INP-WealthPk

Shams ul Nisa

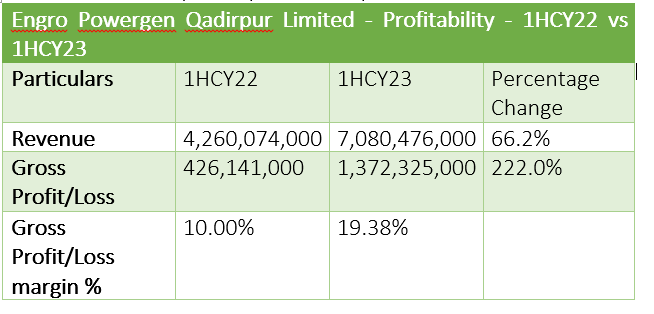

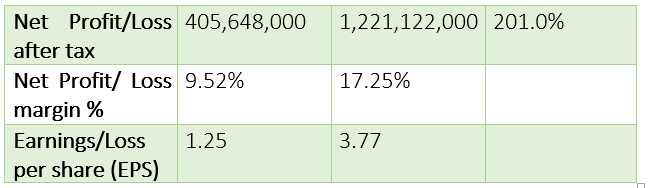

Revenue of Engro Powergen Qadirpur Limited (EPQL) rose by 66.2% to Rs7.08 billion in the first half of the ongoing calendar year 2023 from Rs4.2 billion over the same period of 2022. The strong growth in revenue can be attributed to the company’s effective management of its financial activities and the rise in sales, WealthPK reports. Engro Powergen Qadirpur is a public limited company and a subsidiary of Engro Energy Limited.

The company generates and sells power. It is the first green facility focused on reducing carbon emissions using the gas permeation process. The company is committed to boosting the country’s energy sector, and at the same time reducing environmental hazards through employing innovations in the power production processes.

The company’s gross profit surged 222% from Rs426 million in 1HFY22 to Rs1.37 billion in 1HFY23. The financial report suggests that the company effectively handled the production costs as the gross profit margin increased from 10% in 1HCY22 to 19.38% in 1HCY23.

Similarly, the net profit shot up 201% to Rs1.22 billion in 1HCY23 from Rs405 million in 1HCY22. The company showed a remarkable improvement in managing its operational expenditures as the net profit margin soared to 17.25% in 1HCY23 from 9.52% in 1HCY22. The company’s earnings per share (EPS) increased from Rs1.25 in 1HCY22 to Rs3.77 in 1HCY23.

2QCY23 compared with 2QCY22

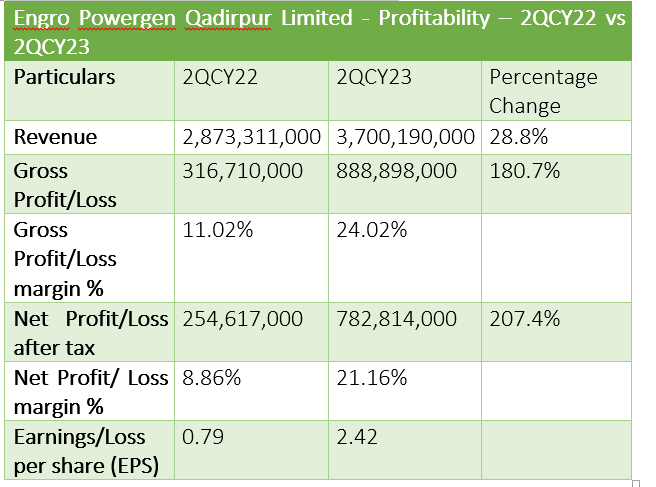

Engro Powergen Qadirpur’s sales increased 28.8% to Rs3.7 billion in 2QCY23 from Rs2.8 billion in 2QCY22. Similarly, the gross profit ballooned 180.7% to Rs888 million in 2QCY23 from Rs316 million in 2QCY22.

The gross profit margin also jumped from 11.02% in 2QCY22 to 24.02% in 2QCY23, showing that the company effectively tackled the cost of production. The company’s net profit exhibited a remarkable growth of 207.4%, increasing from Rs245 million in 2QCY22 to Rs782 million in 2QFY23. Consequently, the net profit margin soared from 8.86% in 2QCY22 to 21.16% in 2QCY23. The EPS jumped to Rs2.42 in 2QCY23 from Rs0.79 in 2QCY22.

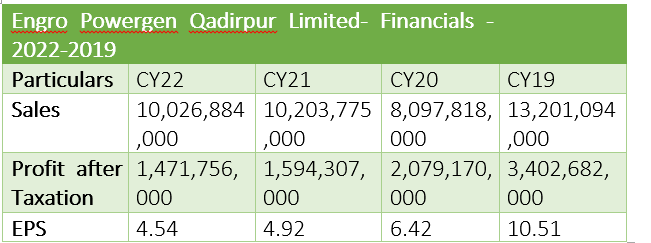

Analysis of last four years financials

The Engro Powergen Qadirpur Limited followed a fluctuating pattern in sales between CY19 to CY22. The highest sales of Rs13.2 billion were recorded in CY19 and the lowest of Rs8.09 billion in CY20. The highest profit-after-tax of Rs3.4 billion was recorded in CY19 and the lowest of Rs1.47 billion in CY22. The earning per share was the highest at Rs10.51 in CY19 and the lowest at Rs4.54 in CY22.

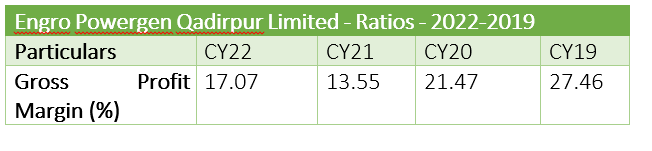

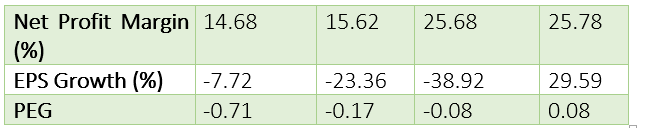

Analysis of ratios in last four years

The EPQL achieved a gross profit margin of 27.45% and net profit margin of 25.78% in CY19, resulting in a growth of 29.59% in EPS. The PEG stood at 0.08 in CY19. In the subsequent years, the gross profit margin declined to 21.47% in CY20, and 13.55% in CY21, but improved to 17.07% in CY22. The net profit margin slightly declined to 25.68% in CY20 and then sharply declined to 15.62% in CY21 and 14.68% in CY22.

The company’s EPS and PEG showed negative growth from CY20 to CY22.

Credit: INP-WealthPk