INP-WealthPk

Shams ul Nisa

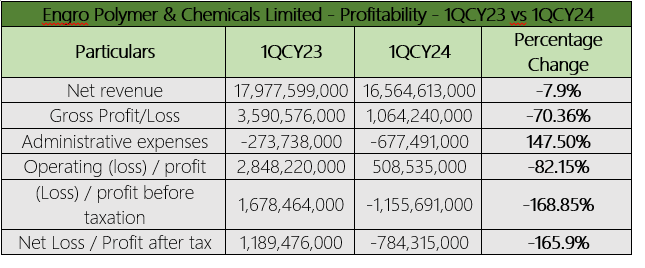

Engro Polymer & Chemicals Limited (EPCL) incurred a net loss of Rs784.3 million in the quarter ending March 2024 compared to a net profit of Rs1.18 billion in 1QFY23, registering a staggering decline of 165.9%, reports WealthPK. According to the company, this decline resulted from less sales volume and a lower core delta. The 1QCY24 saw a substantial decline in the sales volume and lower polyvinyl chloride (PVC) prices due to political uncertainty, a non-conducive business environment, high inflation, rising energy and fuel costs, and a prolonged winter. This resulted in a decline in the net revenue by 7.9% to Rs16.56 billion during the review period. The gross profit also plunged by 70.36%, coupled with administrative expenses rising massively by 147.50% to Rs677.4 million in 1QCY24.

![]()

Similarly, the operating profit stood at Rs508.5 million in 1QCY24, 82.15% less than Rs2.84 billion in 1QCY23. A loss before tax of Rs1.15 billion was noted during the quarter compared to a profit before tax of Rs1.67 billion in 1QCY23, marking a decrease of 168.85%. Thus, the EPCL declared a loss per share of Rs0.65 in 1QCY24 against the earnings per share of Rs0.98 in the same period last year.

Historical trend

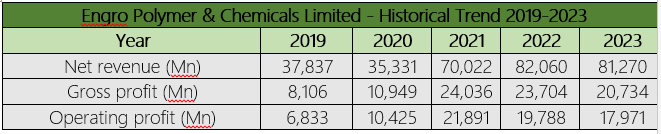

The company's historical pattern of financial indicators ascends from 2019 to 2023 but with mixed results yearly. The overall net revenue swelled by 114.79% from Rs37.8 billion in 2019 to Rs81.27 billion in 2023. From 2017 to 2023, the gross profit grew by 155.79%, operating profit by 163%, net profit by 141.67% and EBITDA by 157.52%. In 2020 only, the net revenue contracted by 6.62% compared to the previous year. The main factors for this fall include Covid-19, lower production volume, and decreased prices of PVC and caustic soda. However, the gross, operating, net profit and EBITDA augmented significantly compared to the previous year, as better cost management led to lower cost of sales.

![]()

The company performed remarkably in 2021, with revenue spiking by 98.19% due to the increased prices and higher exports. The gross profit reached the highest of Rs24.03 billion, up by 119.53%. Furthermore, in the past five years, 2021 posted a maximum operating revenue of Rs21.8 billion and a net profit of Rs15.06 billion. However, the higher sales volume of PVC added to the positive growth of 17.19% in revenue. In 2022 high inflation, lower foreign reserves, and import restrictions compressed the gross profit by 1.38%, operating profit by 9.61%, and net profit by 22.38% compared to 2021. The EBITDA stood at Rs22.8 billion in 2022, 5.61% lower than Rs24.17 billion in 2021. The factors remained persistent in 2023, thus continuously contributing to contraction in all the indicators compared to the previous year.

Liquidity Ratios

![]()

The company's current ratio increased from 1.12 in 2018 to 1.58 in 2020 and 1.39 in 2021. This implied that the company had enough current assets to cover its short-term liabilities, reflecting a relatively stable liquidity position. However, in 2022, the ratio dropped to 1.1, showing a decline in current assets compared to liabilities. Moreover, it was 1.02 in 2023, illustrating the increase in current liabilities over that period. Likewise, in 2019, 2021, 2022, and 2023, the quick ratio stayed below 1, indicating the company's decreased capacity to meet its responsibilities. In 2020, however, a quick ratio of 1.07 was recorded, indicating sufficient assets to meet the current liabilities.

Future outlook

PVC prices are expected to remain stable to slightly bearish, with oversupply and weak global demand potentially causing price declines. Ethylene prices are expected to remain elevated due to supply and logistical constraints. Owing to political stability and new development programs, domestic PVC demand may grow in future. The company aims to maintain sustainable and safe operations for the upcoming quarter, finish ongoing projects safely and on schedule, and navigate the challenging economic climate.

Company profile

Engro Polymer and Chemicals Limited is a subsidiary of Engro Corporation Limited. The primary operations are to produce and distribute caustic soda, vinyl chloride monomer (VCM), and polyvinyl chloride (PVC).

Credit: INP-WealthPk