INP-WealthPk

Shams ul Nisa

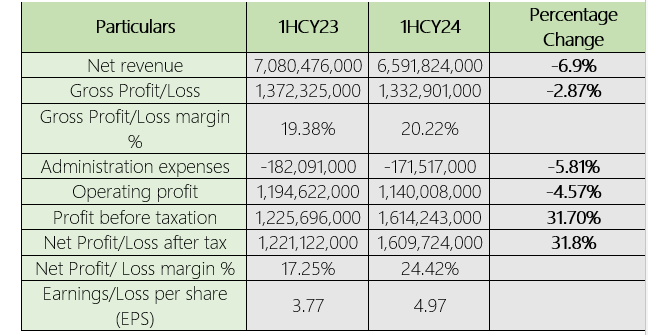

The Engro Powergen Qadirpur Limited’s net profit jumped significantly by 31.8% to Rs1.61 billion, resulting in an improvement in the net profit margin from 17.25% in 1HCY23 to 24.42% in 1HCY24, reports WealthPK. The company, however, reported a 6.9% drop in net revenue, declining from Rs7.08 billion in 1HCY23 to Rs6.59 billion in 1HCY24. Similarly, the gross profit slightly decreased by 2.87% to Rs1.33 billion in 1HCY24. However, the gross profit margin improved from 19.38% in 1HCY23 to 20.22% in 1HCY24, reflecting better cost management and operational efficiencies.

![]()

Additionally, the operating profit fell by 4.57% to Rs1.14 billion in 1HCY24. This was offset by a substantial 31.70% rise in profit before taxation, which reached Rs1.61 billion in 1HCY24 from Rs1.22 billion in 1HCY23. The earnings per share followed this positive trend, rising from Rs3.77 to Rs4.97 in the review period, indicating increased shareholder value and potential positive reception from investors.

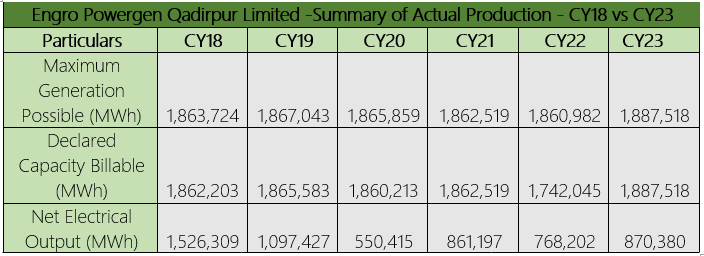

Summary of actual production

The company’s maximum generation capacity in FY18 was 1,863,724MWh, and it remained stable over the years, reaching a peak of 1,887,518MWh in FY23. This consistency suggests ongoing investment in infrastructure and technology to sustain maximum output. The declared billable capacity increased from 1,862,203MWh in CY18 to 1,887,518MWh in CY23, despite experiencing declines in CY20 and CY22 to 1,860,213MWh and 1,742,045MWh, respectively. These reductions could be due to the maintenance issues, operational constraints, or strategic adjustments in the capacity declaration. However, the net electrical output, which was 1,526,309MWh in CY18, saw a sharp decline in CY19 to 1,097,427MWh and hit a low of 550,415MWh in CY20. This drop could be due to the operational challenges such as maintenance problems, fuel supply limitations, and unfavorable market conditions. These fluctuations raise concerns about the plant’s operational efficiency and reliability during the period of decline.

The output started to recover in CY21 and CY22, with a modest rise to 870,380MWh in CY23. Although the recovery suggests improvements in the operational performance, output levels are still significantly lower than the CY18 figures, indicating that the company has not yet fully regained its peak output capacity.

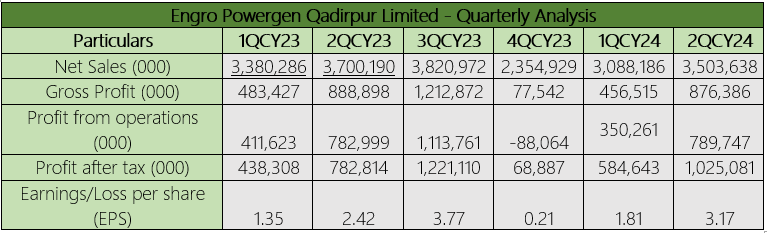

Quarterly analysis

The net sales fluctuated over the quarters, peaking at Rs3.82 billion in 3QCY23 before declining to Rs2.35 billion in 4QCY23. However, the sales stood at Rs3.09 billion in 1QCY24 and Rs3.50 billion in 2QCY24. The gross profit followed a similar trend, hitting a high of Rs1.21 billion in 3QCY23 but dropping significantly to Rs77.54 million in 4QCY23.

The profit from operations grew from Rs411.6 million in 1QCY23 to Rs1.1 billion in 3QCY23, suggesting improved productivity and control costs. However, in 4QCY23, the company incurred a loss of Rs88.06 million in profit from operations, raising concerns about its operational efficiency. In the subsequent quarters, it climbed to Rs789.7 million in 2QCY24. With a single dip to Rs68.8 million in 4QCY23, the profit after tax showed a significant improvement, rising from Rs438.3 million in 1QCY23 to Rs1.02 billion in 2QCY24. The earnings per share also increased from Rs1.35 in 1QCY23 to Rs3.17 in 2QCY24, reflecting enhanced shareholder value and profitability. The company reported a maximum EPS of Rs3.77 in 3QCY23.

Company profile

Engro Powergen Qadirpur Limited was established in Pakistan under the Companies Ordinance, 1984. The company, a subsidiary of Engro Energy Limited, was founded primarily to engage in the production and distribution of electricity.

Credit: INP-WealthPk