INP-WealthPk

Ayesha Saba

Major reforms in Pakistan's banking sector have long been due for streamlining regulations, fostering transparency and facilitating a seamless entry for new entities to invigorate the country's financial ecosystem. This was stressed by experts during a panel discussion titled "Transforming Economy and Society" hosted recently by Pakistan Institute of Development Economics (PIDE), reports WealthPK. Ali Salman, Executive Director of Policy Research Institute of Market Economy (PRIME), told WealthPK that Pakistan's banking sector, like its global counterparts, operated within a complex web of regulations aimed at maintaining stability, ensuring consumer protection and preventing financial malpractices. "In recent years, growth and turnaround in the country's banking sector has been remarkable and unprecedented," He said, arguing, however, that the existing regulations, while well-intentioned, might be hindering the sector's ability to adapt to emerging global trends and technologies. He suggested the focus of banking reforms should be on simplifying regulatory processes to not only alleviate the burden on financial institutions but also stimulate innovation by eliminating unnecessary barriers.

He further stressed the need for increased transparency and accountability within the banking sector to build and maintain public trust. "A mechanism should be put in place to ensure transparent reporting, clear disclosures and curb financial malpractices." Meanwhile, speaking to WealthPK, Dr Nadeem-ul-Haq, Vice-Chancellor, PIDE, said in a modern economy, an efficient financial system was essential to facilitate economic transactions, specialise in production, and establish investor-friendly institutions and competitive markets. He noted that Pakistan's financial sector was intricately tied to the broader macroeconomic environment. "External factors, such as inflation, interest rates and geopolitical tensions, can impact the stability of financial institutions. Striving for robust macroeconomic conditions is crucial to ensure the resilience of the financial sector." He argued that banking reforms should prioritise initiatives that promote financial inclusion. He suggested developing strategies to expand access to banking services, especially in underserved areas, by leveraging technology, such as mobile banking, to reach a wider segment of the population.

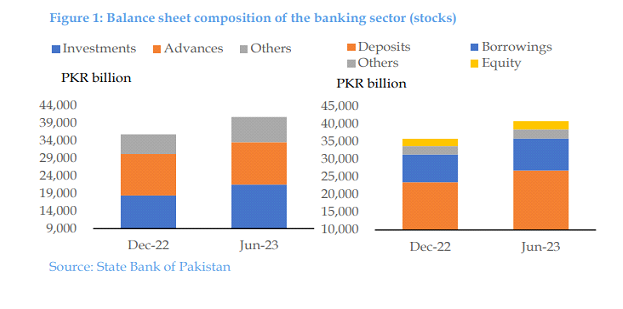

Haq argued that while the world was fast embracing fintech innovations, Pakistan's financial sector struggled with adopting technology to provide a safeguard against cybersecurity threats. "The balancing act between digital transformation and ensuring the security of sensitive financial information is a significant challenge that requires strategic planning and investment." Discussing the transformation of Pakistan's economy and society, the PIDE vice-chancellor emphasised the need to shift the focus from subsidies to opportunities for fair growth and resource conservation. According to the State Bank of Pakistan's Mid-Year Performance Review of the Banking Sector for 2023, despite a stressed macroeconomic environment, the banking sector performed reasonably well in terms of solvency, earnings and management of underlying risks. The asset base grew by 14.0% during the first half of CY23 (16.0% growth in 1HCY22) to reach Rs40,796.7 billion. This growth was mainly contributed by investments, which constituted 52.7% of the asset base, while growth in advances remained subdued.

Credit: INP-WealthPk