INP-WealthPk

Fakiha Tariq

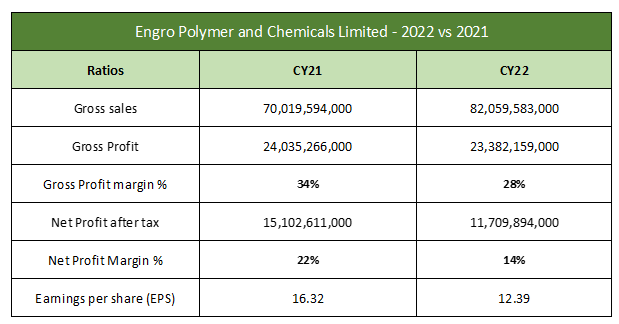

Engro Polymer and Chemicals Limited (EPCL) posted gigantic gross sales of Rs82 billion in the calendar year 2022, which was 17% more than the gross sales of Rs70 billion reported in 2021, and were the highest during last five years, reports WealthPK. Engro Polymer and Chemicals Limited is listed on the Pakistan Stock Exchange with the symbol of EPCL in the chemicals sector. With a market capitalisation of Rs41.9 billion, EPCL is ranked fourth among its peer companies.

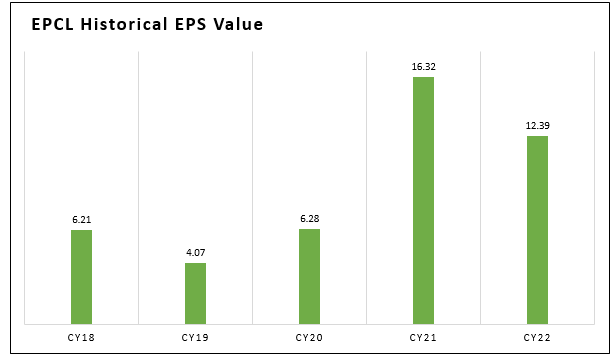

Established in 1997 as a subsidiary Engro Corporation Limited, EPCL is the only manufacturer of PVC (Polyvinyl chloride) resin in Pakistan. It is also engaged in manufacturing and selling many alkaline products for commercial and domestic use. EPCL reported a gross profit on sales of Rs23 billion and a net profit of Rs11 billion in 2022. As a result, the EPS value of EPCL came out to be Rs12.39 per share in 2022. The company reported gross profit and net profit ratios of 28% and 14%, respectively, during the year.

Compared to 2021, EPCL’s financial performance remained less efficient in 2022 as its gross and net profit values declined by 3% and 22%, respectively. The company reported a 34% of gross profit and a 22% net profit on its sales in 2021.

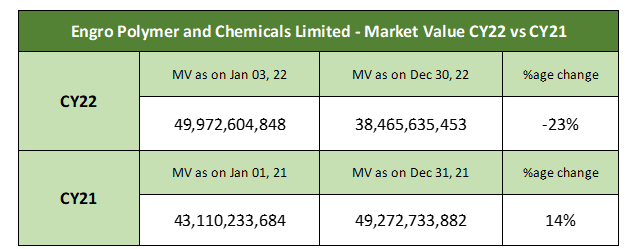

Engro Polymer and Chemicals – Market Value Review – 2022

EPCL sustained a market value loss of 23% in 2022 as its MV squeezed from Rs49.9 billion to Rs38.4 billion.

However, in 2021, EPCL gained a market value of 14% as it lifted its MV from Rs43 billion to Rs49 billion.

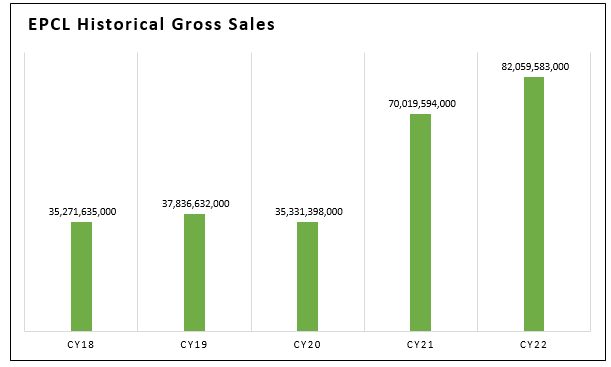

Engro Polymer and Chemicals – Financial Analysis – CY18 to CY22

In the last five years from CY18 to CY22, EPCL posted its highest-ever revenue of Rs82 billion in 2022, followed by Rs70 billion in 2021, as an increasing trend was observed in its sales from CY18 to CY22. Over the last five years, EPCL increased its revenue earning capacity by 133%.

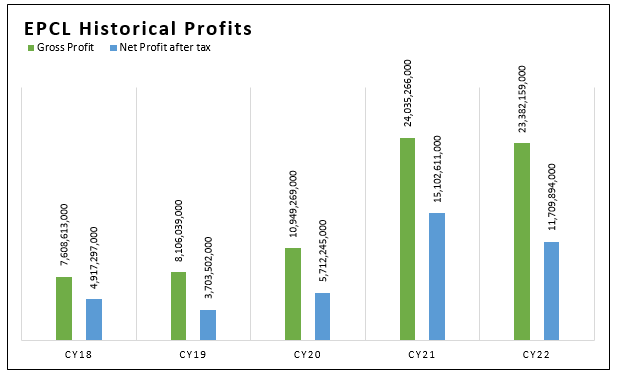

During the last five years, 2021 topped in terms of profit generation for EPCL. A continuous increasing trend in EPCL profits from CY18 to CY21 nipped the profit decline in 2022.

EPCL’s average gross profit ratio remained at 27% and average net profit ratio at 15% during the last five years. The company posted the second-highest half-decade EPS value in 2022. In the last five years, 2021 posted the highest EPS value of Rs16.32.

Credit: Independent News Pakistan-WealthPk