INP-WealthPk

Shams ul Nisa

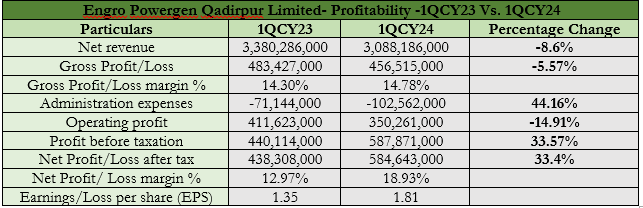

Engro Powergen Qadirpur Limited's sales dipped by 8.6% but its net profit spiked by 33.4% in 1QCY24, reports WealthPk. During the review period, the company had lower dispatch, squeezing sales to Rs3.08 billion from Rs3.38 billion in 1QCY23. However, higher net finance income added to the rise in net profit to Rs584.6 million in 1QCY24.

The company’s gross profit shrank by 5.57% to Rs456.5 million in 1QCY24. However, its gross margin improved slightly to 14.78% in 1QCY24 compared to 14.30% in 1QCY23. This implies better cost management and favorable pricing policies adopted by the company.

The company’s administrative expenses swelled by 44.16% to Rs102.56 million. Despite this increase in administrative costs, its operating profit decreased by 14.91% to Rs350.2 million. Regardless of the rising expenses and decreased operating profit, the company earned a profit before tax of Rs587.87 million in 1QCY24, up by 33.57% from Rs440.11 million in the same period last year. This considerable improvement may indicate higher non-operating income in the review period. Additionally, the net profit margin significantly improved from 12.97% in 1QCY23 to 18.93% in 1QCY24. The earnings per share moved marginally to Rs1.81 during the review period from Rs1.35 in 1QCY23.

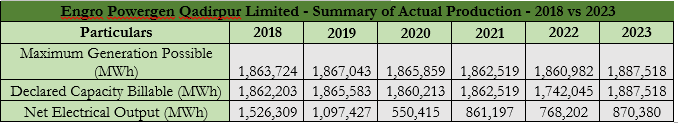

Summary of Actual Production

During 2018 and 2023. Engro Powergen Qadirpur Limited's net electrical output and production capacity remained volatile. The maximum generation possible of the company started at 1,863,724 MWh in 2018 and ended at 1,887,518 MWh in 2023. However, from 2019 to 2022, the maximum generation possible decreased gradually. Its overall growth over six years shows the corporation properly maintained its infrastructure and generation capacity.

The declared capacity billable climbed from 1,862,203 MWh in 2018 to 1,887,518 MWh in 2023, with two dips in 2020 and 2022, falling to 1,742,045 MWh. This decline can be attributed to maintenance problems, operational limitations, or tactical changes in capacity declaration. The company's net electrical output experienced significant fluctuations, dropping from 1,526,309 MWh in 2018 to 550,415 MWh in 2020. This indicates operational disruptions, technical failures, fuel supply issues, and regulatory constraints during this period. However, the output increased to 861,197 MWh in 2021, but slightly dipped to 768,202 MWh in 2022 before rising again to 870,380 MWh in 2023. This recovery implies that the company has tackled production issues to improve net output.

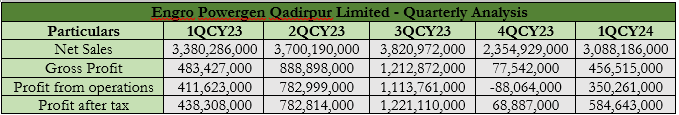

Quarterly Analysis

In the first three-quarters of CY23, the net sales followed a rising trend from Rs3.39 billion in 1QCY23 to Rs3.82 billion in 3QCY23. The primary factors include increased dispatch, higher tariffs on energy and capacity payments, and higher Period Weighing Factors (PWF) applicable to capacity payments. However, lower capacity payments resulted primarily from lower applicable PWF shrank the net sales to Rs2.35 billion in 4QCY23. In the 1QCY24, the company improved its net sales to Rs3.08 billion.

Similarly, the gross profit witnessed a single dip to Rs77.54 million in 4QCY23 and rebounded to Rs456.5 million in 1QCY24. During the review period, the highest gross profit of Rs1.21 billion was posted in 2QCY23. The operating profit increased to a maximum of Rs1.11 billion in 3QCY23, followed by a loss of Rs88.06 million in 4QCY23. However, in 1QCY24, the company earned an operating profit of Rs350.2 million. The net profit increased slightly from Rs438.3 million in 1QCY23 to Rs584.6 million in 1QCY24, with highest profit of Rs1.22 billion recorded in 3QCY23.

Future Outlook

Engro Powergen Qadirpur Limited is working with regulators and stakeholders to find an alternate fuel option for its plant due to declining Qadirpur gas field production. NEPRA Authority approved a modification in the Generation License and announced the Fuel Cost component for gas supply. The company will focus on finalizing the Gas Supply Agreement with PEL, obtaining regulatory approvals, and implementing necessary amendments. Despite the expected decline in power demand due to inflation, power price hikes, and lower economic growth, the company expects the plant to continue receiving dispatch from the power purchaser due to its cheaper electricity generation.

Company Profile

Engro Powergen Qadirpur Limited was established in Pakistan under the Companies Ordinance, of 1984. As a subsidiary of Engro Energy Limited, the Company was founded primarily to engage in the production and distribution of electricity.

Credit: INP-WealthPk