INP-WealthPk

QudsiaBano

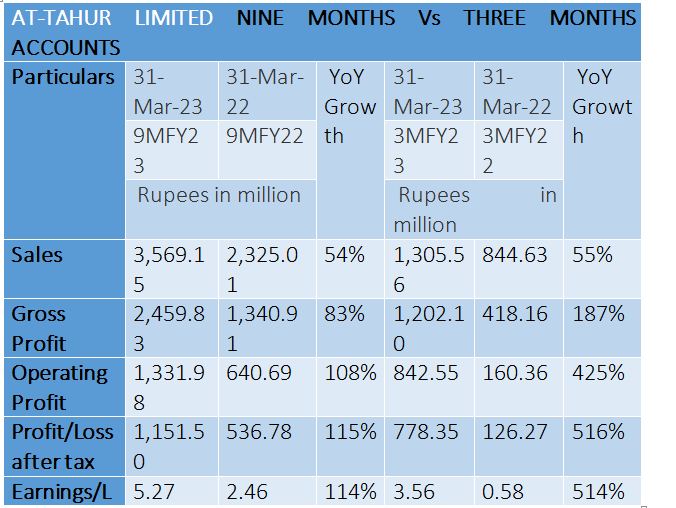

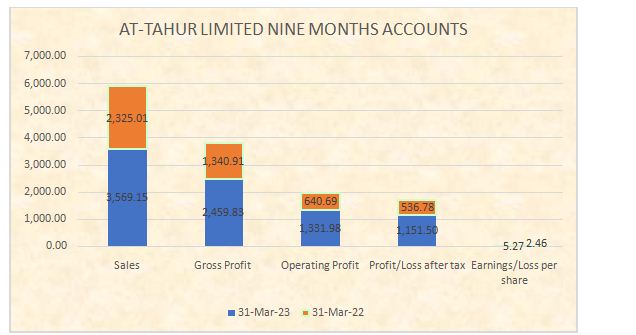

At-TahurLimited, a producer of milk and dairy products, has reported outstanding results for the nine months ended March 31, 2023, demonstrating robust growth across key financial metrics.This has showcased its resilience and adaptability in a dynamic business environment. Sales for the nine-month period surged to Rs3.57 billion, representing an impressive year-on-year growth of 54% compared to the corresponding period last year. This substantial increase in sales can be attributed to the company's successful market expansion, strong customer demand, and effective sales strategies. Gross profit, a key indicator of operational efficiency, also witnessed substantial growth, reaching Rs2.46 billion. This represents a remarkable 83% increase compared to the same period in the previous fiscal year. The surge in gross profit indicates the company's ability to effectively manage its production costs and optimise its supply chain, which in turn helps improve profitability.

At-TahurLimited's operating profit for the nine months reached Rs1.33 billion, reflecting an impressive growth rate of 108% year-on-year. This significant increase in operating profit is a testament to the company's effective cost management and operational excellence. The profit-after-tax for the nine-month period stood at Rs1.15 billion, showing a remarkable growth of 115% compared to the corresponding period the previous year. The substantial increase in profitability can be attributed to both the company's strong operating performance and effective tax planning strategies. Earnings per share (EPS), a crucial metric for shareholders, also exhibited exceptional growth, reaching Rs5.27 per share. This represents a substantial increase of 114% compared to the same period last year. The higher EPS reflects improved profitability on a per-share basis and underscores the company's ability to generate value for its shareholders.

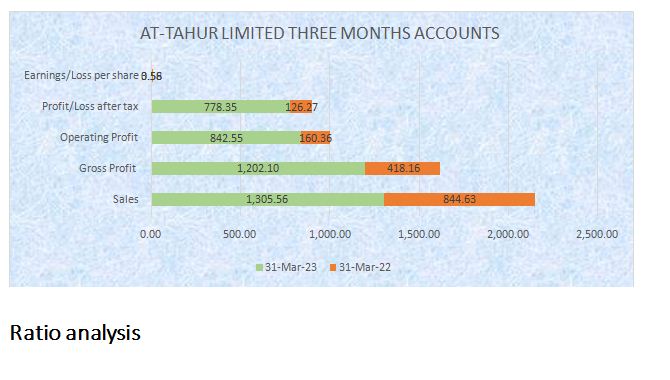

In the three months ended March 31, 2023, At-TahurLimited continued its remarkable growth trajectory, reporting exceptional financial performance. The company's sales for the three-month period reached Rs1.31 billion, showcasing a remarkable year-on-year growth of 55%. The significant increase in sales can be attributed to the company's robust product offerings, efficient distribution channels, and increased market penetration. Gross profit for the three months stood at Rs1.20 billion, reflecting an astounding 187% growth compared to the corresponding period of the previous fiscal year. This substantial increase indicates the company's effective cost management and ability to capitalise on favourable market conditions.

At-TahurLimited's operating profit for the three months surged to Rs842.55 million, representing an impressive growth rate of 425% compared to the same period last year. This remarkable increase highlights the company's strong operational performance and effective execution of its business strategies. The after-tax profit for the three-month period stood at Rs778.35 million, demonstrating an extraordinary growth rate of 516% compared to the corresponding period in the previous year. The substantial increase in profitability can be attributed to the company's robust revenue growth and efficient cost controls. EPS for the three months reached Rs3.56, showcasing a remarkable growth rate of 514% compared to the same period last year. This higher EPS underscores the company's ability to generate strong returns for its shareholders and reflects its sound financial health.

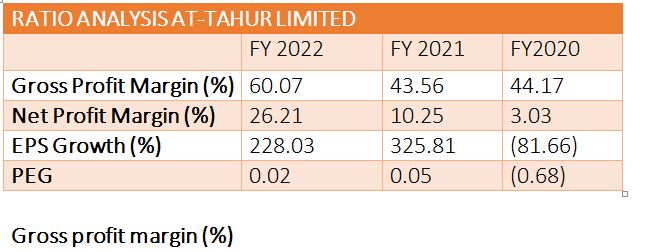

At-TahurLimited has shown consistent improvement in its gross profit margin over the years. This margin increased to an impressive 60.07% in FY22 from 43.56% in FY21 and 44.17% in FY20. This indicates the company's ability to effectively control its production costs and generate higher profits from its core operations. The rising gross profit margin is a positive sign of operational efficiency and competitiveness.

Net profit margin (%)

At-TahurLimited has significantly improved its net profit margin over the years. The margin rose to 26.21% in FY22, a substantial increase from 10.25% in FY21, and 3.03% in FY20. This remarkable growth in net profit margin indicates the company's success in controlling its overall expenses and increasing profitability on a per-dollar-of-sales basis. The improvement in net profit margin is a positive indication of the company's enhanced financial performance and effective cost management.

EPS growth (%)

The earnings per share (EPS) growth of At-TahurLimited has been fluctuating over the years. In FY22, the EPS growth was 228.03% compared to 325.81% in FY21. However, in FY20, there was a decline of 81.66% in EPS. The fluctuation in EPS growth may be attributed to various factors, including changes in the company's financial performance, changes in the number of outstanding shares, and market conditions. Investors should closely examine the underlying reasons for the fluctuations to gain a deeper understanding of the company's financial health.

PEG (price/earnings to growth) ratio

The PEG ratio is an important valuation metric that considers the company's price-to-earnings (P/E) ratio and its EPS growth rate. A PEG ratio below 1 is generally considered favourable, indicating that the stock may be undervalued relative to its earnings growth. At-TahurLimited's PEG ratio has been consistently positive, indicating that the stock may have been undervalued relative to its earnings growth potential in FY22 (PEG of 0.02) and FY21 (PEG of 0.05). However, in FY20, the negative PEG ratio of (0.68) suggests that the stock may have been overvalued relative to its earnings growth potential during that year. Investors should carefully evaluate the company's growth prospects and market conditions when interpreting the PEG ratio.

About the company

At-Tahur is a public limited company incorporated on March 16,2007 under the Companies Ordinance, 1984 (Now Companies Act, 2017). The principal activity of the company is to run a dairy farm for the production and processing of milk and dairy products.

Credit: INP-WealthPk