آئی این پی ویلتھ پی کے

Amir Khan

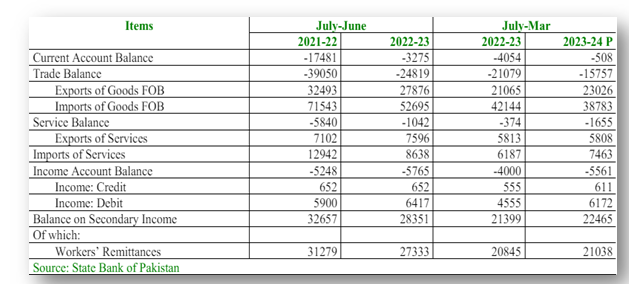

Pakistan's trade deficit fell significantly to $15.8 billion during July-March period of FY2023-24 from $21.1 billion in the same period last year, leading to a reduction in the current account deficit (CAD) and fostering socio-economic improvement. Talking to WealthPK, Additional Secretary of Trade and Diplomacy at the Ministry of Commerce Ahsan Ali Mangi said the reduction reflected the impact of weaker domestic demand, import management measures, and lower global commodity prices. On the other hand, exports saw a rise, particularly driven by a substantial increase in the food group exports. The decline in the trade deficit was primarily due to a marked decrease in goods imports, which dropped from $42.1 billion to $38.8 billion.

This significant improvement played a crucial role in bringing the CAD down to $0.5 billion from $4.1 billion over the same period last year. According to Mangi, although the global economic environment remained uncertain, the government's effective measures had reduced the risks related to the external financing challenges and enhanced the overall performance of the current account. Furthermore, the financial account recorded net inflows of $4.2 billion, mainly from official sources and friendly countries. Talking to WealthPK, Zafar Ali Shah, a former joint secretary at the Ministry of Planning, Development, and Special Initiative, said the financial inflows, coupled with the decreased trade deficit, stabilized the exchange rate and preserved the foreign exchange reserves, even with ongoing debt repayments.

The foreign reserves increased to $8.0 billion by the end of March 2024, up from $4.4 billion at the end of FY2023. He highlighted that significant improvement in the external account had strengthened the investor confidence and improved market sentiments. The Pakistani rupee appreciated by 2.8 percent on the average against the US dollar during July-March FY2024. This progress was achieved amid the successful implementation of reforms agreed upon as part of the Stand-By Arrangement (SBA) with the IMF. While the primary income account posted a higher deficit of $5.6 billion during July-March period of FY2024 compared to $4.0 billion last year, driven by increased interest payments and higher profits and dividend repatriation, the overall improvement in the trade balance and current account offset these outflows. Overall, positive developments in Pakistan's external sector have helped stabilize the economy, instilling renewed confidence in the financial markets and broader economy.

Credit: INP-WealthPk