INP-WealthPk

Jawad Ahmed

The inclusion of four Pakistan Stock Exchange-listed companies in the Morgan Stanley Capital International (MSCI) Frontier Index is a good omen for the stock market, but the equity market’s sustainable performance will continue to be dependent on the country’s macroeconomic outlook and political developments.

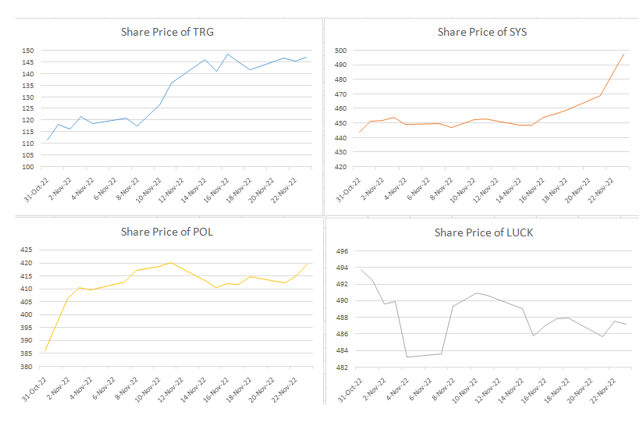

The semi-annual review by global index provider MSCI added four PSX-listed companies, including Pakistan Oilfields Limited (POL), TRG Pakistan, Systems Limited, and Lucky Cement, to one of its indices.

Muhammad Liaqat Ali Khan, Chief Executive Officer of Spinzer Equities (Pvt.) Limited, told WealthPK that the inclusion of these firms in the MSCI Frontier Market FM100 Index is due to their solid fundamentals and growth momentum. “This inclusion has boosted the purchasing momentum of these stocks in the local market.”

“Any company that is included in the MSCI index attracts the interest of overseas investors. It is the most important source of securing large amounts of foreign direct investment for the companies,” he added.

Share prices of these companies have increased the most in absolute terms since the beginning of the month. As a result, TRG Ltd trading at Rs146.94 grew 31.8%, Systems Limited at Rs497.28 climbed 12%, Pakistan Oilfields at Rs419.41 increased 8.7%, and Lucky Cement Ltd at Rs487.15 decreased 1.33%.

Yasir Hussain, a financial expert and equity trader with AKD (Pvt.) Limited, told WealthPK that TRG Pakistan and Systems Limited are technology and communication companies, and the rise in their share price is due to an increase in IT exports during the quarter. “Furthermore, Google's declaration that it will establish operations in Pakistan has increased the trading volume of these equities.”

“The inclusion of these four corporations is scheduled for November 30, but the news also presents some opportunities for investors looking for short-term gains,” he added. Yasir also stated that while this news was good for attracting foreign investors, the companies' fundamentals and the country's macroeconomic environment played an essential role in attracting foreign investment.

According to a note from Topline Securities, the MSCI Semi Annual Review for its Frontier Market FM100 Index, has stimulated a buying momentum, which kept blue-chip stocks in the limelight. “We do not expect any major inflow/outflow from the development as stock market will continue to be dependent on Pakistan’s macroeconomic outlook and political developments,” he underscored.

Credit : Independent News Pakistan-WealthPk