s share prices experienced fluctuations during the three-month period from January to March 2023. The prices ranged from a low of 10.50 to a high of 12.85, reflecting volatility in the stock market and investor sentiment. At the beginning of January, Fauji Cement’s share price opened at 11.65 and showed a slight increase over the next few days, reaching 11.68 and 11.47 on January 3 and 4, respectively. However, the share price dipped to 10.95 on January 16, reflecting a downward trend.

Throughout February, the share price experienced mixed movement, with fluctuations between 11.3 and 12.13. March witnessed a more stable performance, with the share price fluctuating within a narrower range of 11.35 to 12.85. On March 15, there was a significant jump in the share price, reaching 12.56, followed by a gradual decline towards the end of the month, closing at 11.84. Overall, Fauji Cement’s share price displayed moderate volatility during the analysed period. Factors such as market sentiment, industry dynamics, and macroeconomic conditions can influence share prices.

Recent events

Fauji Cement Limited has been actively engaged in promoting health and safety, sustainability, and corporate governance throughout. It celebrated the World Day on Health and Safety on April 28 at its Jhang Bahtar plant. The event included an award-giving ceremony for outstanding performers, training sessions, and the launch of a safety campaign called “People-Based Safety.” The 153rd board meeting held on April 19 focused on reviewing and approving the unaudited accounts for the period ending on March 31, 2023. The meeting reiterated the company’s commitment to transparency and corporate governance.

In line with its sustainability efforts, Fauji Cement organised an annual spring tree plantation drive on March 8 at the Jhang Bahtar plant, highlighting the ecological benefits of trees, such as improving air quality and reducing carbon emissions. Representatives from the environment protection department and local officials expressed appreciation for Fauji Cement’s contributions to the environment.

About the company

Fauji Cement is a public limited entity incorporated in Pakistan on November 23, 1992, under the Companies Ordinance, 1984, which is now replaced with Companies Act, 2017. The firm commenced its business on May 22, 1993.

Credit: Independent News Pakistan-WealthPk