INP-WealthPk

Ayesha Mudassar

The country’s external position continues to be under stress despite a notable contraction in the current account deficit (CAD). The weakened position is mainly due to the precariously low foreign reserves, and massive currency depreciation, said Pakistan Institute of Development Economics Director Dr. Durr-e-Nayab, in a panel discussion on the country’s economic outlook, reports WealthPK.

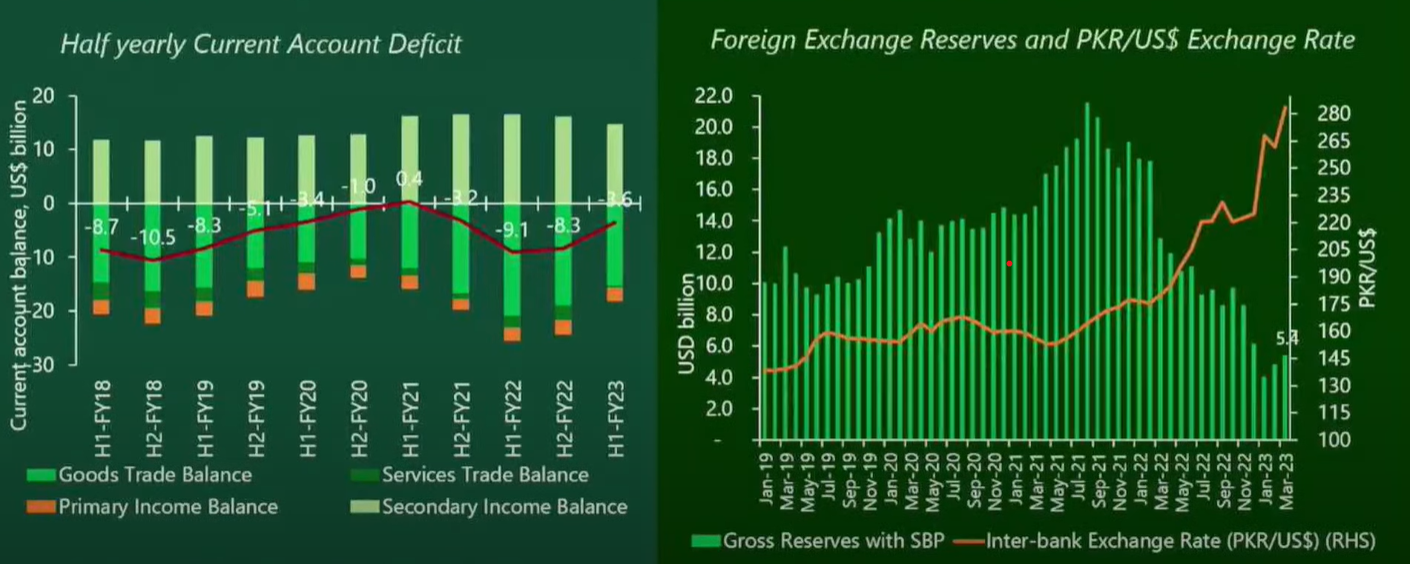

As per the economic updates provided by the Ministry of Finance, import compression measures drove a 60.4 percent contraction of the current account deficit in the first half of the current fiscal year (H1 FY23). The deficit reached just US$3.6 billion in H1FY23 from US$9.1 billion in H1 FY22. Along with a reduction in imports, the growth of goods exports also declined by 6.7 percent in H1 FY23 due to less conducive internal and external conditions.

The implementation of an aggressive yet selective import compression policy has proved an effective step, said renowned economist and Dean of the National University of Science and Technology (NUST) Dr. Ashfaque Hassan Khan. According to the World Bank’s recent report on Pakistan’s Economic Development, official remittance inflows fell by 10.7 percent, with the informal exchange rate cap incentivizing the use of informal non-banking channels.

Reduced remittance inflows and high-interest payments on external debt have decreased the income account surplus by 13.2 percent to US$12.1 billion in H1FY23 from US$13.9 billion in H1FY22. Owing to the delay in the completion of the 9th review of the IMF EFF and associated external financing, the financial account recorded the largest half-year deficit in 12 years. This trend continued in January-February 2023 and as a result, reserves declined from US$11.1 billion at end-FY22 to US$5.4 billion on March 10, 2023, equivalent to 0.9 months of total imports.

The rupee remained under pressure due to a loss of confidence in line with the critically low level of international reserves, and political uncertainty. As per the statistics released by the State Bank of Pakistan (SBP), 27.9 percent depreciation has been witnessed in the PKR against the US Dollar between July 2022 and March 22, 2023.

Source: State Bank of Pakistan, World Bank staff calculations

Credit: Independent News Pakistan-WealthPk