INP-WealthPk

Qudsia Bano

The interbank money market encountered challenges in the first half of FY2023 due to tight liquidity conditions. A substantial increase in govt borrowings exacerbated the situation, placing significant demands on their liquidity requirements. Talking to WealthPK, Ali Kemal, Chief Economist at the SDG Support Unit, Ministry of Planning, Development and Special Initiatives, said in light of persistent tight liquidity conditions in the interbank money market during H1-FY23, it was crucial to examine the implications of this situation for Pakistan's broader economic landscape.

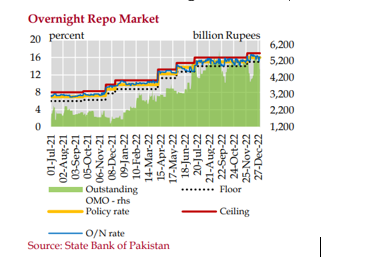

“Comparing the current scenario to the corresponding period in the previous year, it becomes evident that the liquidity situation in the interbank money market has not improved. Slower deposit mobilization has been a contributing factor to this persistent tightness in liquidity. The commercial banks have struggled to keep up with the increasing demand for liquidity, thereby amplifying challenges in the market,” he explained. “To address the mounting liquidity pressures, the central bank has taken several measures. One significant step has been the scaling up of its Open Market Operations (OMO) injections. This strategy has led to a substantial rise in the average outstanding OMOs, which surged from Rs1,983.7 billion in H1-FY22 to an impressive Rs4,887.5 billion during the review period,” said Kemal.

Furthermore, in an effort to alleviate liquidity pressures in the market, the SBP conducted 22 longer tenor OMO injections during July-Dec period in FY23. These included auctions with tenors of 60 days, 63 days, 70 days, 73 days, and 74 days, providing the much-needed relief to the interbank money market. “On a quarterly basis, the liquidity conditions tightened notably during Q2-FY23. This tightening was driven by increased demand for credit from the private sector and the government's heightened reliance on scheduled banks for financing. With the absence of central bank borrowing, the scheduled banks have borne the brunt of these liquidity challenges,” he continued. Ali said persistent tight liquidity conditions in the interbank money market was a cause for concern, as it could impact the overall stability of the financial system and hinder economic growth.

“The government's reliance on the scheduled banks for its financing needs, coupled with slower deposit growth, has created a delicate situation that warrants close monitoring and decisive actions to ensure a smoother flow of liquidity,” he said. “I believe that diversifying the government's sources of financing and exploring alternative methods of raising funds should be considered. Reducing dependence on scheduled banks can free up liquidity for the private sector and reduce the crowding-out effect,” said the official. “Furthermore, a concerted effort to boost deposit mobilization through financial literacy campaigns and incentives for savers could help stimulate deposit growth,” he added.

Credit: INP-WealthPk