INP-WealthPk

Fakiha Tariq

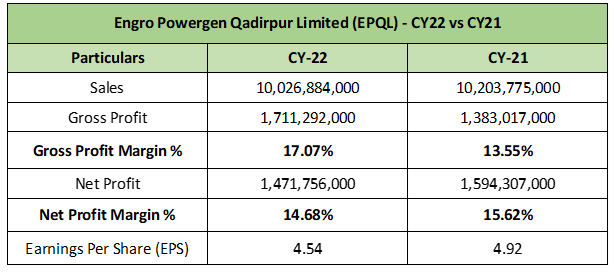

Engro Powergen Qadirpur Limited (EPQL) posted a gross profit of Rs1.7 billion on sales of Rs10 billion during the calendar year 2022, which was 24% more than the gross profit of Rs1.38 billion earned on sales of Rs10.2 billion in 2021, reports WealthPK. EPQL pocketed a net profit of Rs1.4 billion during the year.

With a market capitalisation of Rs8 billion, EPQL is the fifth largest company operating in the power generation and distribution sector on Pakistan Stock Exchange. EPQL, established as an Engro Corporation’s subsidiary in 2008, is Pakistan’s first green energy power plant with a generation capacity of 217MW.

It is to mention here that EPQL made a sales revenue of Rs10.2 billion in 2021, which was just 2% up from Rs10 billion in 2022. The gross profit ratio also moved up from 13.55% in 2021 to 17.07% in 2022. However, EPQL’s net profit ratio declined to 14.68% in 2022 compared to 15.62% posted in the previous year. The earnings per share value also decreased from Rs4.92 in 2021 to Rs4.54 in 2022.

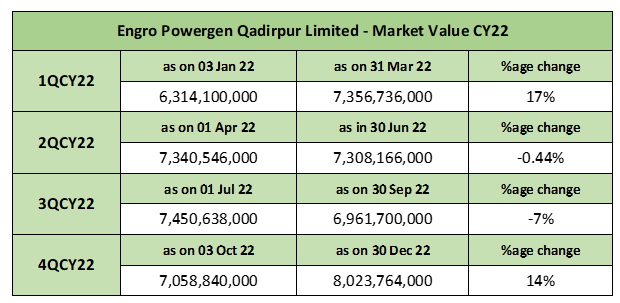

EPQL – Market Value – CY22

In the first quarter of CY22, EPQL gained a market value of 17% followed by a drop of 0.44% and 7% in the second and third quarters of the year. However, the company gained 14% of market value in the fourth and the last quarter of CY22.

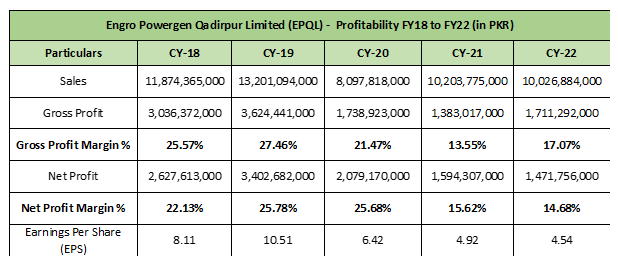

EPQL – Profitability Financials – CY18 to CY22

Historical analysis shows that the company performed relatively well in CY22. Despite economic slump, EPQL managed to reverse the declining trend in profits since 2019. The company’s sales declined from Rs13 billion in 2019 (highest drop in last five years) to Rs10.2 billion in CY21. However, the company’s sales revenue stayed somewhat healthy in CY22 at Rs10 billion, a tiny drop from the previous year.

EPQL’s gross profit declined from Rs3.6 billion in CY19 to Rs1.3 billion in CY21. In CY22, EPQL managed to arrest the declining trend, raising its gross profit to Rs1.7 billion. During 2022, EPQL raised its market cap by 27% as the firm reported a market value of Rs6.3 billion on January 3, 2022, which increased to Rs8 billion on December 30, 2022.

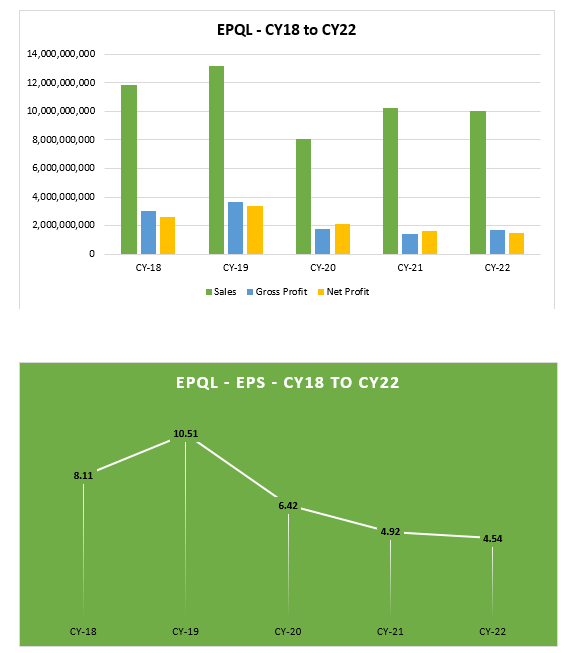

From the graphical representation of EPQL sales, gross and net profits, it can be seen that the company has been bearing high cost of sales since CY18. The firm has managed to narrow down the difference between the gross and net profits thanks to the measures taken to curtail operating and finance costs.

The firm’s earnings per share (EPS) have remained positive over the last five years from CY18 to CY22. However, since 2019, when the EPS stood at a strong Rs10.51, there has been continuous decline in the values till CY22.

Credit: Independent News Pakistan-WealthPk