INP-WealthPk

Hifsa Raja

Exide Pakistan Limited posted staggering growth in sales and profits in the previous fiscal year 2022-23 compared to the earlier fiscal, successfully navigating market challenges and capitalising on opportunities. The consistent growth in sales, gross profit, operating profit and net profit showcases Exide's strategic resilience and effective management practices. As the company continues to evolve within the dynamic energy sector, its ability to drive profitability and growth remains a promising sign for investors and stakeholders.

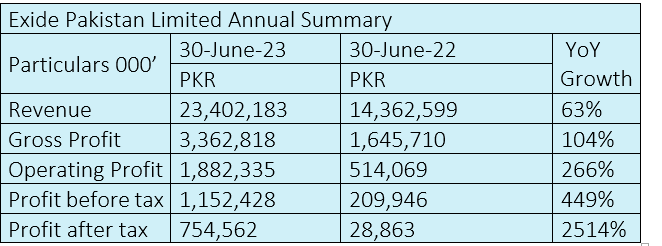

In FY23, the company’s sales soared to Rs23 billion from Rs14 billion in FY22, posting a remarkable growth of 63%. The gross profit also jumped by a strong 104% to Rs3.3 billion in FY23 from Rs1.6 billion in FY21. Likewise, the operating profit ballooned to Rs1.8 billion, up a staggering 266% from Rs514 million in FY22.

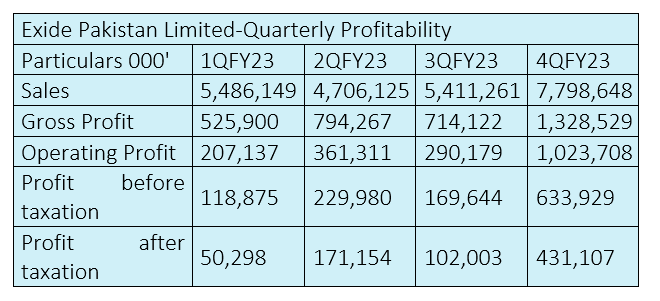

The company’s profit-before-tax soared a huge 449% to Rs1.1 billion in FY23, surpassing Rs209 million posted in FY22. The profit-after-tax rocketed to Rs754 million in FY23 from only Rs28 million in FY22, registering a gigantic 2514% growth year-on-year. Exide Pakistan demonstrated steady growth in sales and profits in the previous fiscal year 2022-23 with the last quarter proving the most fruitful in terms of the net profit, showing the company’s resilience in a dynamic market environment.

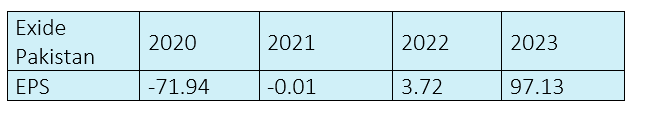

Earnings Per Share

In 2020 and 2021, the company recorded a negative EPS. However, the subsequent years marked a remarkable turnaround for the company, with the EPS soaring to Rs3.72 in 2022 and then shooting up to 97.13 in 2023, showcasing a staggering growth of 37300% in 2022 and 2511.02% in 2023.

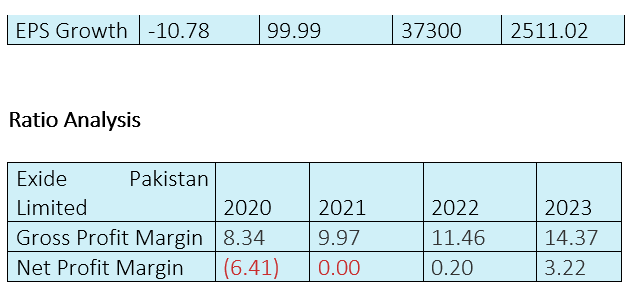

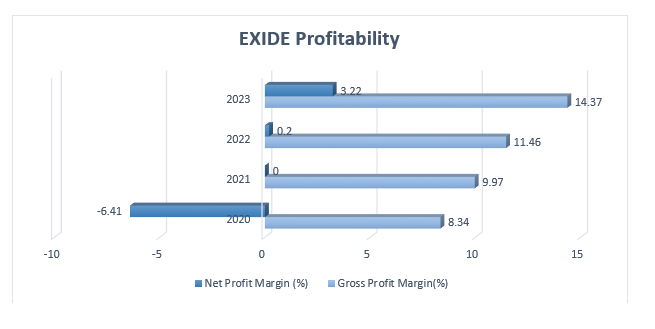

The company's gross profit margin stood at 8.34% in 2020, suggesting room for improvement in managing production costs. A significant positive shift occurred in 2021, as Exide Pakistan achieved a gross profit margin of 9.97%. This indicates the company's focused efforts in optimising its production processes and potentially exploring more favourable sourcing options.

The upward trend continued with a gross profit margin of 11.46% in 2022. Exide Pakistan's ability to further enhance this margin underscores its commitment to refining its cost structures and delivering value to its stakeholders. The most recent data shows an impressive gross profit margin of 14.37% in 2023. This sharp increase is a testament to the company's successful strategies in managing costs while maintaining or even growing its revenue streams.

The company faced challenges, as indicated by a negative net profit margin of 6.41% in 2020. This highlighted an imbalance between expenses, including financial costs and revenue. A significant milestone was achieved in 2021, as Exide Pakistan eliminated its losses and achieved a net profit margin of 0.00%. The net profit margin improved to 0.20% in 2022 before surging to an impressive 3.22% in 2023. This highlights Exide Pakistan's successful transition from losses to profitability and the sustainability of its efforts to generate positive returns for its shareholders.

Exide Pakistan Limited's financial ratios provide a compelling narrative of a company that has undergone a positive transformation in its financial health. The consistent growth in gross profit margin showcases effective cost management, while the progression from negative net profit margins to substantial positive margins reflects the success of Exide Pakistan's strategic initiatives. The company's ability to adapt and improve its financial ratios positions it favourably for sustained growth and profitability in the energy sector.

Industry comparison

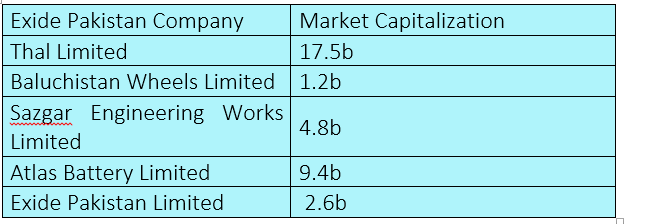

The companies that have been considered the competitors of Exide Pakistan Limited are Thal Limited, Balochistan Wheels Limited, Sazgar Engineering Works Limited, and Atlas Battery Limited. Exide Pakistan Limited’s market capitalisation is Rs2.6 billion. Thal Limited has the highest market capitalisation of Rs17.5 billion, and Balochistan Wheels Limited has the lowest market value of Rs1.2 billion.

Future prospects

The local battery industry is expected to face competition due to capacity expansion and changing market dynamics. The company anticipates that profitability in the coming years may be affected by increase in utility prices, wages and the devaluation of the Pakistani rupee. However, the management remains committed to maximising opportunities through a continued focus on quality improvement, productivity, cost control, and after-sale service, all aimed at enhancing its competitiveness and market penetration.

Company’s profile

Exide Pakistan Limited manufactures and sells batteries, chemicals, and acids in Pakistan. The company offers batteries for use in cars, motorcycles, light transport and heavy vehicles; industrial and locomotive batteries for industrial solutions and batteries for households. It is also involved in the trade, installation and maintenance of solar energy systems. The company was incorporated in 1953 and is based in Karachi.

Credit: INP-WealthPk