INP-WealthPk

Hifsa Raja

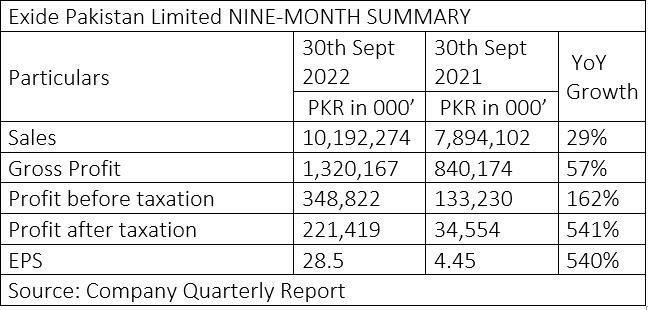

Exide Pakistan Limited’s sales increased 29% to Rs10 billion in the nine months ending September 30, 2022, compared with Rs7.8 billion in the corresponding period of 2021. Of the total revenue, Rs8 billion was the cost of sales. Likewise, the gross profit increased 57% to Rs1.3 billion in 9MCY22 from Rs840 million in 9MCY21, after deducting selling, distribution, operating and administrative costs.

The company’s profit-before-taxation jumped 162% during the six-month period of CY22 to Rs348 million from Rs133 million in the corresponding period of FY21. The profit-after-taxation leapt 541% to Rs221 million in 9MCY22 from Rs34 million over the corresponding period of CY21, reports WealthPK.

The profits of the last quarter of CY22, which are yet to be announced, may dip somewhat due to rising costs of essential raw materials, utilities, labour, markup rates and the Pakistani rupee’s devaluation against the US dollar. The management of Exide Pakistan Limited is likely to take measures to balance out the effects of cost rises. To increase its competitiveness and market share, the management plans to fully capitalise on the potential by maintaining a continuous focus on productivity, quality improvement, cost control and after-sales service.

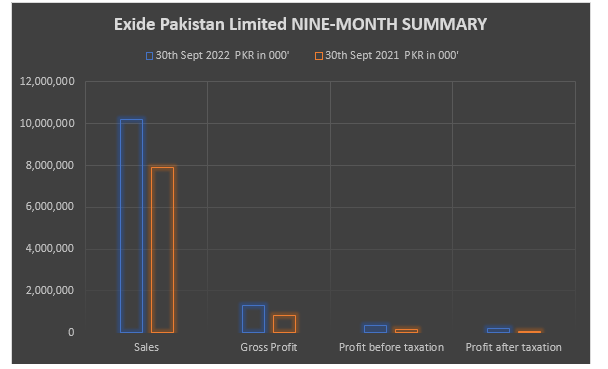

Earnings growth analysis

The company’s earnings per share (EPS) remained negative from 2018 to 2020. However, in 2021, the EPS turned positive and stood at Rs3.72. It is to note here that Pakistan’s auto components sector is experiencing difficult times due to home currency’s depreciation, increasing inflation, rising utility prices, borrowing rates, and skyrocketing material costs.

Industry comparison

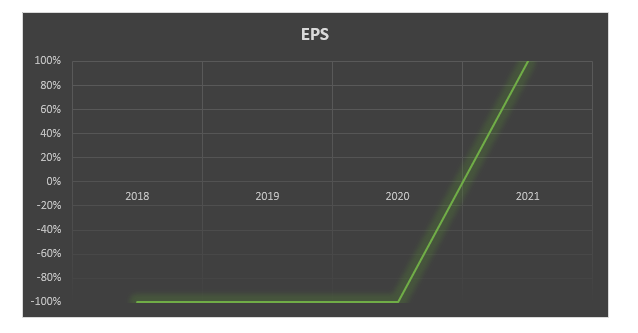

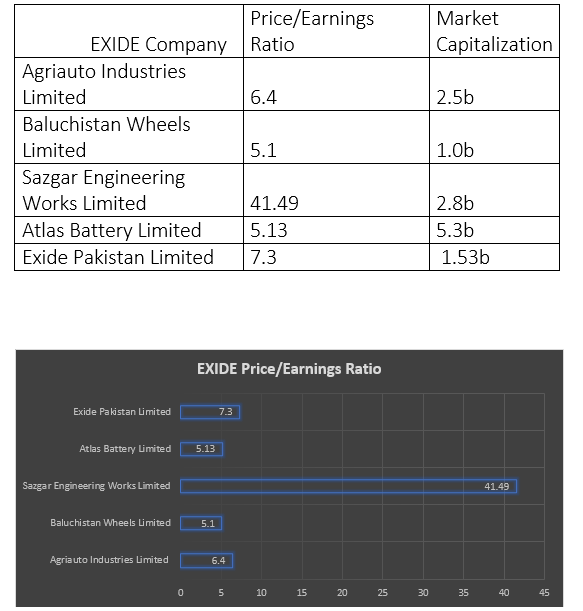

The main competitors of Exide Pakistan Limited include Agriauto Industries Limited, Balochistan Wheels Limited, Sazgar Engineering Works Limited and Atlas Battery Limited. Exide Pakistan’s price/earnings (PE) ratio stood at 7.3 times with a market capitalisation of Rs1.53 billion. Exide Pakistan Limited is the second most overvalued company after the Sazgar Engineering Works Limited.

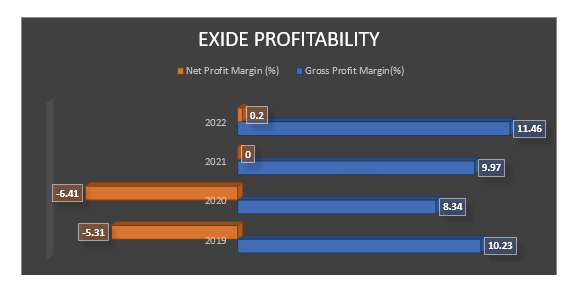

Profitability

Exide Pakistan’s net profit margin in 2019 and 2020 stood negative, but improved in 2021 and 2022. Investors won't feel secure making an investment in a firm with a net profit margin that is close to zero or even negative. The business has only experienced a meagre 5.35% revenue growth during the last three years.

Company profile

Exide Pakistan Limited is engaged in manufacturing and sale of batteries, chemicals and acids. It is also a supplier of solar energy solutions.

Credit : Independent News Pakistan-WealthPk